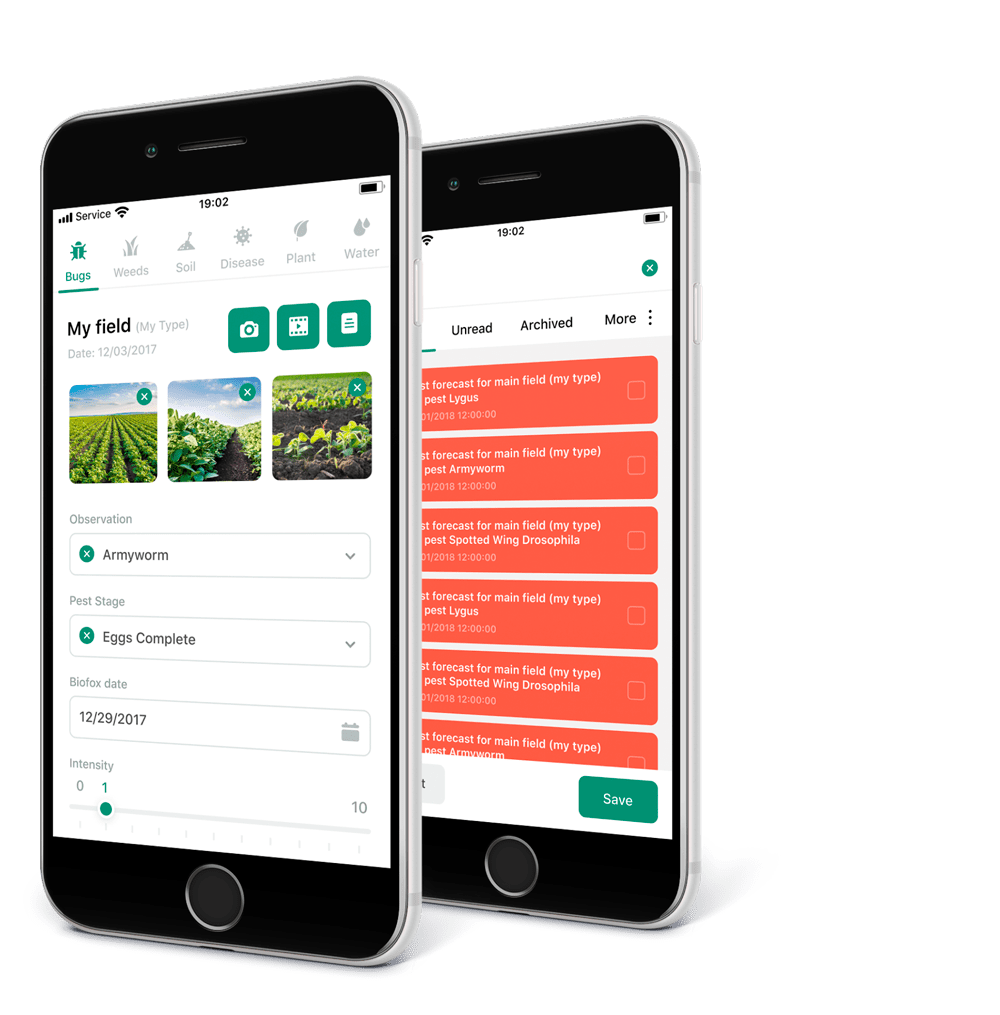

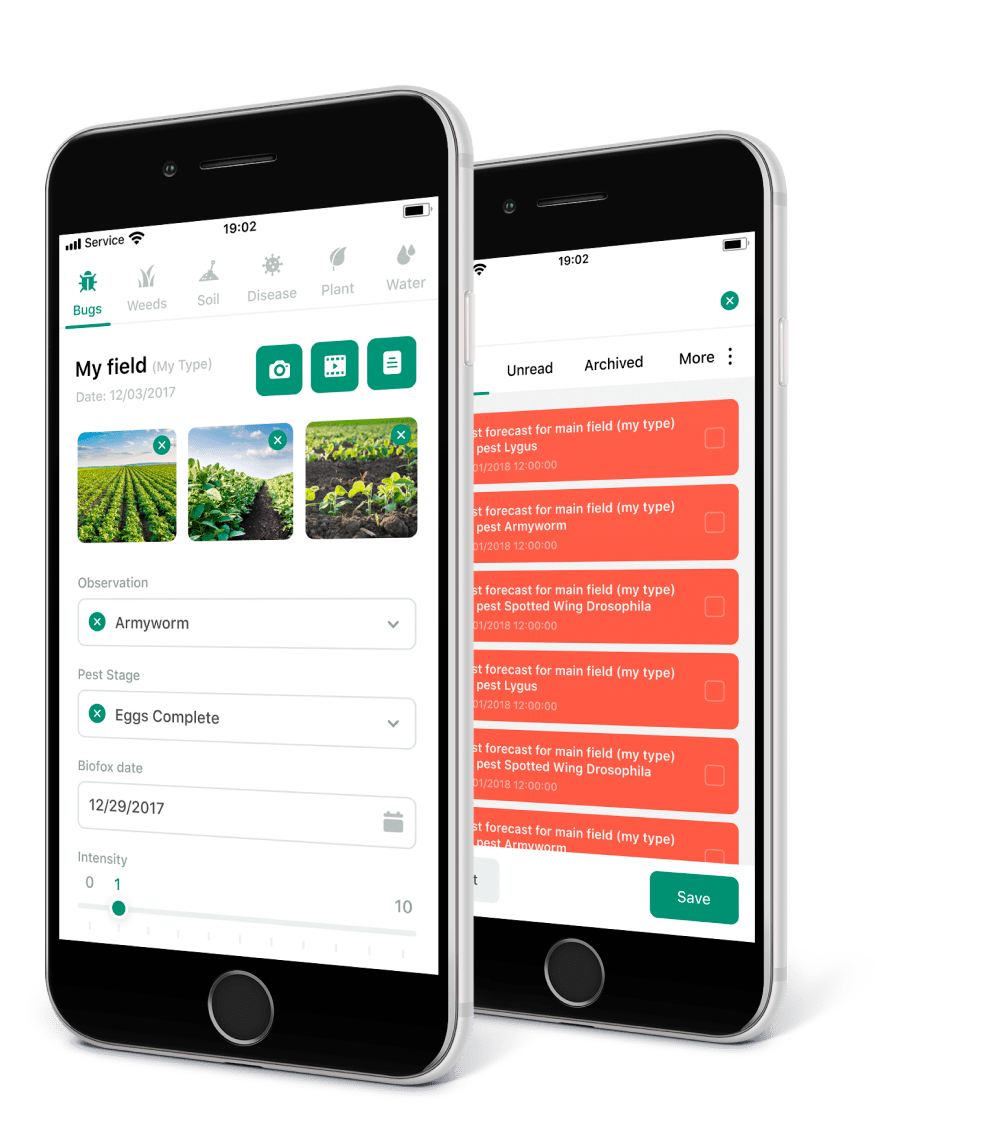

Web & Mobile Pest Forecasting Application

Web and mobile applications for farmers to take care of their yield crop, see predictions on pests, weather forecasts for a specific field, accept notifications on pest danger.

This modern B2B platform in AgriTech sector is being developed for one of the largest research institutes in the USA.

The users of the product are leading food production companies in North America and South America.

Engagement model

Time & Materials

Project Team

1 front-end developer, 1 project manager, 3 back-end developers, 1 QA engineer

Tech stack / Platforms

Features

The purpose of the forecasting platform is to predict, identify and prevent pests and diseases from affecting crop yield by analyzing data from multiple sources (such as weather forecast, fertilizers, and records from IoT devices). It combines internally developed Weather Intelligence and Numerical Decision Support platform with pest models to deliver pest risk assessment to farmers

Development Work

The work was organized using the Agile development model and Scrum framework. We split the development into 2-week sprints with a presentation of the new features at the end of each stage. Unified QA team was assigned to the project from the very beginning. The client communicated with the team in Slack and Skype, we also used Git as a code repository.

Related Projects

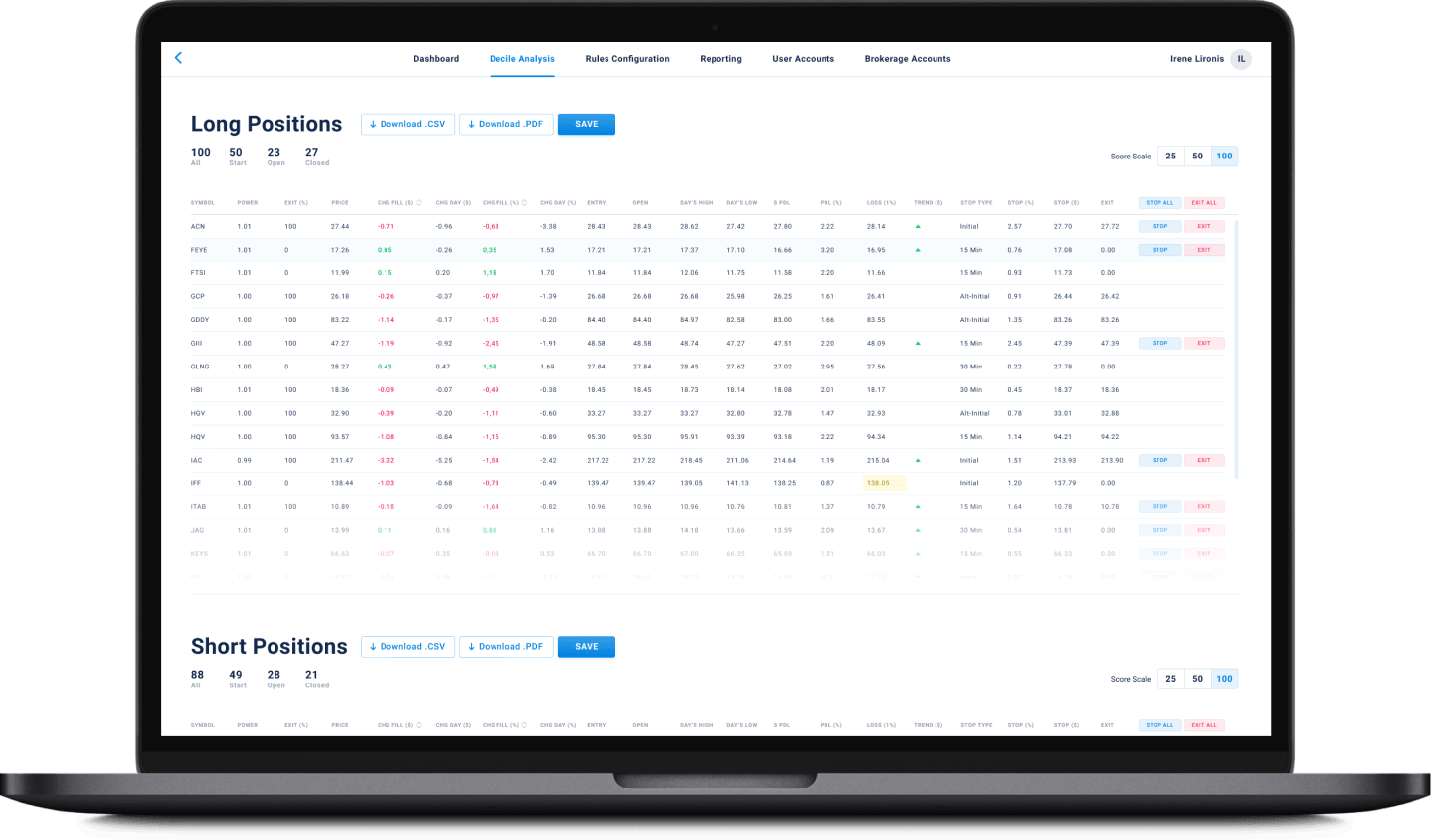

All ProjectsFinancial Data Analytical Platform for a Large Investment Management Company

Financial Data Analytical Platform for a Large Investment Management Company

- Fintech

- Enterprise

- ML/AI

- Project Audit and Rescue

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.

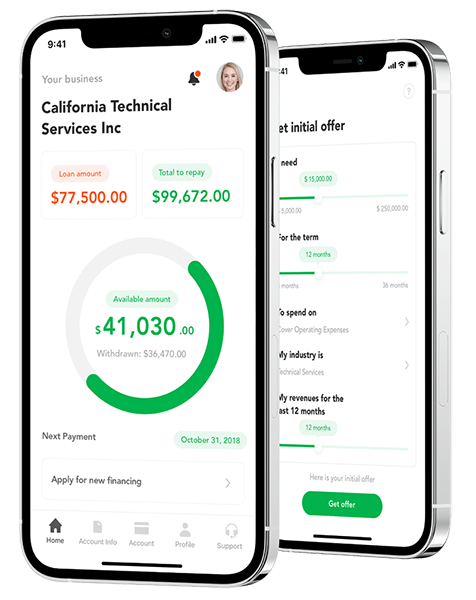

App for Getting Instant Loans / Online Lending Platform for Small Businesses

App for Getting Instant Loans / Online Lending Platform for Small Businesses

- Fintech

- ML/AI

- Credit Scoring

Digital lending platform with a mobile app client fully automating the loan process from origination, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management. Featuring a custom AI analytics & scoring engine, virtual credit cards, and integration with major credit reporting agencies and a bank accounts aggregation platform.

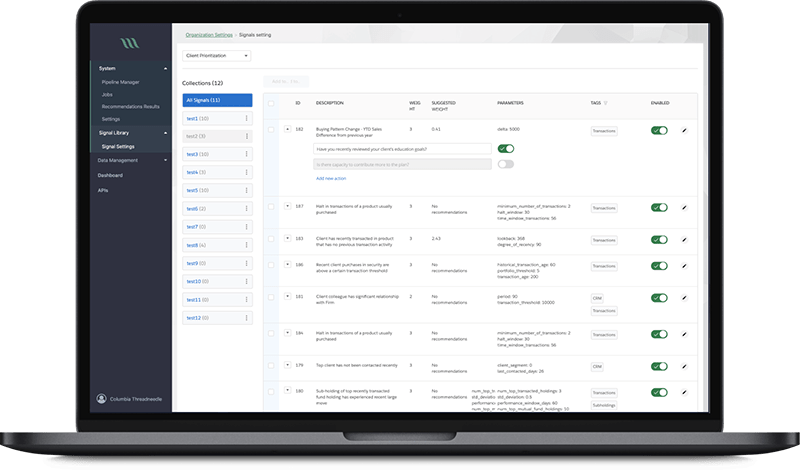

AI-Powered Financial Analysis and Recommendation System

AI-Powered Financial Analysis and Recommendation System

- Fintech

- ML/AI

The system uses machine learning techniques to process various content feeds in realtime and boost the productivity of financial analysts and client relationship managers in domains such as wealth management, commercial banking, and fund distribution.

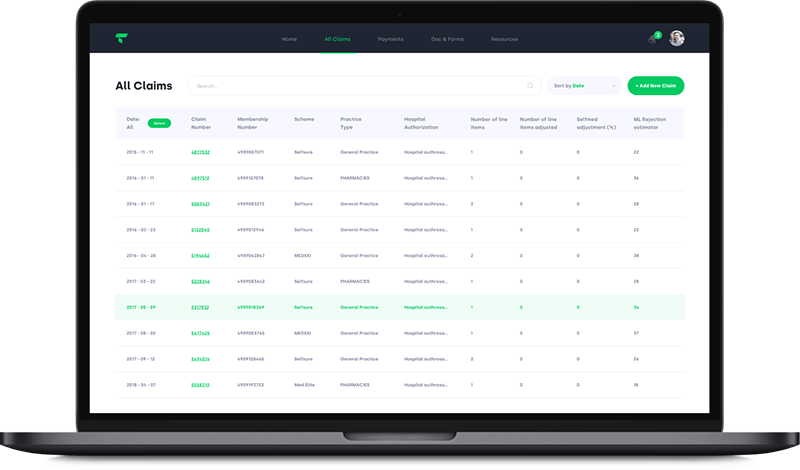

Claims Management System for Evaluating Hospital Bills

Claims Management System for Evaluating Hospital Bills

- Insurance

- Healthcare

- ML/AI

The healthcare claims management system is a web app that helps medical insurance auditors making a judgment on the claims issued by the medical aid providers. It reduces the costs of claims auditing process and fraudulent risks or human mistakes with the help of machine learning algorithms.

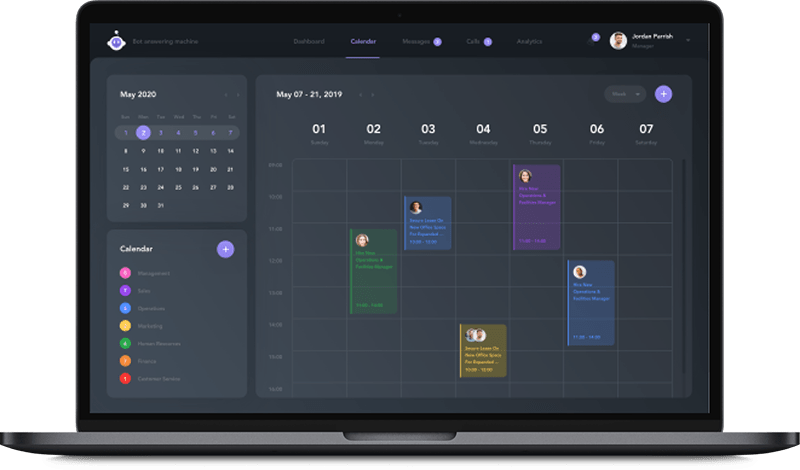

Bot Answering Machine

Bot Answering Machine

- Healthcare

- ML/AI

The system allows a business to train its own chatbot that will be able to answer phone calls, greet user over the phone/sms, provide information about a client’s services, and also help a user to schedule an appointment based on the available time slots. The application is HIPAA-compliant and has emergency calls scripts. There is also a dashboard where clients are able to create, configure and train very own conversational agent.

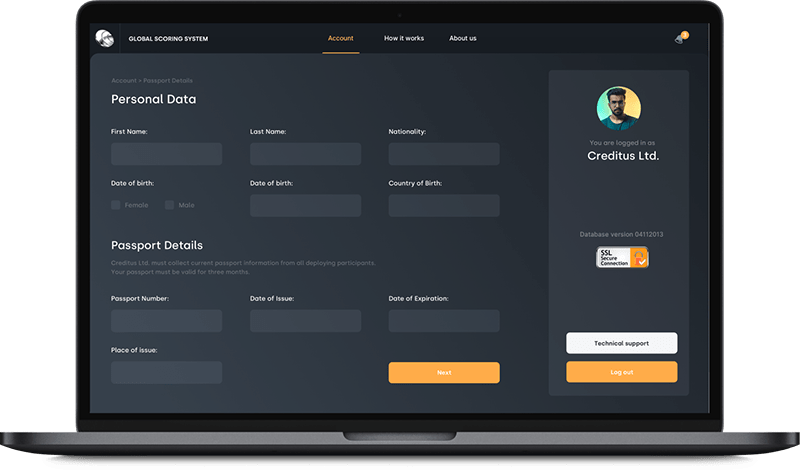

Credit Scoring SaaS App for Financial Organizations

Credit Scoring SaaS App for Financial Organizations

- Fintech

- ML/AI

- Credit Scoring

The system is a SaaS platform allowing the client to evaluate solvency and reliability of the potential borrowers using statistical methods of analysis of the historical and nontraditional data sources such as social network profiles and others. It allows the client to upload his normalized and anonymized database of previous loans data, build mathematical models and calculate the credit score of the future potential borrowers entering their data through the system’s web interface.

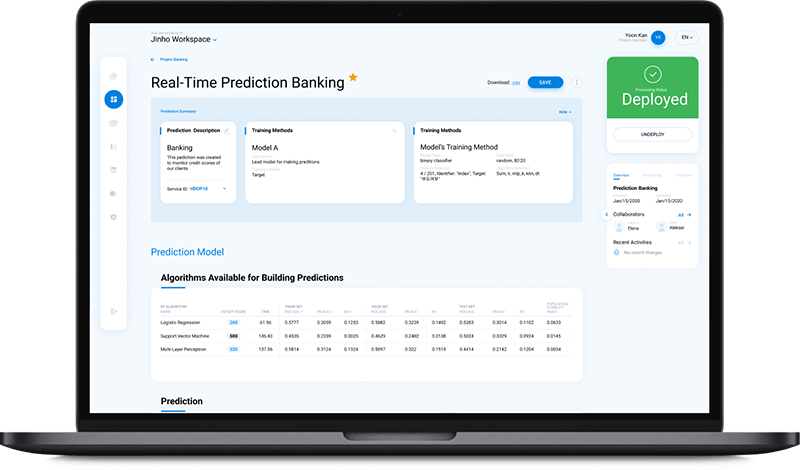

AI-based Financial Data Management Platform

AI-based Financial Data Management Platform

- Fintech

- ML/AI

Financial platform that automates key-decision making processes, with AI-based predictive modules that reflect the credit cycle. This financial platform is equipped with rich data-streaming, processing, and reporting capabilities to provide real-time, on-demand data.

Contact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland