The 2020 Global Insurance Outlook by EY has already set key themes and top priorities through 2022. One of them is Digital Transformation. What does it mean?

According to the report, digitization should be taking place across the entire value chain, including underwriting, distribution, and claims. It is the means to increase efficiency, boost productivity, recruit new talent, and reduce stubbornly high costs. For example, the cost of the claims journey can be reduced by as much as 30%.

However, there are still companies that are reluctant to go digital and have no chance to gain a competitive edge in the future. In this article, we’ll explore the nuances of automating one of the key insurance business processes – claims management – by creating and adopting a claims management system. Let’s discuss its benefits, features, development process, and costs.

What is an Insurance Claims Management System?

Claims management software is built by insurance software development companies for insurance carriers and agencies to automate the processing of claims on behalf of a client. For example, burglary and theft, fire, wind and hail damage, customer injury, and reputation harm. The system keeps all information related to the insurance product, client, and claim, as well as provides additional analysis to enable proper anti-fraud analysis, damage cost calculation, and other aspects.

Key Benefits of an Automated Claims Management System

A robust software can streamline claims management and dramatically improve its efficiency helping to reduce operational costs and financial losses from fraudulent or exaggerated claims. By automating their claims management system, car insurance companies in Massachusetts have been able to offer better customer service and reduce the amount of time it takes to settle claims. Take a look at the primary benefits of claims management software:

• Reduces fraudulent claims. With the help of proactive analysis based on previously recorded data, the software swiftly detects fraud or suspicious claims. As a result, an accelerated investigation process, proactive claims monitoring, and prevented payments for fake claims.

• Improves claims processing efficiency. The system eliminates the possibility of human error by automating the entire process. It provides quick access to claim details which are recorded within a centralized system of record.

• Reduces claims management costs through automation and decreased human involvement. In the automated process, trivial claims are resolved with no human involvement, and only non-standard, big or suspicious claims are alerted to additional manual analysis.

• Improves customer experience. Insurance claims management software encourages customer loyalty, ensuring fast and accurate data processing.

There are off-the-shelf claim management systems on the market. However, many businesses choose to develop their own custom-made software due to some reasons:

- It’s tailor-made to the specific needs, market niche, client type, and size of your company.

- It allows scalability as your business welcomes new clients.

- It helps avoid license fees and paid subscriptions.

- It’s compatible with the software already used in the organization.

- It may be seamlessly integrated with any third-party software you’ll need in the future.

- It increases the productivity of your team.

- It’s supported by the team involved in the development process.

Features that Determine the Cost of Insurance Claims Management System

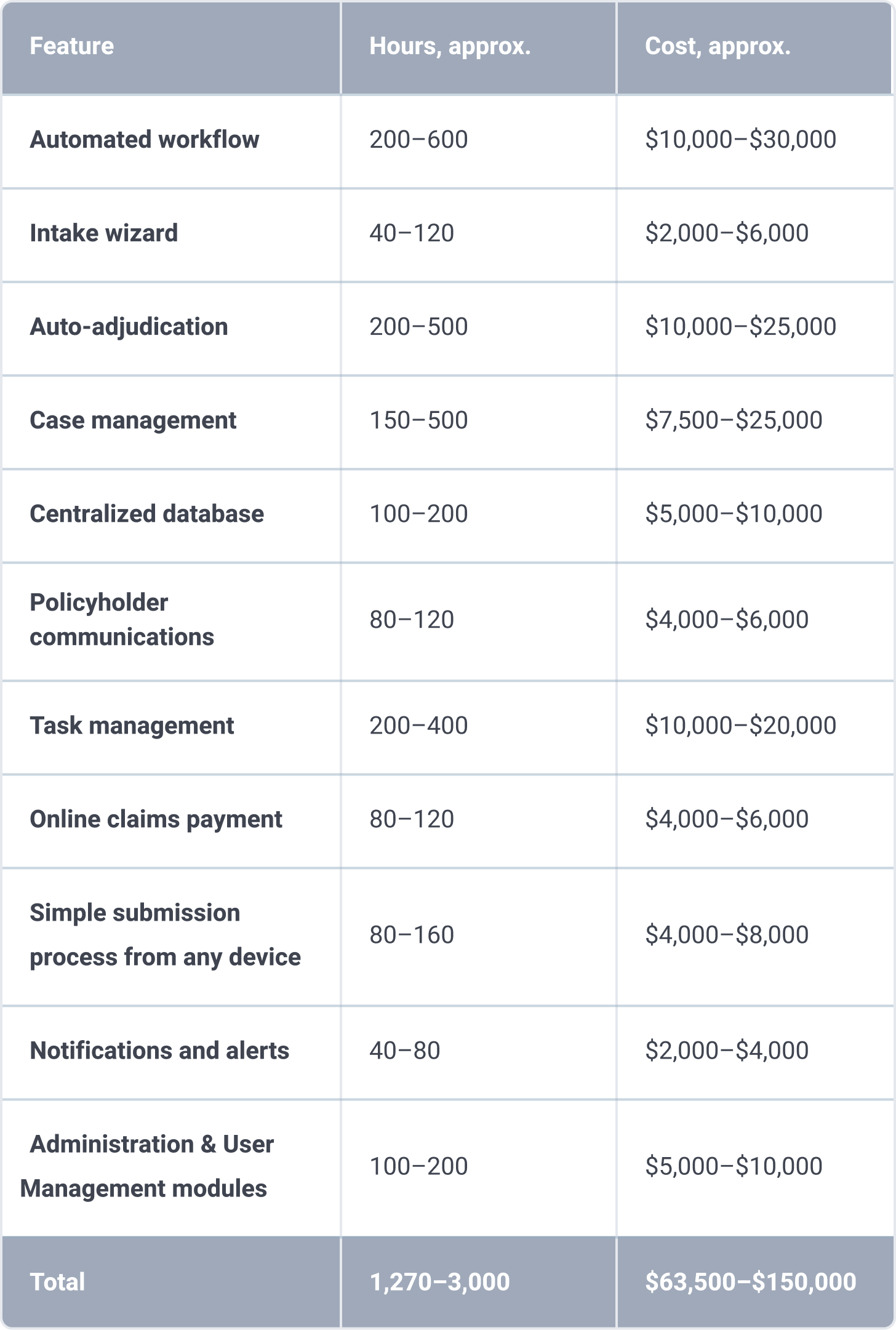

We’ve singled out 10 features that determine not only the cost of the system but also its effectiveness:

Automated workflow

It’s end-to-end claims workflows that eliminate operational inefficacies and legacy issues, as well as timely claim routing and notifications. Minimizing manual work reduces the possibility of human errors and improves productivity. The development of this feature can take 200 – 600 hours depending on the workflow complexity.

Intake wizard

The feature guides the user throughout the claim with questions to ensure all the necessary data is collected. The questions and the whole process can be configured to meet your specific business needs. The development process takes 40 – 120 hours.

Auto-adjudication

The feature also minimizes human involvement by introducing automated workflows to the claims process based on specific rules. Assignment rules are configurable based on the benefit type, the eligibility status, the payment specification, and other criteria. To keep claim durations on track, the rules can also be introduced with due dates. Rule-based adjudication engines may take approximately 200 – 500 hours depending on the complexity of the rules. Many companies use AI algorithms trained on their own statistics to augment and potentially replace rule-based logic. But this usually comes as a second phase.

Case management

The feature allows a claim manager to perform a range of tasks:

- View, add, and edit claim details

- Manage phone calls, medical and return to work events, rehabilitation, documents

- Write a detailed synopsis

- Review eligibility rules

- Make an action plan with detailed steps

- Attach forms and documents

- View claim status

- Export information in PDF format

The development process may take 150 – 500 hours.

Centralized database

Insurance subsidiary companies are often distributed across the country. This feature allows the management to access the files, templates for claims, and any other information. The development process takes 100 – 200 hours.

Policyholder communications

The feature allows policyholders to receive and get timely notifications via any messengers. Approximately the development of this feature takes 80 – 120 man-hours.

Task management

It is more than a to-do list. The feature allows team members to assign and create tasks, see their progress, add comments, delegate subtasks, and set deadline. The development process takes 200 – 400 hours.

Online claims payment

The feature allows the claims management system to automatically calculate payments based on the claim, policy, and benefits information provided. The payment system can be configured to meet your needs, such as consolidating payments or setting up automated scheduling. Clients can choose between different payment methods: by credit card or via online payment systems like PayPal, WePay, 2CheckOut, etc. Realization of this feature takes 80 – 120 hours.

Simple submission process from any device

You can configure different claim forms for different claim processing scenarios with the help of a form builder available via both mobile and desktop web browsers. The final docs can be exported to MS Word, MS Excel, and PDF. The data is also integrated into a task management system. The development process takes 80 – 160 man-hours.

Notifications and alerts

Agents can get notifications about new claims, and alerts about an increased amount of claims. For example, an upsurge in property damage claims when a disaster occurs. The development process takes 40 – 80 working hours.

Administration, Reporting and User Management modules

These modules are an integral part of the whole system. The administration module is the administrator’s interface and allows to process of all configuration operations of the system. The user management module is used for managing user information and providing access to different levels. The reporting module is designed to provide a feature-rich and user-friendly interface for managing reports. The development process of the mentioned above modules takes 100 – 200 hours.

At an average developer’s hourly rate of about $50, it will cost you between $63,500 and $150,000 to implement all of these features. Please note that this is not the final price – contact us for a more detailed breakdown of the cost of developing a custom insurance claims management system.

Claims Management Software Development Process

Itexus provides full-cycle custom software development that fosters the digital transformation of businesses in the insurance sector. Our services range span from analysis and planning to the maintenance of your custom product:

• Analysis and planning. Claims management software development starts with an in-depth study of the insurance market and the client’s business goals. Business Analytics research the competition and identify the main functionality and the budget. They also perform a technical feasibility study to define the various technical approaches that can be followed to implement the project successfully with minimum risks.

• Requirements definition. The next step is to clearly define and document the product requirements and get the client’s approval. The client gets detailed project documentation including the software requirements specification (SRS), high-level UI mockups, as well as software architecture documents with the recommended technology stack, architecture, and third-party components.

• Prototyping and design. A prototype is a working model of a claims management application with some limited functionality. It allows a UX designer to get valuable feedback from the client early on in a project and help understand user-specific requirements. When UX mockups are finished and validated, a UI designer converts them into interfaces with all necessary icons, illustrations, and animations.

• Software development. That’s when the actual development starts and the product is built. The development process is organized based on Agile and Scrum frameworks. The development team works in two-week sprints demonstrating new features to the client and incorporating his feedback.

At the same time, the project manager keeps track of the project budget and scope and reports the costs to the client on a weekly basis.

• Testing. At this stage, the product is assessed for errors and document bugs. It doesn’t follow the software development process but rather becomes a subset of all the stages. Testing won’t be complete until the product reaches the quality standards defined in the SRS.

• Deployment into production in the cloud or client’s private data center. The product may first be released for a limited audience. The client tests the system in the real business environment

• Maintenance. This is when a maintenance team comes into play. They do a range of tasks to guard the smooth performance of the app:

- Detecting and resolving issues.

- Monitoring production servers.

- Creating and deploying system updates and patches.

- Timely updating of security software.

To Sum It Up

On average, claims management software development from scratch will cost from 1,130 to 3,000 hours depending on the number of features, design complexity and the number of third-party integrations. Then multiply the man-hours by an average developer hourly rate. For example, at Itexus, we apply a $35-$40 per hour rate to Fintech projects. In the end we get an estimate of around $45K – $100K.

Itexus delivers custom claims management systems for the Insurance industry tailored to unique business operations and challenges. We don’t believe in one-fix-for-all solutions and employ a custom approach to any software we make, be it for clients in Insurance, FinTech, Healthcare, Retail, Hospitality, Education, or any other industry. Contact us to discuss your needs and our team of professionals will offer the most suitable software solution for your business needs and goals.