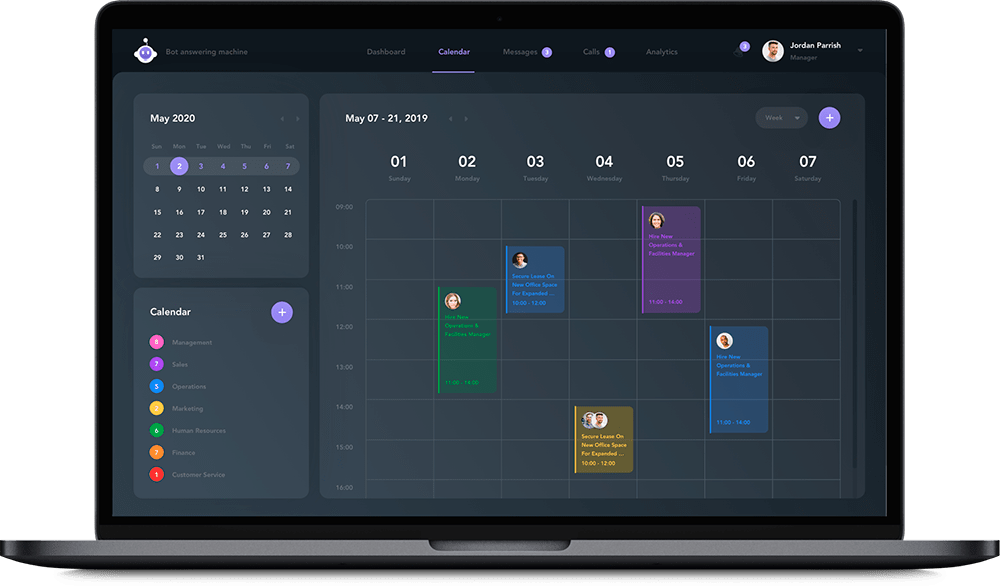

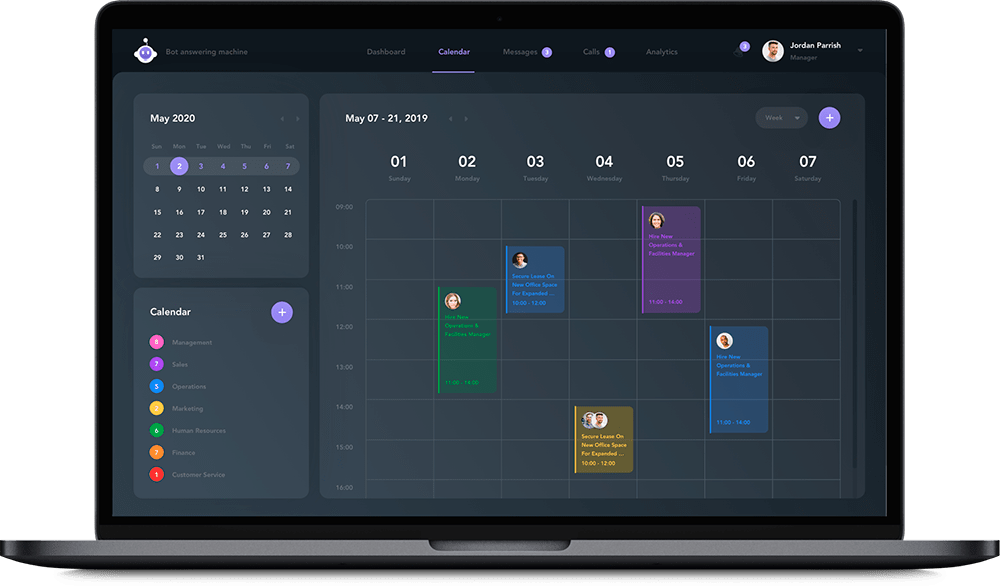

Bot Answering Machine

The system is able to train its own Bot to be able to answer phone calls, greet users over the phone/SMS, and provide information about a client’s services.

The system allows a business to train its own chatbot that will be able to answer phone calls, greet users over the phone/SMS, provide information about a client’s services, and help users schedule an appointment based on the available time slots.

The application is HIPAA-compliant and has emergency calls scripts. There is also a dashboard where clients are able to create, configure and train their very own conversational agent.

Solution

NLP, NER, Speech to Text, Text to Speech

Project Team

1 Tech Lead, 1 Full-stack developer, 1 BA/PM, 1 QA engineer

Tech stack / Platforms

Technical Solution

Because of the nature of chatbots and specific application requirements, the project is based on the following technologies:

• Natural Language Processing (NLP)

The application must be able to understand natural human language (and the variations that come with it) and translate it into signals that can be understood by machine/program. In our case, we are saying about Natural Language Classification (NLC) problem.

• Named-Entity Recognition (NER)

This component is needed to be able to recognize and extract important details like products, pricing, location, and date/time from users’ speech.. This allows the system to appropriately schedule appointments between practitioners and users.

• Speech to Text

This component is responsible for translating recorded/streamed voices into text, which can then be processed by the NLC component.

• Text to Speech

This component is responsible for converting predefined text answers to voice, which is then transferred to the user via phone.

As the team was developing an MVP, speed to market was identified as one of the key factors. That is why instead of using third-party services such as Google Tensorflow and API.ai, we strongly suggested using IBM Watson services because they can help with solving project tasks. We recommended the following:

• Watson Conversation

Quickly build and deploy chatbots and virtual agents across a variety of channels, including mobile devices, messaging platforms, and even robots.

• Watson Speech to Text

Easily convert audio and voice into written text for a quick understanding of content.

• Watson Text to Speech

Convert written text into natural-sounding audio in a variety of languages and voices.

• Voice Gateway

Cognitive Self-service agent. IBM Voice Gateway connects to a telephone network and routes the calls through Watson Speech-to-Text, Conversation, and Text-to-Speech services.

Voice Gateway is a kind of orchestration tool that was created to help build an Interactive Voice Response system. It ties together the following IBM services for that purpose: Watson Conversation, IBM Speech To Text, and IBM Text to Speech. The main use case for IBM Voice Gateway is the following:

The following diagram describes the main system components and a possible deployment scheme:

Service Orchestration engine’s main function can be the following:

Service Orchestration engine’s main function can be the following:

- De-identify requests to remove personal information such as PHI, PII, and PCI before it is sent to the Conversation service

- Personalize responses from the Conversation service, e.g., using a customer’s location information to provide a personalized weather forecast

- Enable telephony features, such as including caller ID or collecting DTMF digits for account numbers

- Customize interactions with customers by using APIs

- Use Voice Gateway state variables, e.g., to complete a long transaction

- Integrate voice security by using DTMF or biometrics

Related Projects

All ProjectsMental Health App for Meditation

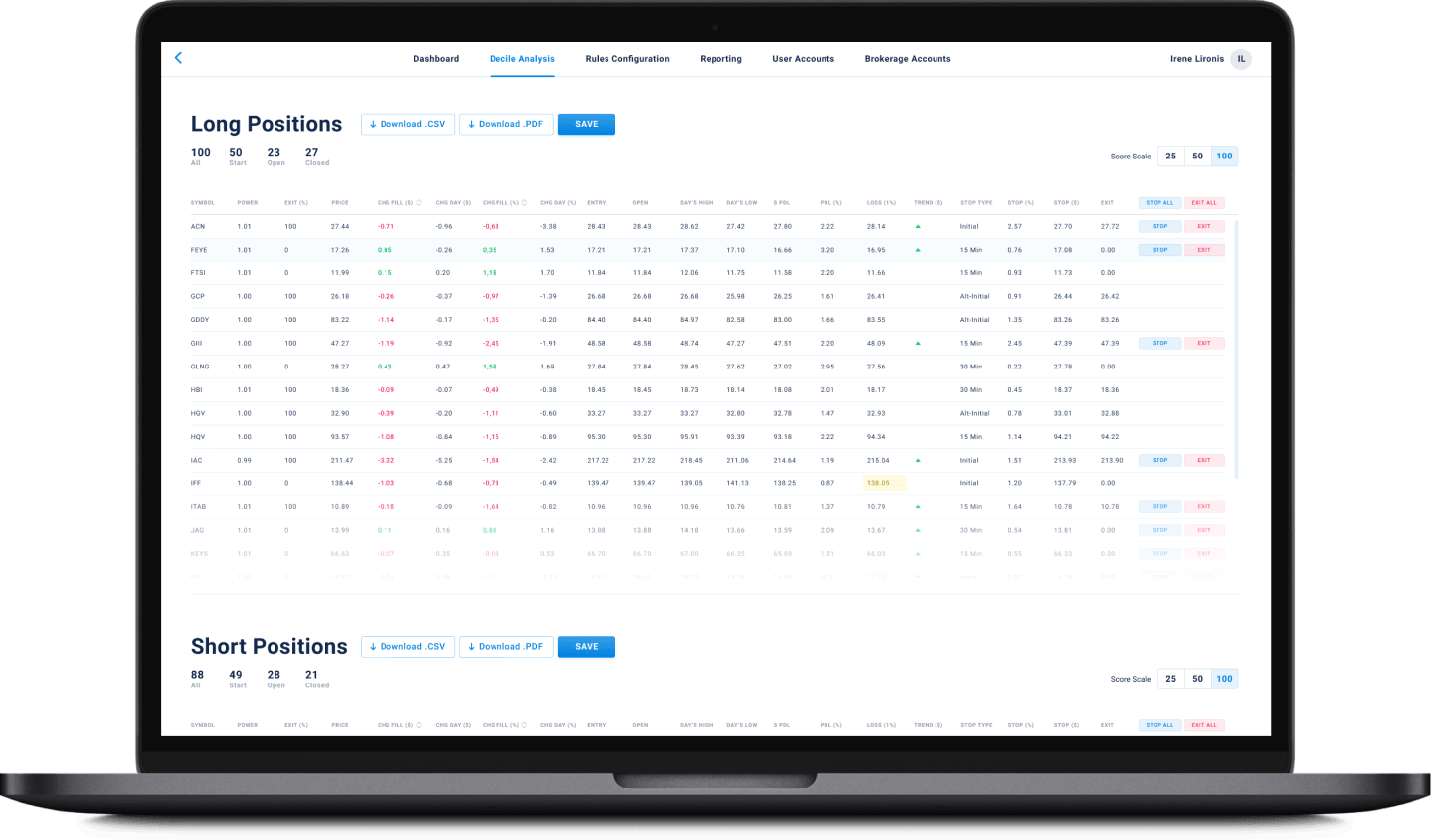

Financial Data Analytical Platform for a Large Investment Management Company

Financial Data Analytical Platform for a Large Investment Management Company

- Fintech

- Enterprise

- ML/AI

- Project Audit and Rescue

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.

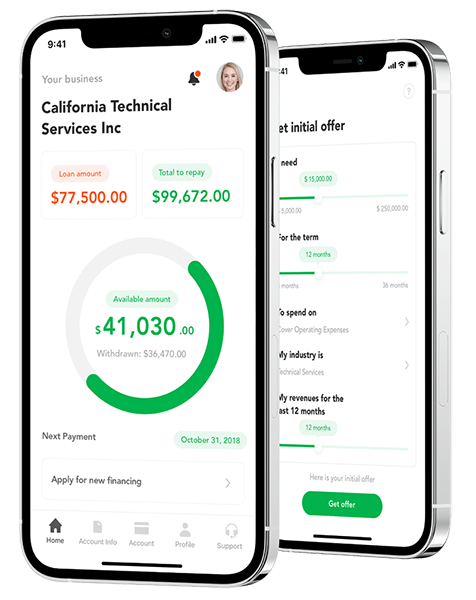

App for Getting Instant Loans / Online Lending Platform for Small Businesses

App for Getting Instant Loans / Online Lending Platform for Small Businesses

- Fintech

- ML/AI

- Credit Scoring

Digital lending platform with a mobile app client fully automating the loan process from origination, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management. Featuring a custom AI analytics & scoring engine, virtual credit cards, and integration with major credit reporting agencies and a bank accounts aggregation platform.

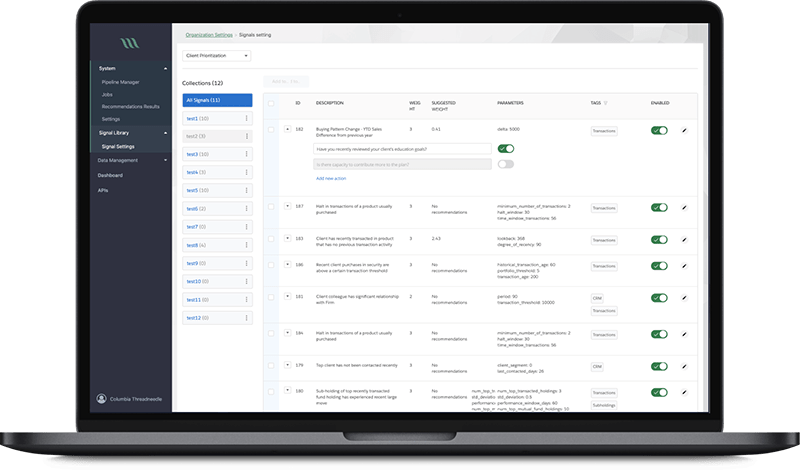

AI-Powered Financial Analysis and Recommendation System

AI-Powered Financial Analysis and Recommendation System

- Fintech

- ML/AI

The system uses machine learning techniques to process various content feeds in realtime and boost the productivity of financial analysts and client relationship managers in domains such as wealth management, commercial banking, and fund distribution.

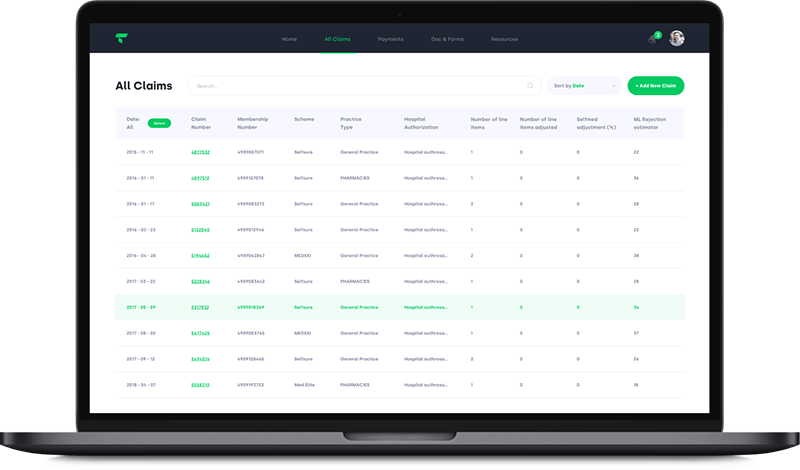

Claims Management System for Evaluating Hospital Bills

Claims Management System for Evaluating Hospital Bills

- Insurance

- Healthcare

- ML/AI

The healthcare claims management system is a web app that helps medical insurance auditors making a judgment on the claims issued by the medical aid providers. It reduces the costs of claims auditing process and fraudulent risks or human mistakes with the help of machine learning algorithms.

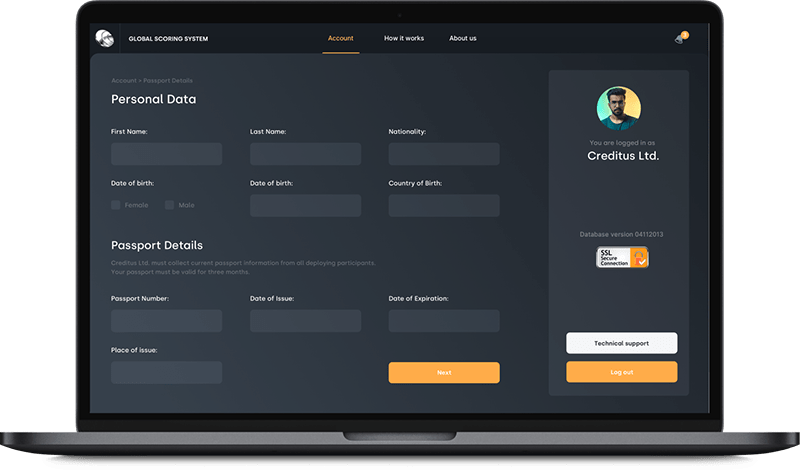

Credit Scoring SaaS App for Financial Organizations

Credit Scoring SaaS App for Financial Organizations

- Fintech

- ML/AI

- Credit Scoring

The system is a SaaS platform allowing the client to evaluate solvency and reliability of the potential borrowers using statistical methods of analysis of the historical and nontraditional data sources such as social network profiles and others. It allows the client to upload his normalized and anonymized database of previous loans data, build mathematical models and calculate the credit score of the future potential borrowers entering their data through the system’s web interface.

Contact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland