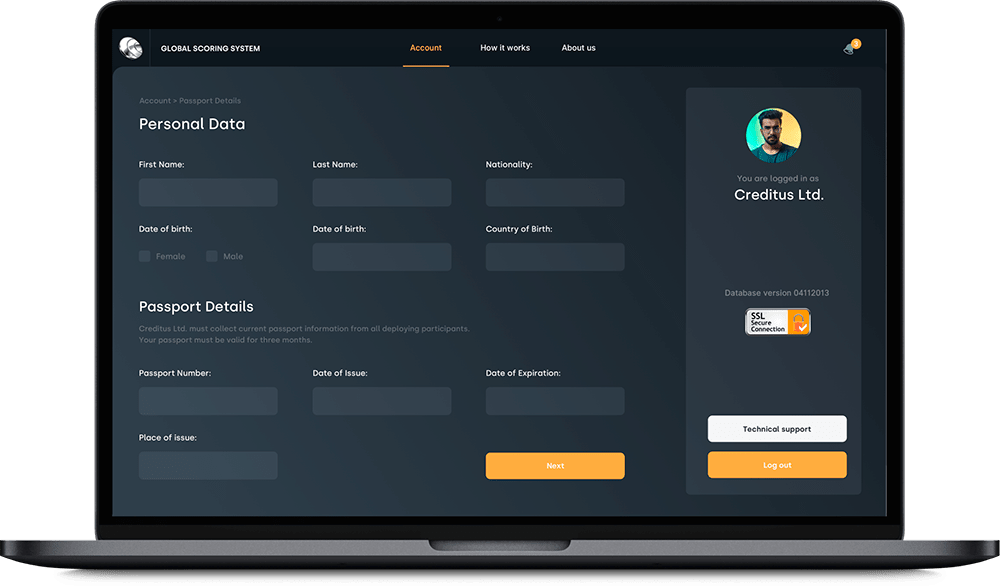

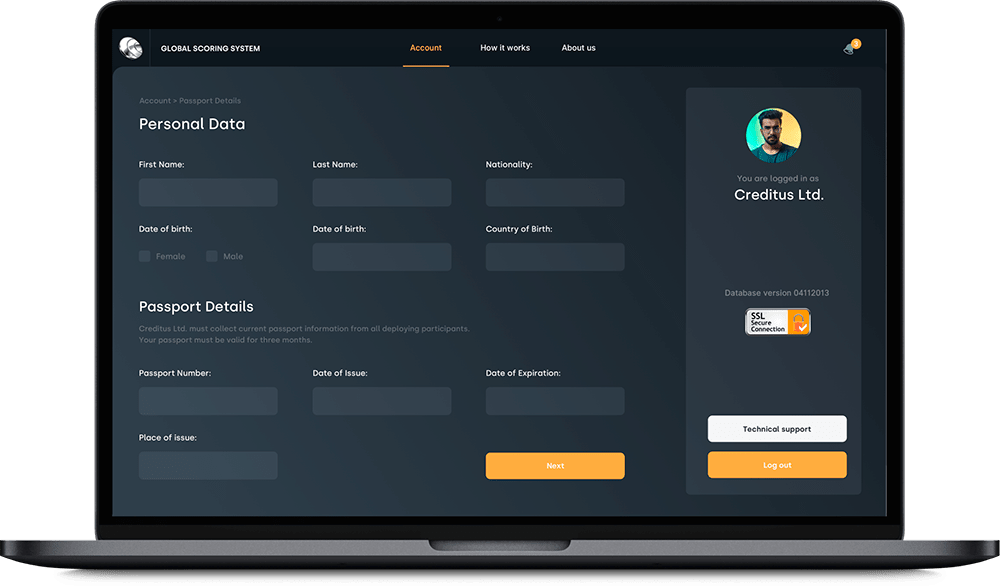

Credit Scoring SaaS App for Financial Organizations

The platform allows users to evaluate solvency and reliability of the potential borrowers

The system is a SaaS platform allowing the client to evaluate solvency and reliability of the potential borrowers using statistical methods of analysis of the historical and nontraditional data sources such as social network profiles and others.

It allows the client to upload his normalized and anonymized database of previous loans data, build mathematical models and calculate the credit score of the future potential borrowers entering their data through the system’s web interface.

Engagement model

Time & Materials

Project Team

2 developers, 1 QA Engineer, 1 PhD mathematician-consultant part time

Tech stack / Platforms

System Architecture Highlights

- Statistical module providing a web services API to various clients such as a website or end client’s software

- Web site interacting with the statistical module through the web services

- The system can be uses on a SaaS module or can be installed on customer’s servers.

- The statistical module can be operated through the web interface or can be integrated with customer’s software.

- The SaaS system is capable of handling large volumes of data and high computational load through horizontal scalability

- Neural Network, Logistic Regression and Decision tree mathematical algorithms or credit scoring are implemented

How it Started

The client is a startup company that is providing credit scoring services using non-traditional data sources to various financial organizations, Banks and Micro financial institutions in the first place. The client contacted Itexus looking for a financial technology partner to implement the core product and become a local services partner to them.

Development Work

Key aspects of the development process:

- Short two-week iterations and deliveries of product increment versions at the end of each iteration

- Continuous integration, nightly builds, automatic execution of unit and integration tests

- Regular code tests by the architect and automatic code analysis using Sonar (http://www.sonarqube.org/)

Related Projects

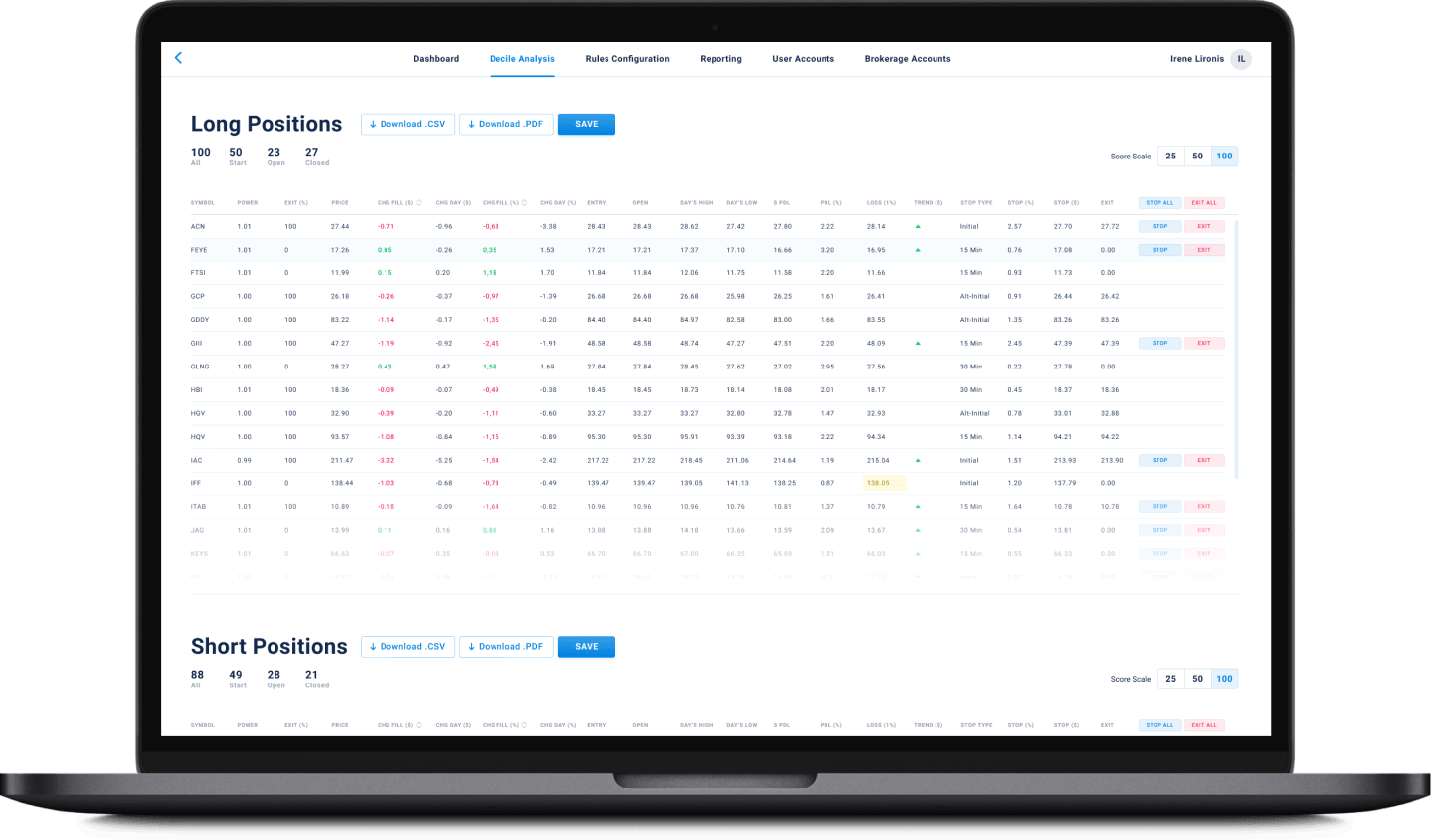

All ProjectsFinancial Data Analytical Platform for a Large Investment Management Company

Financial Data Analytical Platform for a Large Investment Management Company

- Fintech

- Enterprise

- ML/AI

- Project Audit and Rescue

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.

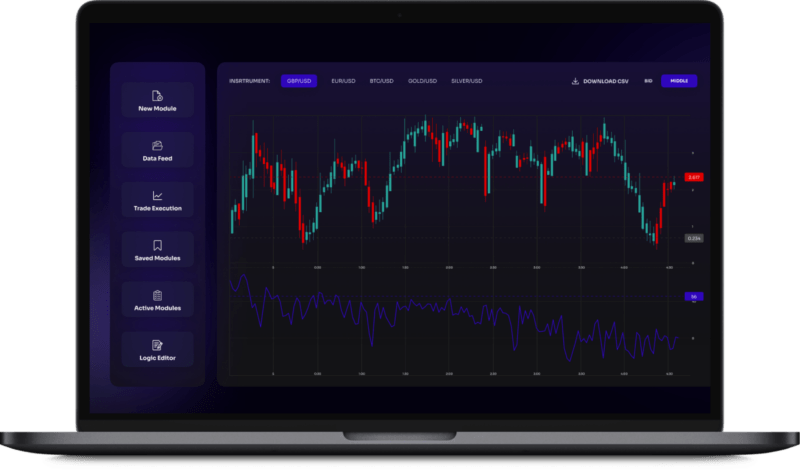

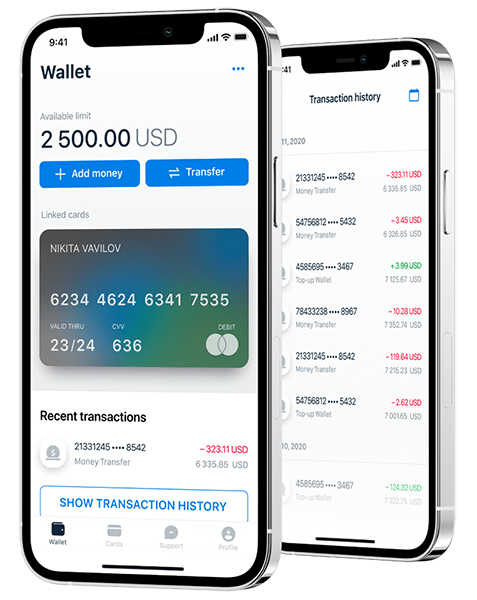

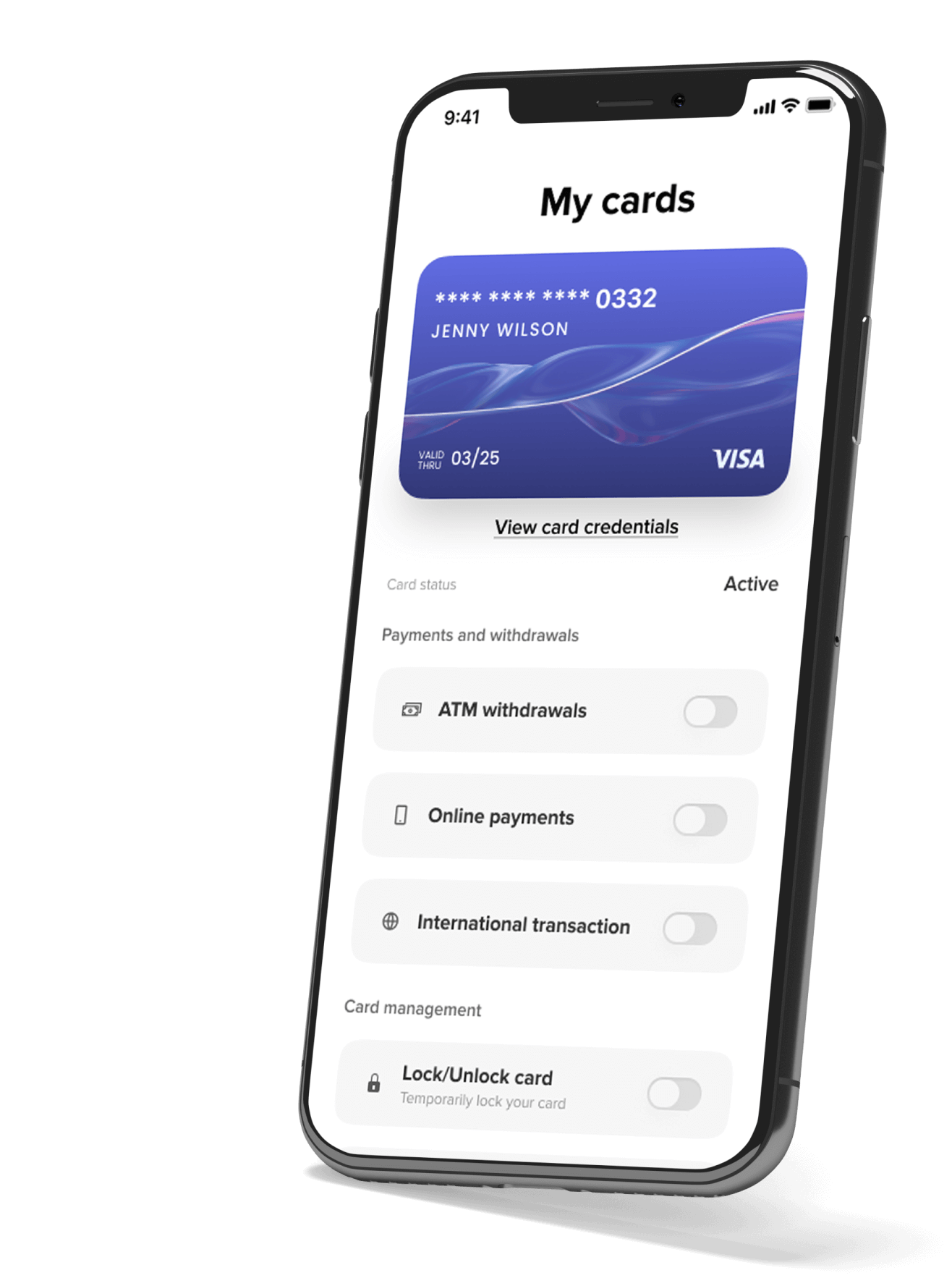

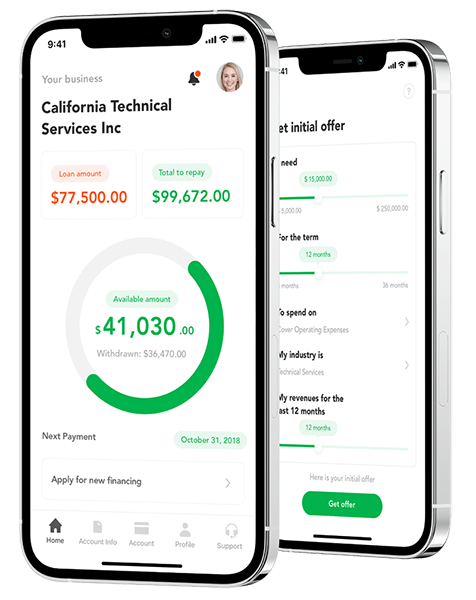

App for Getting Instant Loans / Online Lending Platform for Small Businesses

App for Getting Instant Loans / Online Lending Platform for Small Businesses

- Fintech

- ML/AI

- Credit Scoring

Digital lending platform with a mobile app client fully automating the loan process from origination, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management. Featuring a custom AI analytics & scoring engine, virtual credit cards, and integration with major credit reporting agencies and a bank accounts aggregation platform.

Wealth Management Platform

Wealth Management Platform

- Fintech

Wealth management platform connecting investors with a professional wealth-advisory company, allowing investors to answer a questionnaire and receive either a recommended model portfolio or a custom-tailored individual portfolio, that is further monitored, rebalanced and adjusted by a professional wealth-adviser based on the changing market conditions and client’s goals.

Contact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland