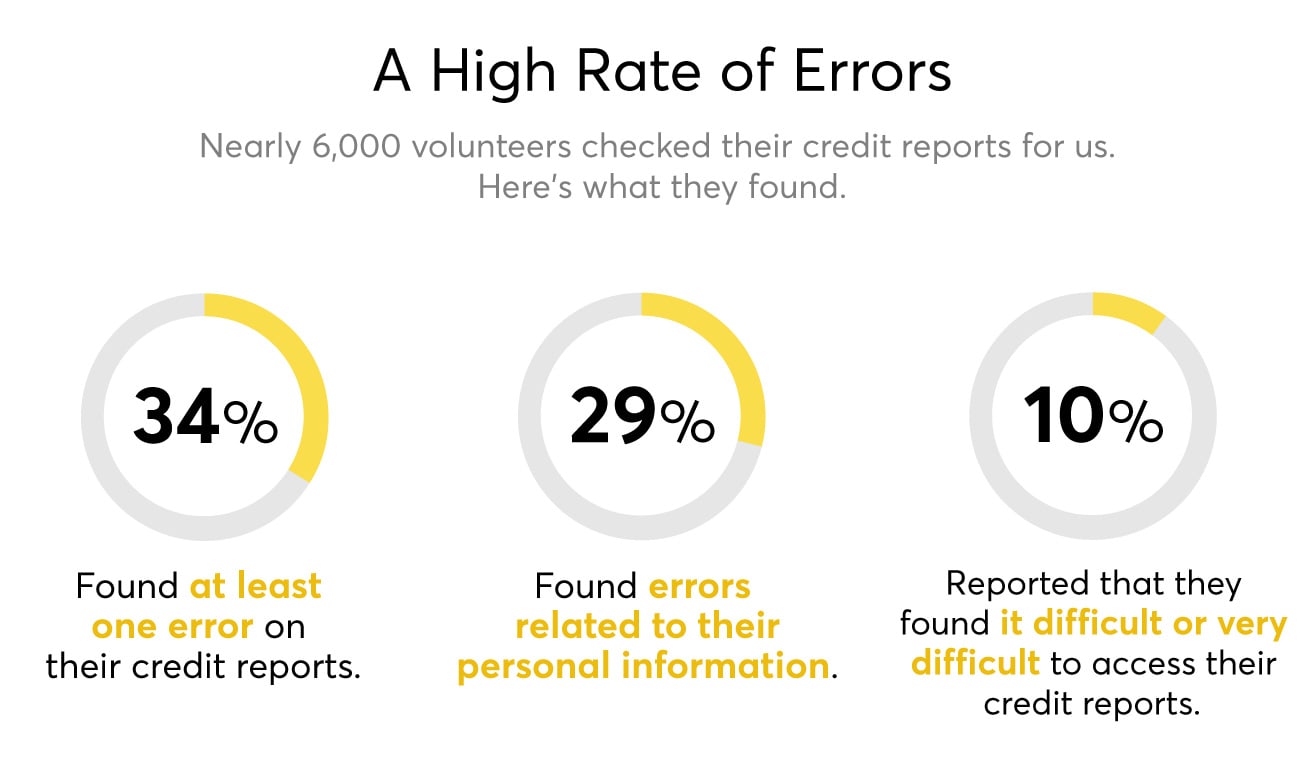

According to Consumer Reports, 34% of consumers have discovered at least one error on their credit reports that could potentially affect their credit score. The good thing is that there is a way to monitor these reports for fraud and errors – with a credit scoring app. This is a personal-use solution that accesses credit reports (with the user’s permission), compiles a VantageScore, and makes it available to the user and creditors.

Standard credit scoring solutions are limited to specific countries and score models. That’s why companies from around the world turn to Itexus to develop custom credit score apps tailored to the needs of their users.

In this article, we explain how credit score apps work and present their benefits, key features, and costs.

How Credit Score Apps Work

When you take out a loan, lenders report your activity to credit bureaus such as TransUnion, Equifax, or Experian (in the U.S.), and the information is compiled into credit reports. A credit scoring app (also called a credit report app or credit score loan app) scans the data collected about you by the credit bureaus and gathers your credit history. The latter includes public records and account openings. Then, the app displays a score that lenders can use to assess how likely you are to repay.

A credit scoring service checks the following:

• Name or address changes in your credit file

• Updated public records (including court dates and bankruptcies)

• New account openings (including credit cards and loans)

• Hard credit inquiries, such as credit card and loan applications submitted

• Unpaid accounts sent to collections, balances, and other payments

Apps for checking credit scores help you determine how certain financial decisions are likely to affect your score. This is done with the help of artificial intelligence.

The Use of AI in Credit Scoring Apps

Artificial intelligence is a great way to create an individual credit score based on factors such as employment opportunities, current income, recent credit history, earning potential, and credit history.

AI tests hundreds of hypotheses within minutes using machine learning algorithms and the user’s historical data and creates different models for the user to see what can be done to improve their score.

This more granular approach allows banks and credit card companies to assess each borrower more accurately and enables them to extend credit to people who would have been rejected under the scorecard system, such as new college graduates, transient foreign nationals, and others.

AI is highly adaptable. For example, it can adapt to new problems, such as credit card churners who have high credit scores but are unlikely to be profitable for the card issuer.

Key Benefits of Credit Score Apps

We’ve identified four important benefits of credit scoring apps to explain why your potential users need the best app to track their credit scores.

Debt management

A credit score is a ready and easy-to-understand snapshot of a person’s financial situation. When users have the ability to instantly see if their credit score has gone up or down, they can easily see if their debt is getting out of hand.

Increased chances of a loan

Some credit scoring apps act as a proxy for past credit histories or other transactional data. This happens because some apps use anonymized data such as the number of contacts and mobile apps, the number of files in emails, and the amount of data a mobile user consumes as the basis for creating a user profile. If a person is unbanked, this is a valuable opportunity to worry less about their ability to repay loans. Using credit score apps as alternative data even helps reduce the time required to approve a loan.

Financial history analysis

A credit scoring app shows when users hit financial lows and were at their peak. It tells you when they tended to borrow and when they were more frugal. A credit scoring app provides this information and makes it possible to adjust lifestyles accordingly

Free financial advice

Some apps can advise users on how to reduce their debt or give tips on which investments are right for them.

Credit Score App Development Components & Cost

In this section, we’ll talk about the key features that credit score monitoring apps should have so that users can stay updated and eventually improve their credit scores.

Authentication & Onboarding

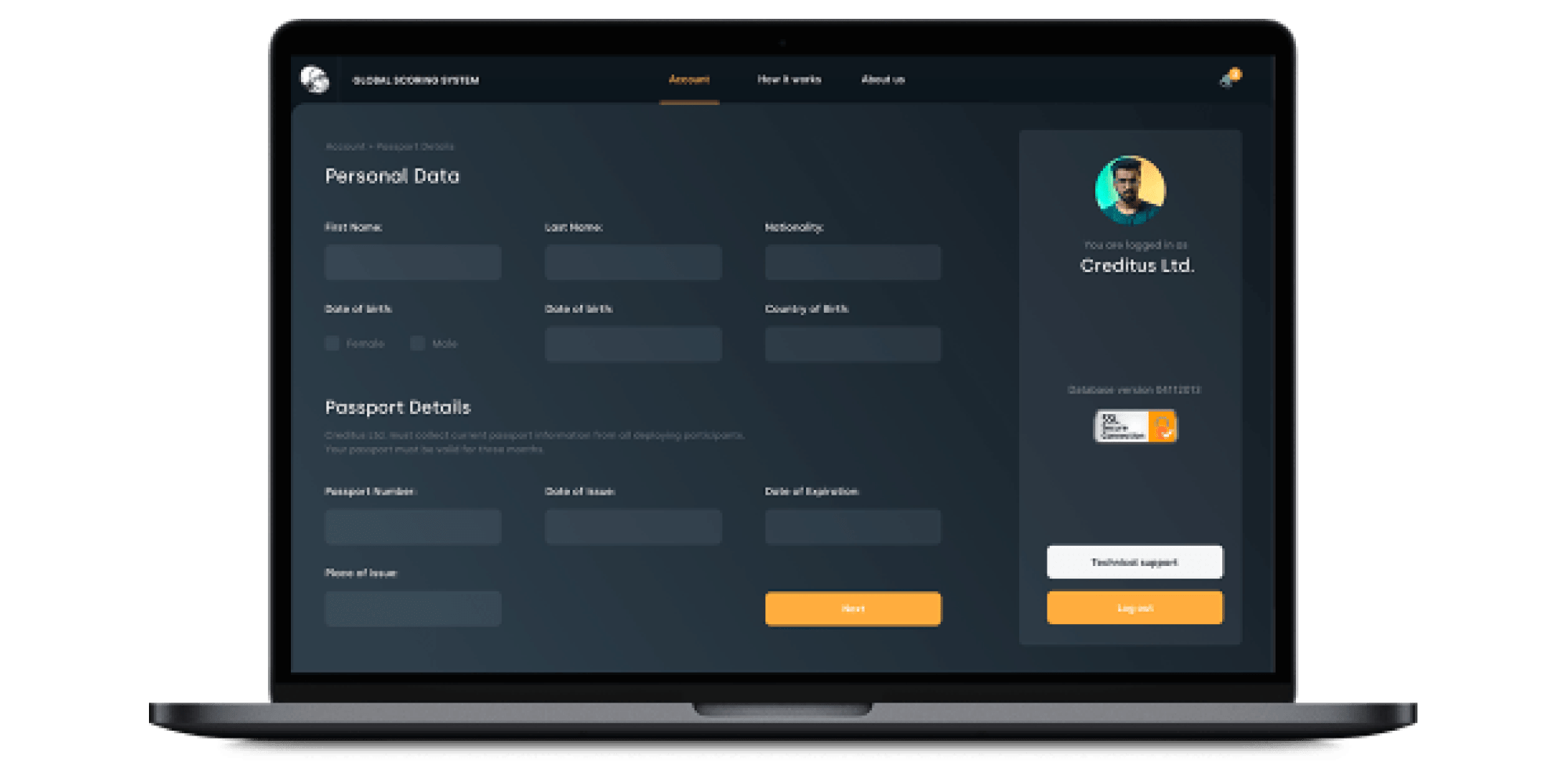

Intuitive registration and onboarding processes are very important. Credit scoring applications typically require verification of a lot of data, including personal information and Social Security Number (SSN). It’s also a good practice to ensure that a user logs in with two-factor authentication where biometrics (such as Face ID or Touch ID) acts as the second factor. Depending on the complexity of the app and the scope of the features, authentication, and onboarding take between 24 and 400 man-hours to develop.

Reports/Analytics

A report is a detailed breakdown of an individual’s credit history generated by a credit reporting bureau. It is presented visually in the form of charts. A report includes personal information, public records such as bankruptcies, details about lines of credit, and a list of entities that want to see the consumer’s credit score. AI in the credit scoring app allows users to receive personalized money management recommendations. For example, they can get a notification that their car loan is 16% and they may be overpaying. The development of this feature requires 100 to 450+ hours of work.

Loyalty Program

Once known only in the airline industry, loyalty programs are now everywhere, even in the financial sector. The best credit score apps have personalized offers for a credit card, car loan, or even a home loan based on the user’s credit history. Estimated development time: 190 – 260 working hours.

Notifications & Alerts

A user can get credit alerts when their credit bureau receives new credit information from creditors, as well as notifications about the user’s new credit checks. Top credit score apps also notify the user when their personal information is affected by a data breach. The development process takes 40 – 80 man-hours.

Support

Users of the most accurate credit score app can find answers to their questions in a section of the FAQ or get support from customer service via a chat or contact form. Customer service is responsible for acknowledging every customer inquiry. It keeps all customer inquiries in one place and provides helpful and meaningful feedback.

To fully automate the support department, you need software used in call centers, such as Five9 and Genesys, as well as ticketing and CRM systems like Salesforce and Zendesk. The development of the function requires 60 – 95 working hours.

Additional Features

Itexus always tailors the app structure to the client’s unique requirements. At your request, we can add various integrations and additional features to turn your solution into the most reliable credit score app.

For example, we can provide a security monitoring service to check if users’ personal data has been breached. This way, the app scans users’ personal data on both the public and dark web, court records, social media, medical benefits statements, and various databases, and tracks any fraudulent use of your data. After that, it sends alerts when credit cards, bank details, etc. are used without authorization. These alerts help you find out if users need to change their passwords and how to manage cybersecurity.

Itexus Experience: Credit Scoring SaaS App

A startup company that provides credit scoring services to various financial institutions using non-traditional data sources turned to Itexus to implement their idea for a credit scoring app. For this client, we developed a SaaS platform that allows the client to assess the solvency and reliability of potential borrowers using statistical analysis methods of historical and non-traditional data sources such as profiles from social networks and others.

To learn more about the project, please read the case study.

Summary

On average, a credit scoring app with basic features requires between 414 and 1285+ man-hours for front-end and back-end development. To estimate development costs, multiply the labor hours by the average hourly rate of a developer, which varies drastically by region, domain, and expertise. At Itexus, we charge an hourly rate of $35-$40 for fintech projects. Multiply it by the number of hours, and you’ll end up with an estimate of about $50,000 to get started with your best accurate credit score app .

Of course, these are rough calculations, and the exact numbers will depend on the scope of work and your budget. If you want to get a full picture of how we can help your business, feel free to contact our team. With our extensive experience in credit scoring app development, we can create a solution of any complexity and with all the required integrations.