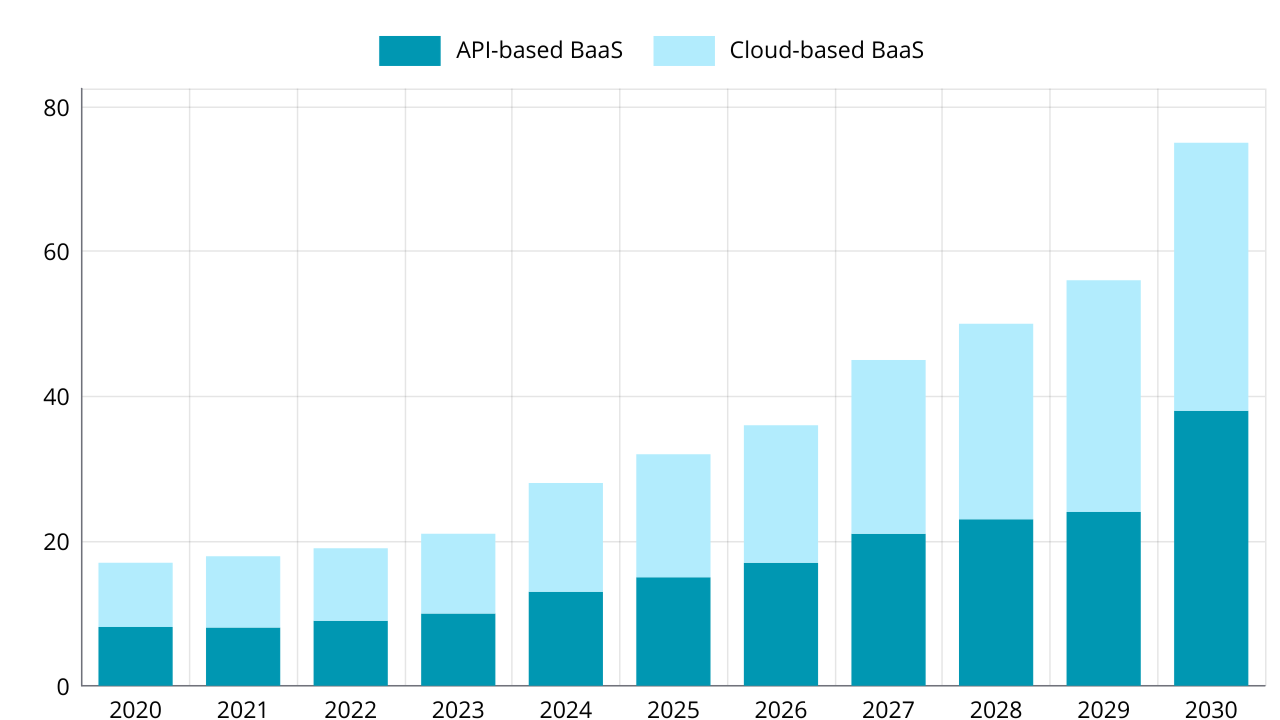

$74.55 billion! That’s where the Banking as a Service (BaaS) market is projected to reach by 2030, up from $19.5 billion today.

What slice of that pie will you claim?

This presents a huge opportunity to shake things up. But here’s the catch: choosing the right BaaS provider.

Once overheard two seasoned coaches debating the acquisition of the perfect player for their team—discussing speed, strategy, and stamina. It’s funny how this debate mirrors the process of picking the right BaaS provider.

In this article, we’ll break down how to make a choice that puts you ahead, not behind.

What is Baas?

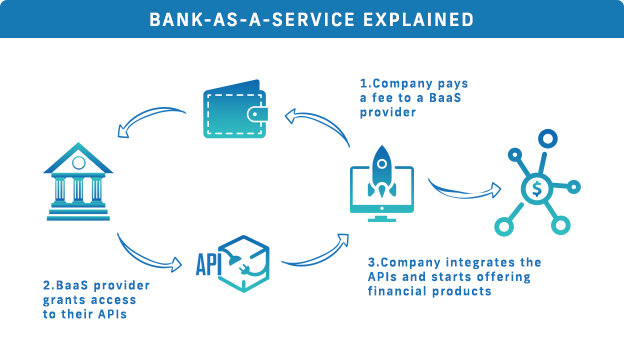

Banking as a Service (BaaS) was first talked about in the early 10s. In 2011, the Parse platform was launched. The principle of BaaS is to provide the client with access to the banking infrastructure (account opening, card issuance, authentication, payments) via APIs without the need to obtain a banking license from the state regulator.

Key Factors in Choosing a BaaS Provider

In my opinion, when choosing a BaaS provider, you should evaluate its functionality, such as:

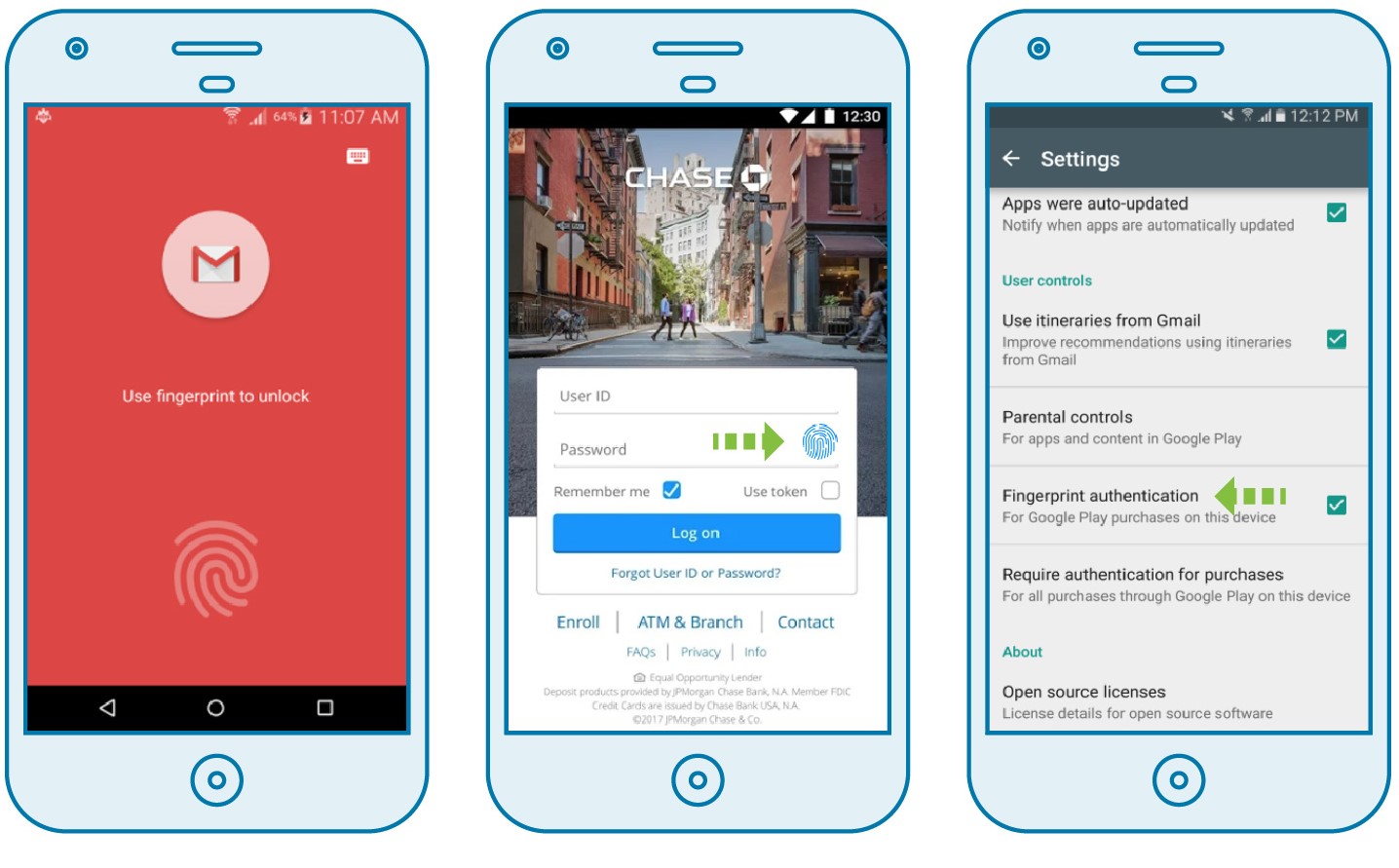

- Support for different authentication methods (OAuth, email/password, social media, biometrics, SMS). User profile management.

- Database management. Support for different types of databases NoSQL, MySQL, relational databases, availability of necessary tools for editing and management.

- API and server logic. A very important factor to pay attention to. This includes API customization, creating custom functions and triggers.

- Files. File storage, including multimedia, caching.

- Push notifications. Support for pop-up messages for iOS and Android mobile operating systems.

SDK and integrations. This feature helps to integrate your own projects written in different programming languages. Implementation of analytics services, choice of payment systems.

An example of a client authentication window.

How to assess the reputation and reliability of a BaaS provider

There are several stages to assess the work and functionality of a BaaS provider. During the initial reputation check, I base it on the company’s history, its achievements, and feedback from other clients. The longevity of the provider indicates a good reputation and demand for services.

Technical expertise. At this stage I try to assess the provider’s technical staff, their qualifications, work experience, availability of relevant certificates confirming the skills of employees.

It is not superfluous to conduct interviews, including technical interviews where employees can demonstrate their knowledge, skills, programming styles. Employees of BaaS provider responsible for cloud technologies should preferably be AWS Certified Solutions Architect, Google Professional Cloud Architect. Employees responsible for information security should have Certified Information Systems Security Professional (CISSP), Certified Cloud Security Professional (CCSP) certificates.

Today there are a lot of BaaS providers, but in my opinion, some of them with significant cases, innovative technologies and scalability deserve trust:

Solarisbank. The bank is based in Berlin and offers banking solutions to its customers across Europe. Its main advantage is the integration of all banking products on one platform.

Home page of the official Solarisbank website

Railsbank. Railsbank is one of the largest companies I have ever worked with. The main office is located in London. The main advantage of Railsbank is its simple and intuitive API gateway, through which all banking products can be fully managed.

Main page of the official website of Railsbank

Starling Bank. It is a UK digital bank that provides end-to-end BaaS services. I can recommend it too as one of the best banking service providers, suitable for both small and medium sized businesses. It has an easily customizable API in its arsenal. The bank’s employees pay a lot of attention to security.

Home page of the official website of Starling Bank

Why safety and regulatory compliance are so important

After years of working with Bank as a Service (BaaS) providers, I’ve learned one crucial lesson: you must be vigilant about information security. We’re dealing with clients’ money and financial transactions, and fraudsters are always on the lookout. Attackers constantly improve their skills, using modern tools and social engineering to gain access to customer accounts.

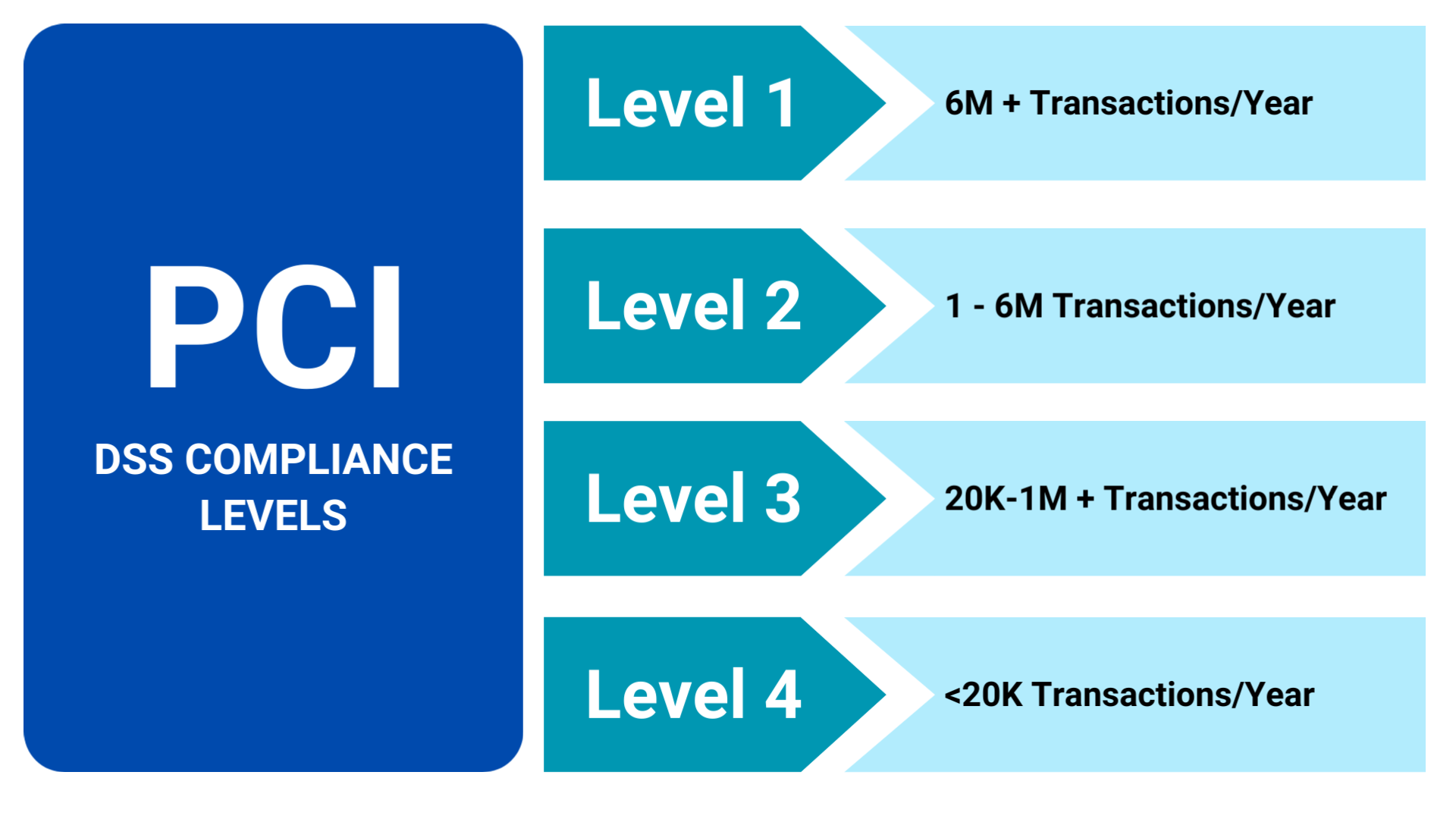

Start with certification. A BaaS provider must have all the necessary international security certifications, such as ISO 27001, SOC 2, and PCI DSS, which is essential for handling payment data. Let me explain further: the PCI DSS (Payment Card Industry Data Security Standard) certification is specifically designed to protect bank cardholder data. It has four levels of compliance, depending on the number of transactions processed per year

Platform integration, features and functionality

I’ll let you in on a little secret: to successfully integrate a BaaS platform into your existing business, you need to carefully examine all the features and functionality. What do I mean by the word “features”?

- User Authentication. Including two-factor authentication and SSO (Single Sign-On).

- Working with databases in real time. Processing of massive amounts of data.

- Cloud technologies. Very important if the business has to scale in the future.

- Working with files. Storage, backup, fast recovery.

- Analytical tools. To have insights into user behavior and offer them the right products.

Since my business is based on sales, it was important for me to offer additional services to the client, such as cashback, discounts, accumulation of points. All these functions can be realized using a BaaS platform, by issuing client cards with open accounts on which cashback and points were accumulated.

Before deciding on a BaaS provider, it’s important to understand how well their platform can integrate with my existing system. To fully understand, it is necessary to understand the platform’s support for the main features:

- Support for popular protocols. For example, RESTful and GraphQL APIs:. This makes integration with most systems much easier.

- SOAP support.

- Import-export of personal user data. Will be needed when scaling or migrating accounts to another platform.

- Support and integration with external APIs. This includes webhooks, various libraries, SDKs, support for various payment systems and analytics tools.

How much it costs to integrate a BaaS platform

Finally, I’ll get to the most interesting part. How much money you will need to spend to integrate a BaaS platform into your system. Based on my experience, I can say that budgeting will depend on several factors:

The size of the customer base.

Future plans. Whether or not you plan to scale.

Many BaaS providers offer a free trial period so that the client can familiarize themselves with the platform’s functionality and features. There are different pricing plans that are fixed or dependent on traffic, transactions, database size, API requests. Such a plan is called Pay-as-you-go and the feature is that the client pays for the platform as they use it.

You’re probably interested in hearing more specific numbers? Well, here are the numbers: Firebase, which is owned by Google, offers BaaS platforms to its customers for $0.18 per gigabyte, plus you have to pay $0.16 for every million read write operations. AWS Amplify will cost $1.25 for every gigabyte of database in DynamoDB, plus you’ll have to pay extra for Amplify queries. BaaS provider Back4App offers free plans for small applications (budding startups). For everyone else, plans start from $5-25 dollars per month.

I’ll give you a little advice. Some companies are in the habit of charging the client extra money, for example, for traffic overruns or for exceeding other limits within the tariff plan. To avoid such hidden costs, you should carefully read the terms and conditions and spell out clear amounts for services in the contract.

For more efficient budget spending, I recommend implementing BaaS platform in stages. What does this mean? Introducing additional features as the company grows and scales, and regular monitoring of costs will be required.

Why support is so important in long-term cooperation

When choosing a BaaS provider, you should not only rely on the cost and range of features offered, but also on the quality of technical support. At any moment something can always go wrong, there may be issues that need to be urgently resolved. Unstable operation or temporary stoppage of BaaS platform is a loss for the company and inconvenience for customers.

Competent technical support is important at all stages of BaaS-platform implementation. In order not to get into a critical situation, it is required to find out in advance the availability of communication channels with specialists:

- Email.

- Hot multichannel phone line.

- Internal chat and messengers.

I strongly recommend using the services of a personal manager, such an option is provided in some BaaS providers’ tariff plans. For large companies whose business is located in different time zones, it is important to get access to 24/7 support.

For long-term cooperation, I recommend using the SLA-support option and requiring the BaaS provider to specify in the contract the response time to requests and responsibility for violation of this clause.

For stable operation of the whole business, it is better to turn to a BaaS provider who considers the relationship as a long-term cooperation and is interested in it. Here it should be written about and for BaaS providers important reputation, which is formed from their relationship with customers.

I would also like to point out that BaaS providers offer online training, courses, webinars, video lessons as additional support options. I highly recommend taking advantage of them.

Summarizing

In this article you and I have looked at the basic principles of BaaS providers, what they offer, how you need to know to successfully integrate the platform into your existing system.

For me, BaaS platform is a tool that helps to sell additional services, attracting new customers. Today BaaS systems are actively developing and improving. You should not miss the chance to seize the moment to scale your business due to new ideas that BaaS offers.

It is difficult to overestimate the possibilities of BaaS system for business, however, it is important to decide on the services it provides: issuing bank cards and opening individual customer accounts to sell goods at a discount, cashbacks, points. The right choice of model can be the reason for a significant increase in sales, and profit growth.

Why delay, if you can right now start developing a plan to implement a BaaS platform and start choosing a potential BaaS service provider for long-term cooperation.