Crypto Retirement Investment App

Web application that allows users to increase and diversify their retirement investments with crypto assets and helps to expand knowledge in the cryptocurrencies through educational content.

About the client

Our client is an American startup whose co-founders have a deep understanding of the financial industry and are professionals in crypto investments, retirement funds management, and marketing in the financial services industry.

Project team

Project Coordinator, Project Manager, Tech Lead, Business Analyst, 2 Angular and Node.js Developers, Software Testing Engineer, QA Team Coordinator, Lead DevOps, 2 UX\UI Designers

Engagement model

Time & material

Effort & duration

6 months

Solution

Crypto investment app

Project background

According to the Retirement Industry Trust Association (RITA), between 3-5% of all IRAs are invested in alternative assets – e.g., real estate, precious metals, and cryptocurrency. With the raising popularity of investing in crypto to save for retirement, crypto investment app constantly emerge. However, existing systems don’t provide complex solutions that cover the full cycle of operations with crypto IRAs – funding accounts, including transfers and rollovers, crypto buy & staking, etc. Moreover, they are designed for savvy crypto traders with deep understanding of the topic – for an average person, it’d be quite difficult to use such a system without assistance or self-education.

To this end, our client approached us to develop an end-to-end solution that will eliminate all the drawbacks of existing crypto IRA programs. The app was supposed to cover the full cycle of operations with crypto retirement arrangements, make managing IRAs more user-friendly and attractive, ensure full transparency of transactions and transaction fees, and provide some unique features to win users loyalty.

The solution should also be responsible for keeping the accounts of IRA ‘s customers safe and in compliance with the regulations set by IRS and the government. Therefore, it was important to implement proprietary secure storage methods to ensure the safety of customers’ assets and prevent theft.

Tech stack / Platforms

Target audience

The solution is targeted at people who live in the USA and want to increase the gains on their self-directed IRA accounts with help of crypto investments (buying and selling different cryptocurrencies, getting rewards for crypto staking) and acquire or enhance their knowledge of IRA and crypto.

Project challenges

Absence of a Product Owner and a CTO in the client’s team

- Since this role wasn’t assigned to a specific person, the responsibilities of the product owner were distributed among the co-founders, resulting in an unclear product vision. Our client also wanted to hire an internal CTO with extensive technical knowledge and experience in fintech to supervise the project. However, the startup had difficulty finding such a person, and the absence of CTO stalled progress significantly.

High-risk investment

- Cryptocurrencies and crypto markets are highly volatile, which discourages investors and increases the likelihood that existing/potential backers will reject project funding.

Technical limitations

- The main custodian, crypto investment platform Prime Trust, was unable to provide full functionality for retirement investing with crypto assets.

Solution overview

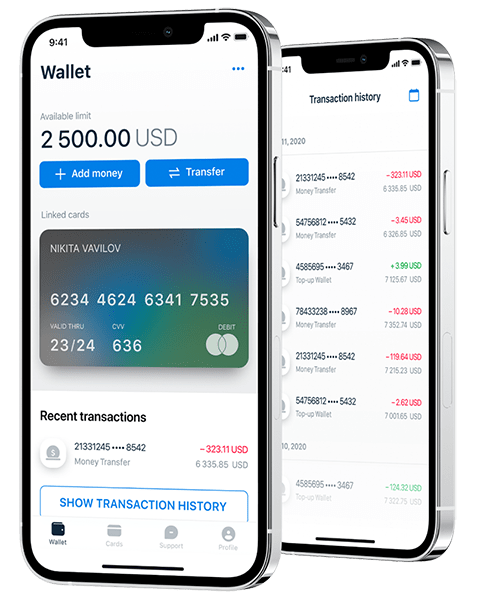

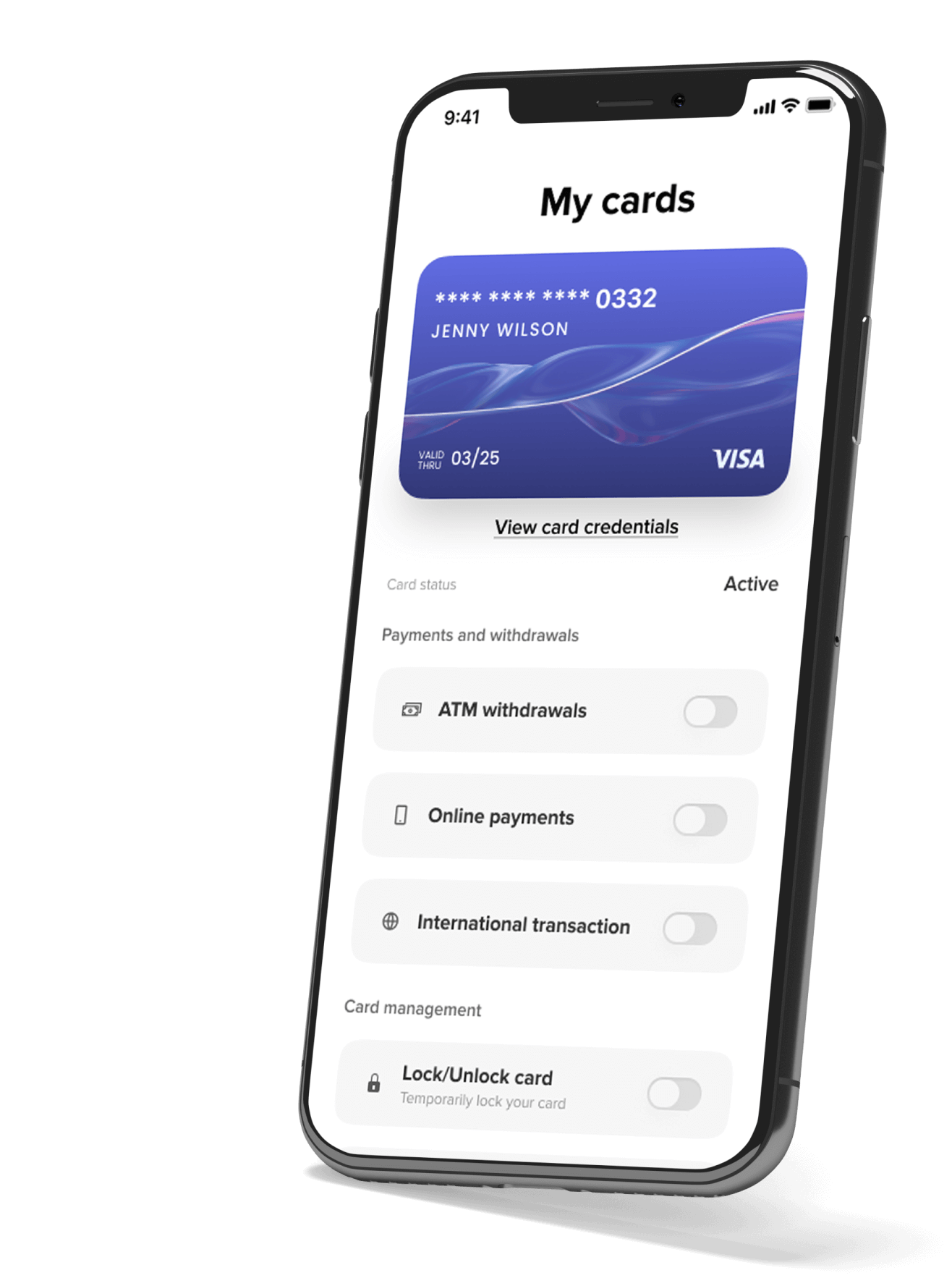

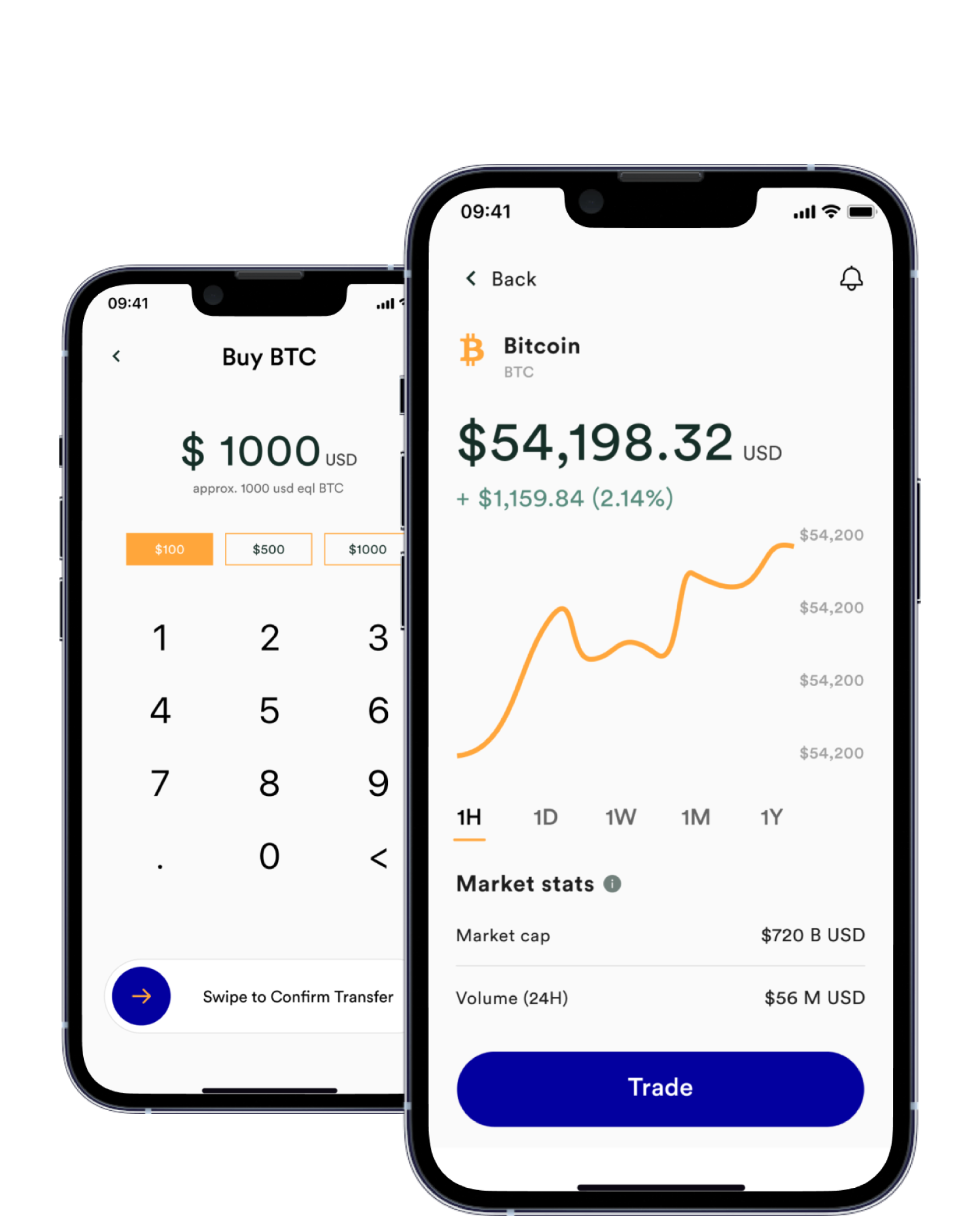

The web app allows users to increase and diversify their savings on IRAs through investing in crypto, as well as to perform other operations with crypto. In the app, users can fund their crypto IRA accounts (including transfers and rollovers from their existing external regular IRA or 401(k) IRA accounts), buy/sell cryptocurrencies, earn rewards for crypto staking, top up their accounts with fiat money, and withdraw funds from accounts. The application also helps users gain deeper knowledge of cryptocurrencies and IRA accounts through educational videos and articles.

Solution main features

Admin panel:

- access Admin’s dashboard

- manage system settings

- access reports & analytics (including creation of mandatory annual Regulators Taxation reporting forms)

- manage users

- manage the app’s monetization functionality and own funds

Client portal:

- sign up / open account, fill in personal data, upload documents to pass KYC check

- access user’s dashboard

- fund IRA (with fiat money & crypto)

- buy/sell crypto

- initiate crypto staking

- view & manage investment portfolio

- withdraw funds (both fiat money & crypto)

- access reports & analytics (including creation of mandatory annual Regulators Taxation reporting forms)

- view account balances and transactions statistics

- access educational content (videos, articles, etc.)

- access customer support

- manage settings

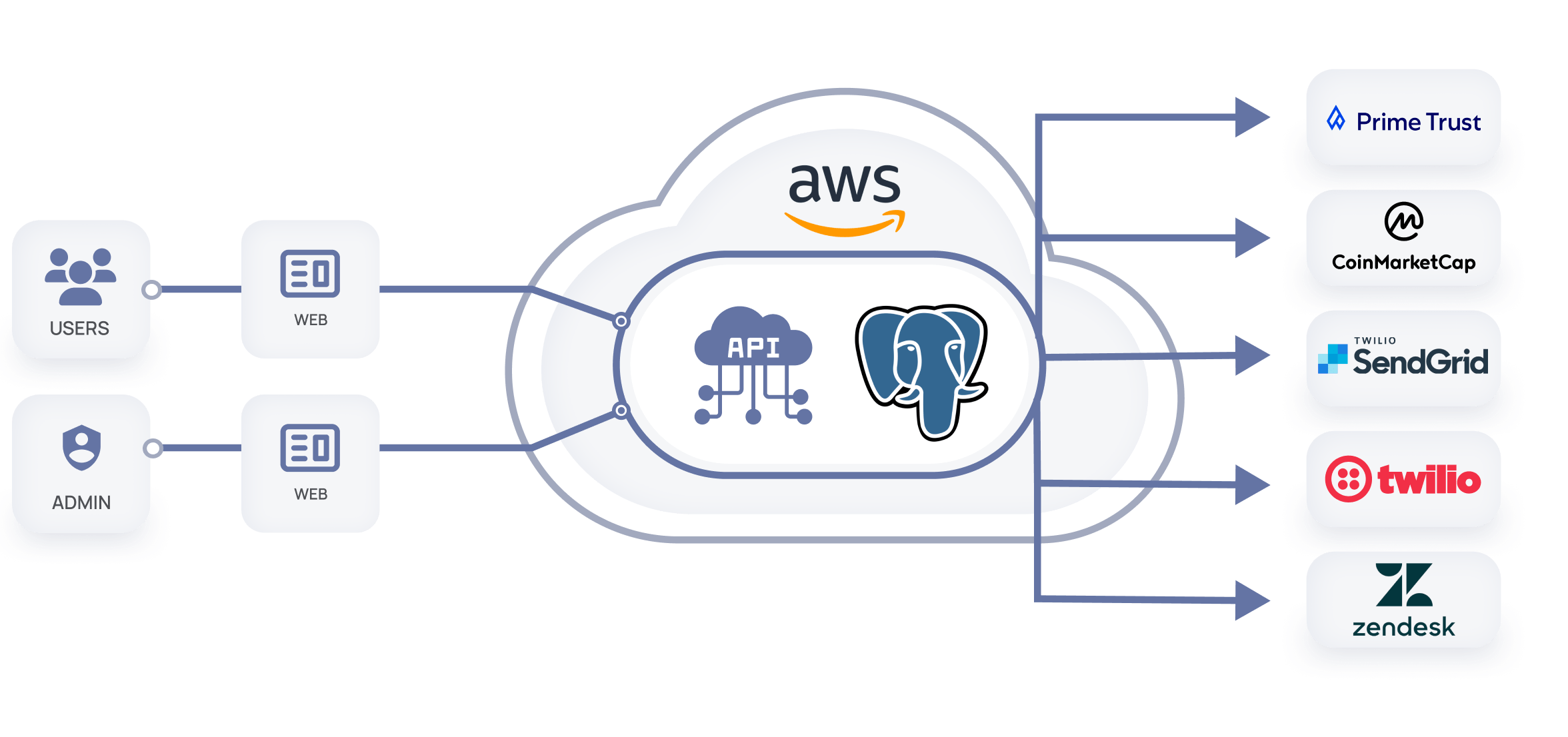

Third-party integrations

- Prime Trust is the primary custodian of the solution and is used for user KYC, account opening, and crypto trading.

- Coinmarketcap is used to receive crypto prices feeding for reflecting in the user’s investment portfolio.

- Zendesk is a cloud-based help desk management solution used for customer service and support.

- Twilio is used for 2FA and to send OTP for protected actions.

- SendGrid is a cloud-based SMTP provider used for confirming email addresses, sending transactional emails, and possibly for marketing campaigns.

Development process

We began with an extensive discovery phase and created the following artifacts:

- A vision and scope document with a detailed description of the project and a variety of diagrams – from user flow and user journey mind maps to solution architecture diagrams and others.

- A work breakdown structure (WBS) document with a detailed breakdown of all the features of the future solution, an accurate estimate for each feature, and a resource plan for the project.

Originally, the client planned to outsource the landing page development and the solution design to an American agency. However, they were so excited about the discovery process and results that they asked us to develop a landing page for the project. We delivered a functional, well-designed page, and the client was pleasantly impressed with the skills of our UX /UI team. Therefore, they decided to entrust our specialists with the design of the solution as well.

After the discovery phase and landing page development, we moved on to the next steps. Our UX/UI specialists created warframes for the client’s and admin’s modules of the system and, after the client’s approval, drafted the final design of the future solution. Once the design was ready, we moved to the development phase. Within 6 months, Itexus’ cross-functional team delivered the solution to the client.

Results

All in all, within 6 months we delivered an MVP that includes a landing page and a fully functional web app that allows users to manage their crypto retirement investments. Our client’s further plans include the development of a mobile version of the platform – and we’ll be there to implement it, as well as to support and maintain the app once it goes live, update it and add advanced features upon our client’s request.

Looking for a talent pool to fill the software development gap for your project? Itexus engineers are ready to tackle your idea, let’s discuss it.

Related Projects

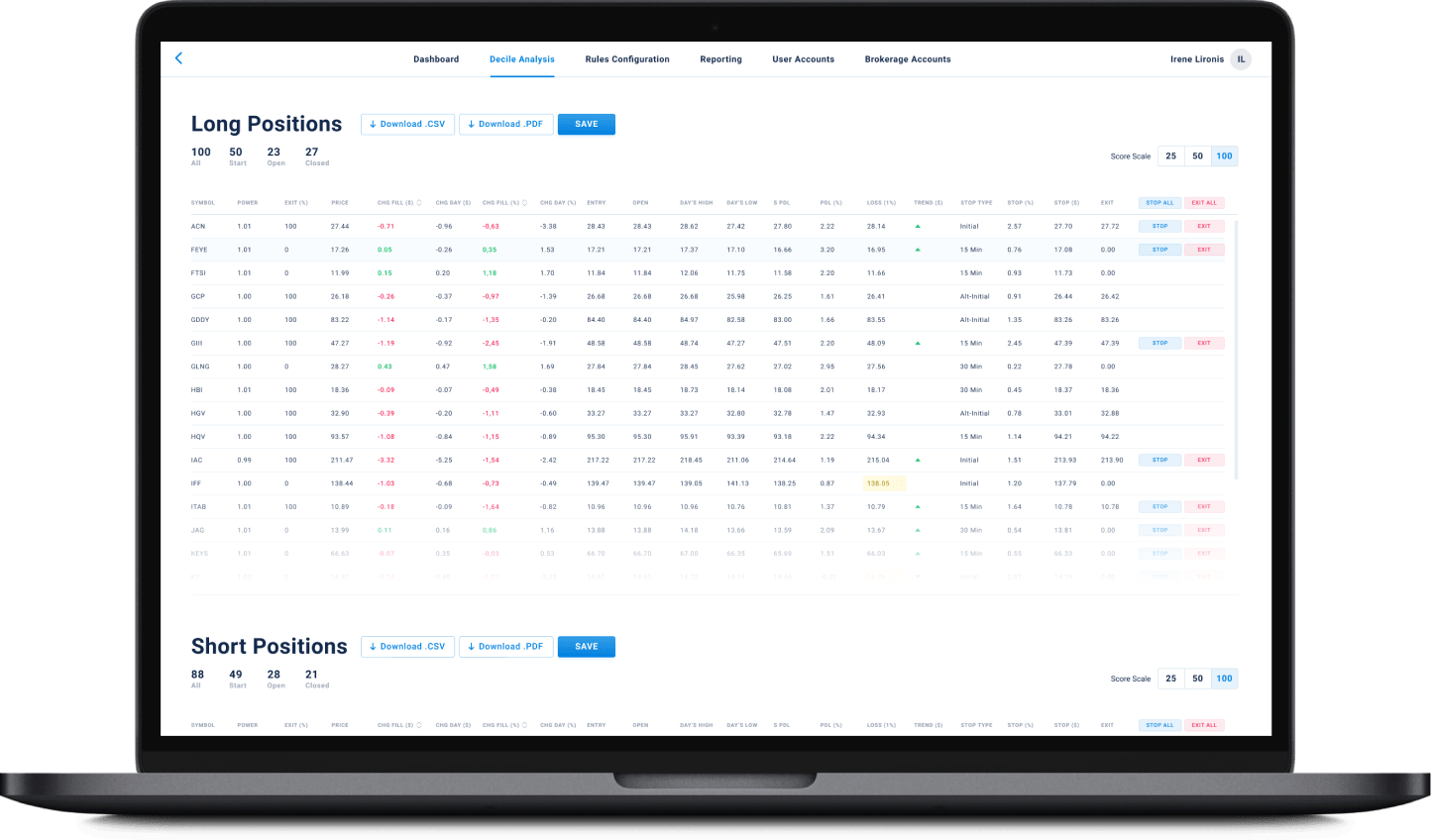

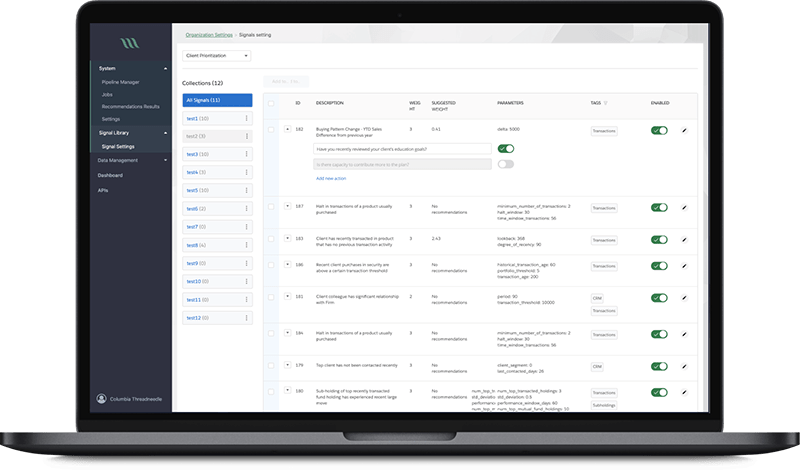

All ProjectsFinancial Data Analytical Platform for a Large Investment Management Company

Financial Data Analytical Platform for a Large Investment Management Company

- Fintech

- Enterprise

- ML/AI

- Project Audit and Rescue

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.

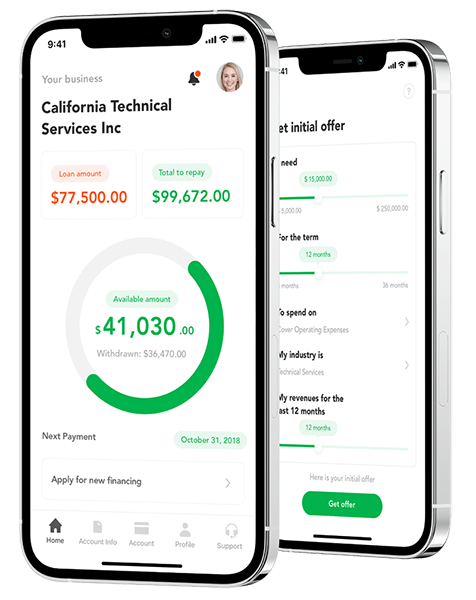

App for Getting Instant Loans / Online Lending Platform for Small Businesses

App for Getting Instant Loans / Online Lending Platform for Small Businesses

- Fintech

- ML/AI

- Credit Scoring

Digital lending platform with a mobile app client fully automating the loan process from origination, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management. Featuring a custom AI analytics & scoring engine, virtual credit cards, and integration with major credit reporting agencies and a bank accounts aggregation platform.

Wealth Management Platform

Wealth Management Platform

- Fintech

Wealth management platform connecting investors with a professional wealth-advisory company, allowing investors to answer a questionnaire and receive either a recommended model portfolio or a custom-tailored individual portfolio, that is further monitored, rebalanced and adjusted by a professional wealth-adviser based on the changing market conditions and client’s goals.

AI-Powered Financial Analysis and Recommendation System

AI-Powered Financial Analysis and Recommendation System

- Fintech

- ML/AI

The system uses machine learning techniques to process various content feeds in realtime and boost the productivity of financial analysts and client relationship managers in domains such as wealth management, commercial banking, and fund distribution.

Contact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland