DevOps Solution for AI-Based Financial Recommendation System

Due to the complexity and tough security requirements of AI-based financial recommendation and analytic system Itexus DevOps team made great efforts to setup processes automation and migrate the system between different cloud platforms.

About the Project

The client is a FinTech startup developing an AI-powered financial analysis and recommendation system for the stock market and wealth management domain. The product is used by tier 1 banks and asset management companies.

The system processes various data feeds such as CRM data, news, documentation archives, client portfolios, and transactions and stock market data and recommends news and documents relevant to the client and his portfolio and helps prioritize the clients according to the stock market events.

DevOps Solution Highlights

Due to the enterprise nature of the project, its complexity, 5+ years duration, security requirements, cloud independence during its course we had to cope with a very wide range of DevOps tasks on all major cloud platforms.

Industry

FinTech

Engagement model

Time & Materials

Solution

Machine Learning, NLP, Enterprise

Effort and Duration

5+ years

Tech stack / Platforms

Process Automation

The complexity of the system, the necessity to support and update multiple versions for different clients required full automation of the development and deployment processes with strict version control and release management. During the development process our team successfully completed the following DevOps tasks:

- Setup Continuous Integration and Continuous Delivery (CI/CD) pipeline for Python applications with Jenkins supplemented with automated Unit and Service level tests

- Setup automated code quality analysis check as part of the CI process using Veracode

- Moved all infrastructure to Docker containers

- Setup Database cluster manager

- Setup site-to-site VPN access for the distributed development team

- Implement an automated monitoring system based on Sentry. The development team received automated alerts of any issues (peak memory/cpu usage, data processing delays, errors, service unavailability etc) happening with the production instance.

- Codified the Infrastructure with Terraform (Infrastructure as a code approach)

As a result of the automation, the team could release new software versions much faster, of much better quality, without errors caused by human factors and could significantly reduce the time and money spent on integration/deployment and testing activities.

Migrations Between Cloud Providers

Major cloud providers have startup support programs providing their cloud infrastructure for free for the first 1 or 2 years. Our client could obtain such credits from AWS, Google Cloud, IBM Cloud and Microsoft Azure and he didn’t have to pay a dime for his development infrastructure for 5 years. However this required the development team to keep the system cloud-agnostic and once in 1-2 years migrate up to 30 servers and data (Dev, QA and Production environments) from AWS to Google Cloud, from Google Cloud to IBM Cloud and from IBM Cloud to Microsoft Azure.

We used Docker, Ansible, Cloud Formation to perform this migration.

On-Premises Installation for Enterprise Clients

Enterprise clients required that the system is installed in their own cloud and installation and support is handed over to their own DevOps team. Access to the production environment for our team was restricted. We created an Installation guide, Ansible Playbook, and Cloud Formation Template allowing the clients to automatically create all infrastructure and install the system and subsequent updates without involving our engineers. We also conducted a few training sessions with screen sharing to train the customer’s DevOps team to use the installation scripts.

All highlights of the project and the development process are described here.

Related Projects

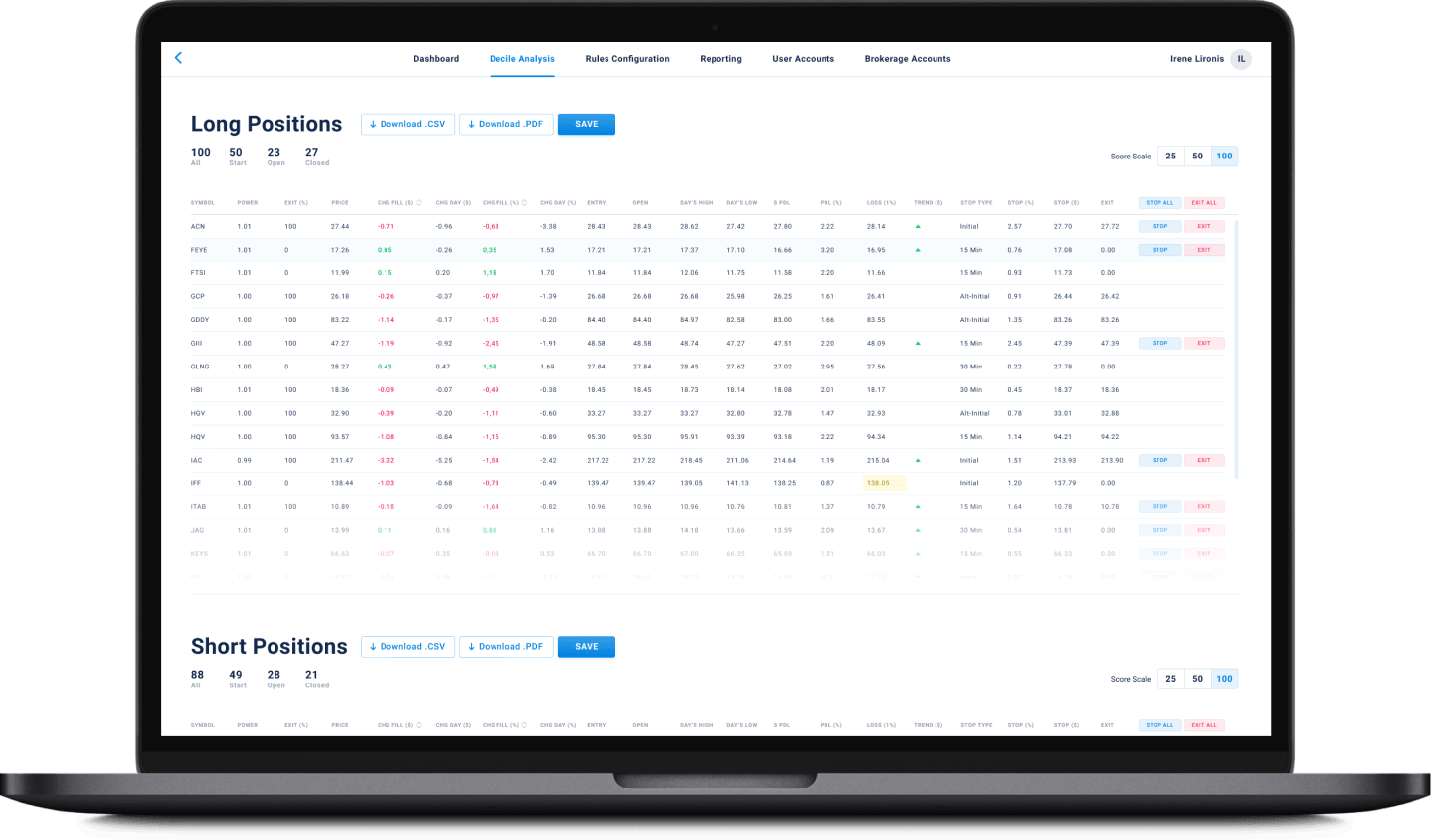

All ProjectsFinancial Data Analytical Platform for a Large Investment Management Company

Financial Data Analytical Platform for a Large Investment Management Company

- Fintech

- Enterprise

- ML/AI

- Project Audit and Rescue

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.

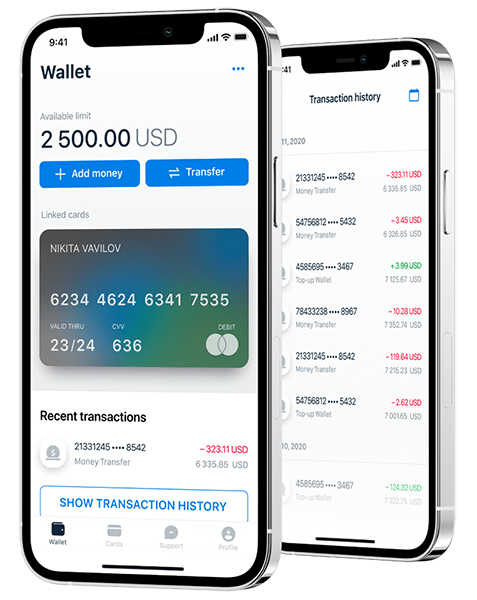

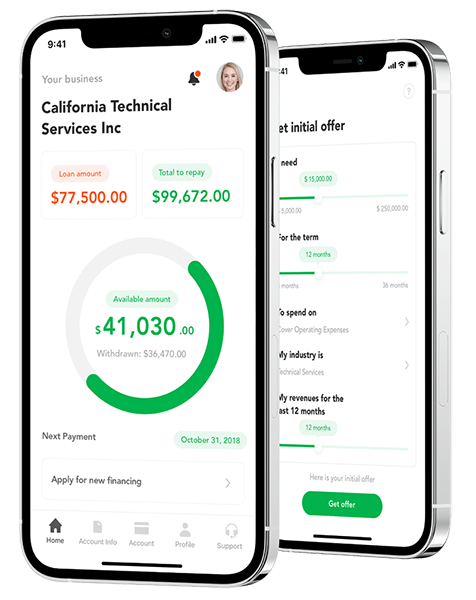

App for Getting Instant Loans / Online Lending Platform for Small Businesses

App for Getting Instant Loans / Online Lending Platform for Small Businesses

- Fintech

- ML/AI

- Credit Scoring

Digital lending platform with a mobile app client fully automating the loan process from origination, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management. Featuring a custom AI analytics & scoring engine, virtual credit cards, and integration with major credit reporting agencies and a bank accounts aggregation platform.

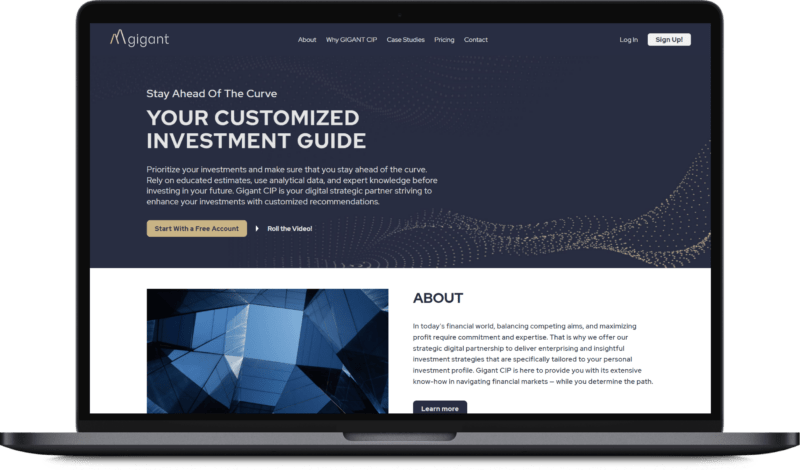

Wealth Management Platform

Wealth Management Platform

- Fintech

Wealth management platform connecting investors with a professional wealth-advisory company, allowing investors to answer a questionnaire and receive either a recommended model portfolio or a custom-tailored individual portfolio, that is further monitored, rebalanced and adjusted by a professional wealth-adviser based on the changing market conditions and client’s goals.

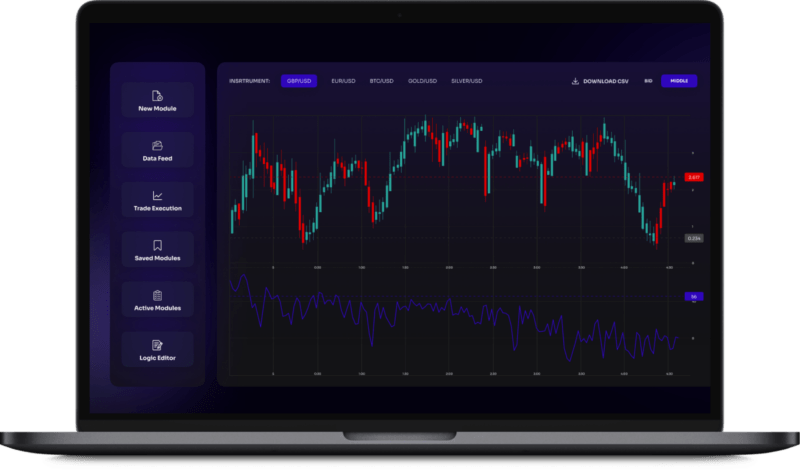

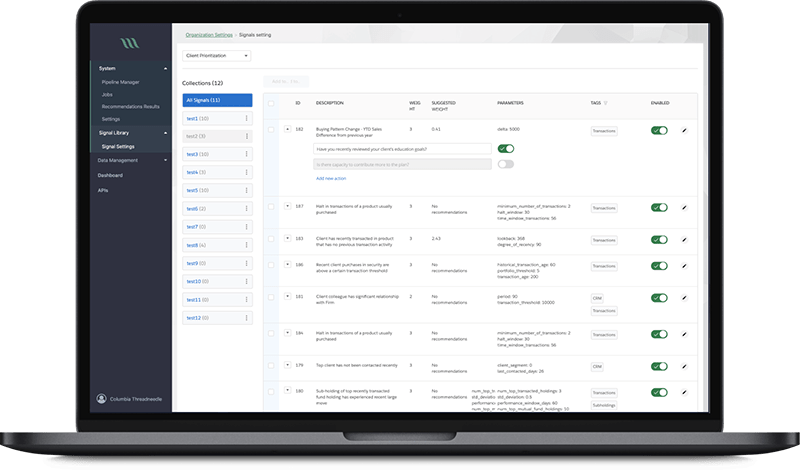

AI-Powered Financial Analysis and Recommendation System

AI-Powered Financial Analysis and Recommendation System

- Fintech

- ML/AI

The system uses machine learning techniques to process various content feeds in realtime and boost the productivity of financial analysts and client relationship managers in domains such as wealth management, commercial banking, and fund distribution.

Contact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland