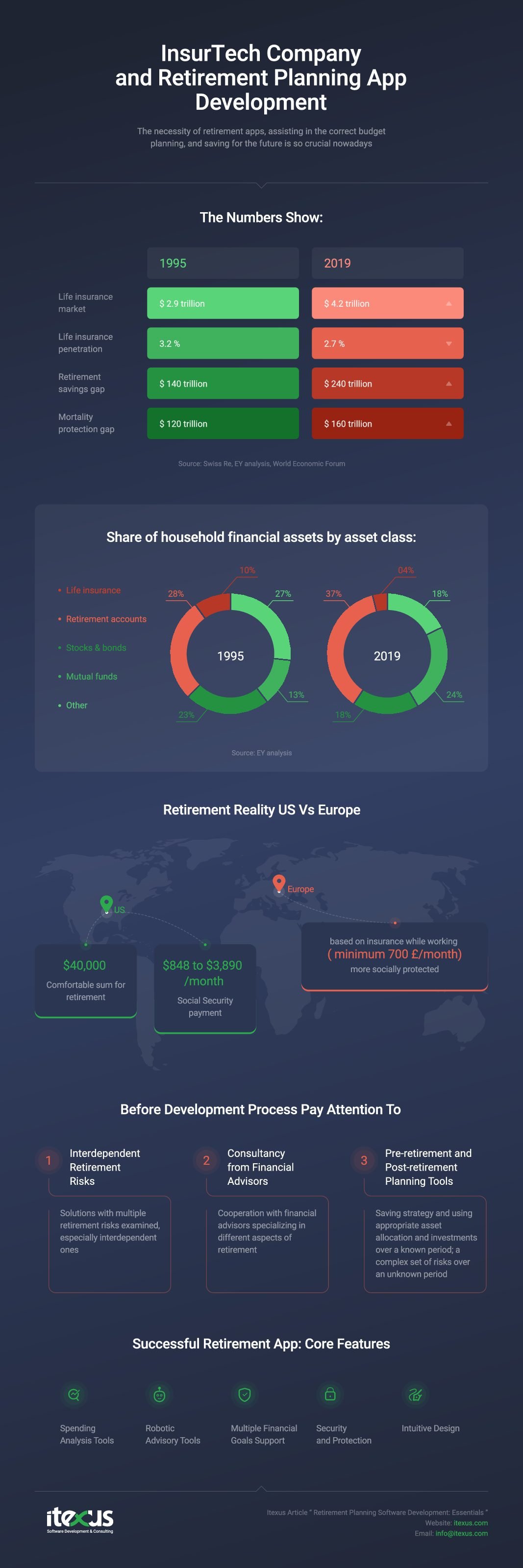

The share of the aging population has been increasing worldwide since the 1950s, so the average life expectancy for men and women in the United States is 76 and 83 years old, respectively, compared with 80 and 85 years in Europe. As a result, the retirement age has also increased, which is 67 for U.S. citizens and varies between 62 and 67 in Europe and Asia.

Some countries provide better social security, while others are shifting retirement and retirement benefits into the private sphere of citizens’ lives. This means that a statistically average person expects to live another 25-30 years after retirement, and it is a good feeling to be sure that the generated funds will be sufficient. That’s why the need for retirement apps that help with proper budgeting and saving for the future is so crucial these days. Retirement management software is mainly aimed at individuals or financial advisory companies, but recently more and more insurance companies are also interested in offering retirement plans to their clients.

US and European Retirement Reality

If we talk about the reality in the U.S., there are several ways people can prepare for retirement. The first is to pay Social Security, which varies from $848 to $3890 per month. Most people, especially those who have worked in low-paying jobs or have not been able to be formally employed for a decent amount of years, don’t rely solely on Social Security payments and have begun planning for retirement well in advance. An average amount of money for a comfortable retirement in the U.S. is considered to be $40,000. Part of this amount is covered by Social Security benefits, and the other half depends entirely on people’s ability to save and prepare for retirement. There are two main ways to run a retirement account: through 401(k) plans organized by employers, or through IRA and its modifications. But neither way might be sufficient. In the event of a job change, one’s existing 401(k) plan will remain unprotected unless terminated. However, modern tribulations, especially COVID -19 and many other plausible misfortunes, could cause people to deplete their IRA accumulated savings much earlier, leaving them completely unprotected by the time they need to retire.

The situation in Europe and the United Kingdom is similar, but not exactly the same. Pensions in Europe are paid based on the insurance people had while they were working. For a retired couple in England, for example, £25,000 per year is a comfortable sum, considering that £14,000 of it is paid by the government. In other European countries, pension rates are lower, as is the cost of living. In summary, retirement in Europe, unlike in the U.S., is more socially secure. Nevertheless, retirement solutions can be very useful if one wants to have greater financial opportunities as a retiree.

What is Retirement Management Software?

The main goal of any retirement planning tool is to help people estimate their income, give an idea of retirement needs and current spending models. There are several parameters to consider when using retirement analysis software:

- individual’s future lifespan,

- expected inflation rate,

- gross income,

- dual income couples,

- taxes,

- different types of bank accounts,

- required minimum distributions,

- changing Social Security rules,

- asset reallocation,

- planned expenses: college education, buying a house, new car, etc.

Everyone’s experience is different. Therefore, financial planning software can only suggest a plan, although with the development of today’s technologies (ML, AI, Data Science, etc.) the prediction is getting very precise, especially if the software is custom developed.

Why Retirement Management Software Is Vital for Insurance Industry

To reach customers and become a trusted partner for life, insurance companies should seriously consider including retirement options in the insurance package for businesses and individuals. The right insurance software could protect customers’ income in retirement, keep savings on track and improve investments. In addition, life insurance options offer tax-deferred growth and tax-free cash flow due to preferential tax treatment.

What Aspects Insurance Companies Should Pay Attention To?

✅ Interdependent Retirement Risks

Insurance companies should be selective in the retirement planning software they recommend. The top priority should be given to solutions with multiple retirement risks examined, especially the ones that are interdependent. Such programs are good because they frame the analysis in terms of insurable events.

✅ Consultancy from Financial Advisors

The retirement app should include a wealth of information about inflation rates, market trends, health care costs, etc. Ideally, each insurance company should engage financial advisors or at least offer one or two free consultations to recommend the right plan that addresses the client’s specific needs. It is also advisable to work with financial advisors who specialize in different aspects of retirement planning: annuities, investment plans, analysis, simulations, Monte Carlo predictions, etc.

✅ Pre-retirement and Post-retirement Planning Tools

When developing custom retirement analysis software, insurance companies should consider the difference between pre-retirement and post-retirement planning tools. Pre-retirement planning is generally based on developing a savings strategy and using appropriate asset allocation and investments over a known period of time. Post-retirement practices have to address a complex set of risks over an unknown period of time.

Core of the Best Retirement Finance Planning App

To order a sound and resilient retirement planning software that will automate customer service, ensure superior customer experience, and bring better revenue to your company in the long run, consider the following.

✅ Spending Analysis Tools

The integration of spending analysis tools stems from the fact that, unlike revenues, expenditures are not predetermined. They should be adjusted within certain limits, the solution might advise cutting travel or entertainment expenses, etc. To ensure the success of retirement planning, spending habits could be visualized and interacted based on the user’s actual expenses to create new spending habits in the shortest possible time.

✅ Robotic Advisory Tools

Based on the personal data provided the robotic retirement planning calculators come up with the exact time when one’s funds might run out. By using sophisticated algorithms and machine learning, the path to different scenarios is cleared and provides clients with sound advice for better funds management. The most common are ‘What-If’ scenarios, Monte Carlo simulations, or a linear model based on either goals or cash flow. It is important to provide 401(k), IRA limits, and regular tax law updates to keep the program up to date and extremely helpful.

✅ Multiple Financial Goals Support

This feature is important to avoid overestimating the amount that can be saved for a comfortable retirement, thus giving clients an incomplete picture. There should be other goals you want to save for besides retirement: college, buying a new car, moving to a new house, etc.

✅ Security and Protection

Most retirement software used today is web-based, but with the rise of smartphones, it can also run as an app. Since phones are vulnerable to phishing and hacking, all financial solutions should be protected. This could be two-factor authentication, encryption, and other security protocols.

✅ Intuitive Design

There is no doubt that customer loyalty and retention depend on how user-friendly and useful the app is. This point is extremely important in retirement calculators, as the software is quite complicated by nature. The built-in guidance and structure of retirement apps are more beneficial for customers than introducing complicated schemes and in-depth financial planning algorithms that can only be interpreted by a professional.

Summary

There are plenty of retirement management solutions available to meet the different needs of end-users and help them prepare for a comfortable retirement. There is the option of using free and paid apps for individuals or purchasing a complete package from an insurance or financial company. But the question of accuracy is still up in the air. For insurance companies and financial advisory agencies, it is best to order custom development and ensure that all aspects and key features described in this article are applied. Make your retirement planning software highly interactive, user-friendly, secure for entering sensitive data, helpful for comparing multiple scenarios, mapping stress tests, and creating the savings plan. It should also be easy to update and make changes to the existing retirement plan.

Itexus can point to a number of successfully developed financial apps that integrate machine learning, AI, data science, and other cutting-edge technologies. If you have an idea of what kind of financial software you would like to develop, or if you already have an app that needs an upgrade, contact us.

To recap

We’ve compiled an infographic to make it easier for you to remember all the important parts of the article, in a visual form.