Peer-to-peer, also known as person-to-person or P2P lending, is a relatively new approach to lending and borrowing. They allow borrowers to get money quickly and investors to increase their returns without having to deal with traditional financial institutions.

The popularity of P2P solutions is growing rapidly due to the benefits they offer to both parties. According to the report by Precedence Research, the size of the global P2P lending market was estimated at $83.79 billion in 2021. It is predicted to exceed around $705.81 billion by 2030, with a CAGR of 26.7% from 2022 to 2030. In this article, we will explore the pros & cons of such solutions and their key features, as well as go over the development of P2P lending platform stages and costs.

What is P2P Lending App?

The main idea behind peer-to-peer lending is that lenders and borrowers can find each other bypassing intermediaries represented by banks or other financial institutions. It is the modern alternative to traditional bank financing, especially in the field of smaller consumer loans.

P2P lending offers both secured and unsecured loans. However, the majority of loans are unsecured, and secured loans are usually collateralized with luxury goods.

Key Advantages and Disadvantages of Peer-to-Peer Lending Platforms

Let’s take a look at why P2P loans can be a good alternative to traditional lenders, and discuss some drawbacks that should be taken into account.

Advantages

• Lower interest rate for borrowers and higher returns for investors

Unlike banks, peer-to-peer lending apps do not have to spend on staff or physical infrastructure maintenance. For this reason, their interest rates are much lower compared to those of banks. And lenders, on the contrary, can expect higher returns than if they chose other forms of investment.

• Instant and simple access to funds

Most of these platforms usually have a list of investors waiting to lend to the appropriate borrowers, which ensures quick and convenient access to money for borrowers.

• Proper risk management

P2P platforms conduct their own risk assessment protocols, which require borrowers to provide some information to demonstrate their creditworthiness. Comprehensive underwriting should include credit, affordability, identity, and fraud checks.

• More flexibility

Peer-to-peer lending is unsecured, meaning borrowers do not have to put up collateral or tie personal property to the deal. This also ensures that the application process is quick and straightforward, allowing parties to dispose of funds more quickly.

Disadvantages

• Higher risk for lenders

Borrowers applying for P2P loans may have a low credit score that does not allow them to apply for a loan from a bank. In addition, P2P investments are usually not insured or otherwise protected. This means that in the worst-case scenario, the lender can lose the entire amount invested.

• Legal constraints

In some countries, P2P loans are prohibited or heavily regulated. But the same goes for all fintechs – they all have to comply with a variety of regulations and guidelines because they deal with sensitive data. You just need to make sure that the laws of your target market allow P2P lending and that your app complies with all the required policies and guidelines, that’s all.

How Does a P2P Loan App Work?

Peer-to-peer lending is a fairly straightforward process. There are two user roles in the app: money lender and money borrower. All transactions are handled through a dedicated online platform. The following steps describe the general P2P lending process:

1. First, potential borrowers and lenders need to register on the platform to start using it.

2. Borrowers need to link their bank account to the app (it is usually required to be more than one year old) and provide their personal information including their occupation. This information is usually accessible to lenders.

3. Lenders must determine what type of loan they can offer and also link their bank account to the platform. In this way, the money can be credited to the borrowers.

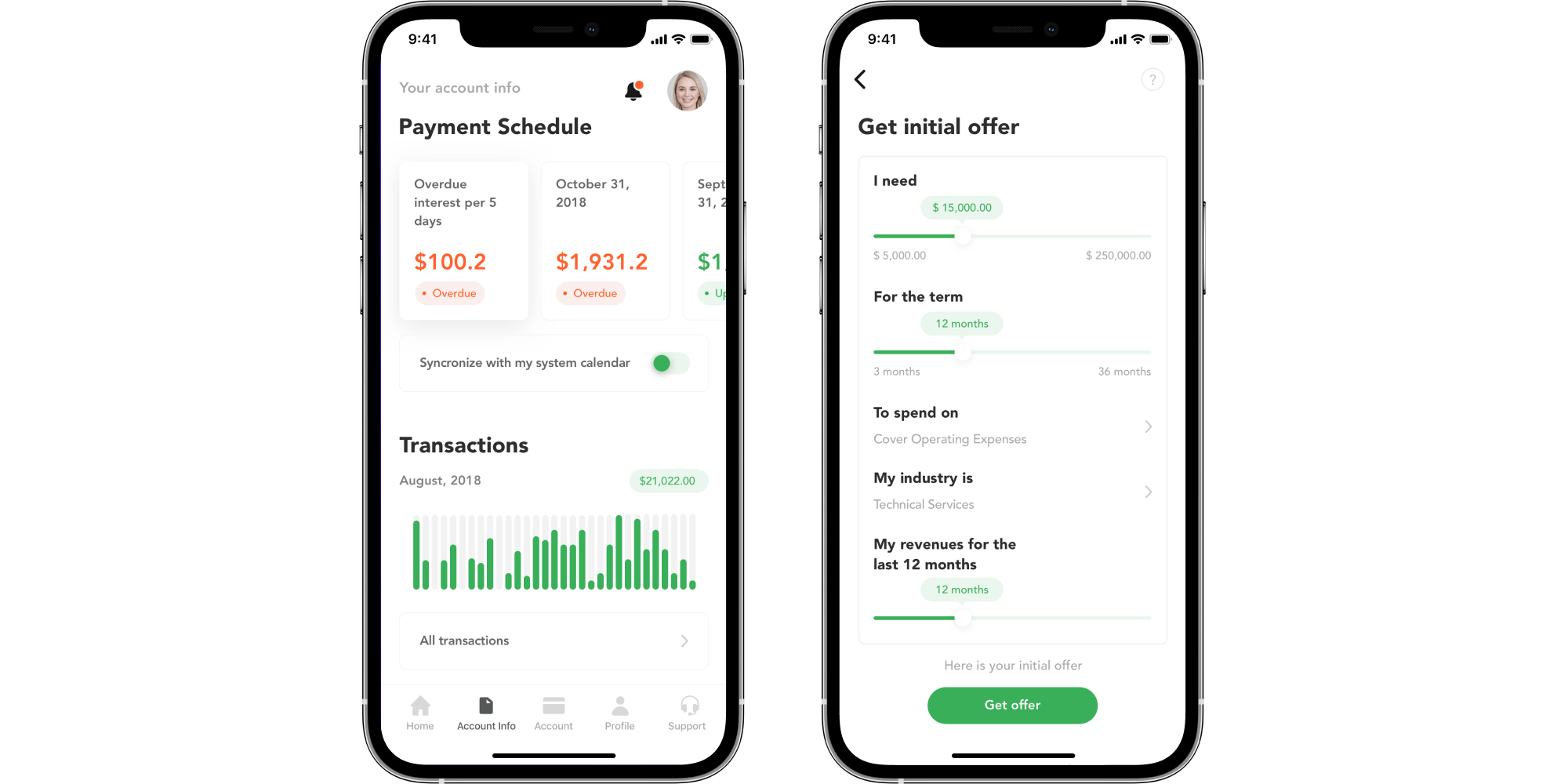

4. To apply for a loan, the borrower must specify the purpose, the amount needed, the desired term, etc.

5. The lenders see the borrower’s application and can make an offer if it matches their preferences and criteria.

6. The borrower sees several loan offers from different lenders and can choose the most favorable one. Both the borrower and the accept the terms of the loan.

7. The platform transfers the agreed amount from the lender’s account to the borrower’s account and charges a commission. This can be either a fixed amount or a percentage of the amount borrowed.

8. The app shows the dates for repayment and the amount to be paid each month. The borrower is responsible for making regular (usually monthly) interest payments and repaying the principal when due.

What to Consider Before Developing a Peer-to-Peer Lending App?

Before you start developing a P2P loan platform, you should consider the following factors, which can lead to risks for your solution if not taken into account.

✔️ Find a Reliable Banking Partner

You’ll need a banking partner to take care of your financial transactions so check all available offers to choose the most favorable terms. You can also try to negotiate personal pricing terms for your platform.

✔️ Comply with government rules and regulations

Your P2P platform, like all other organizations offering financial services, must comply with a variety of policies and regulations that apply in your target region. To this end, we recommend that you hire a lawyer who has hands-on experience in digital lending.

✔️ GDPR Compliance

The General Data Protection Regulation (GDPR) ensures that your users have basic rights, such as the right to information, the right to access, the right to rectification, restriction of processing and erasure of data, the right to data portability and rights regarding automated decision making and profiling.

✔️ Ensure Streamlined Borrowers Onboarding & Verification

To meet AML standards, ensure a robust borrowers’ onboarding and verification process that includes:

- Government-issued proof of identification

- Verification of phone number

- Proof of tax return

- Bank account information

- Verification of income

✔️ Set Interest Rates

You need an advanced algorithm for pricing loans. It should be constantly updated and perfected. To obtain a loan, borrowers must have:

- A minimum score of 600 FICO

- A credit profile with no delinquencies

- At least one open bank account

- A debt-to-income ratio below 40%

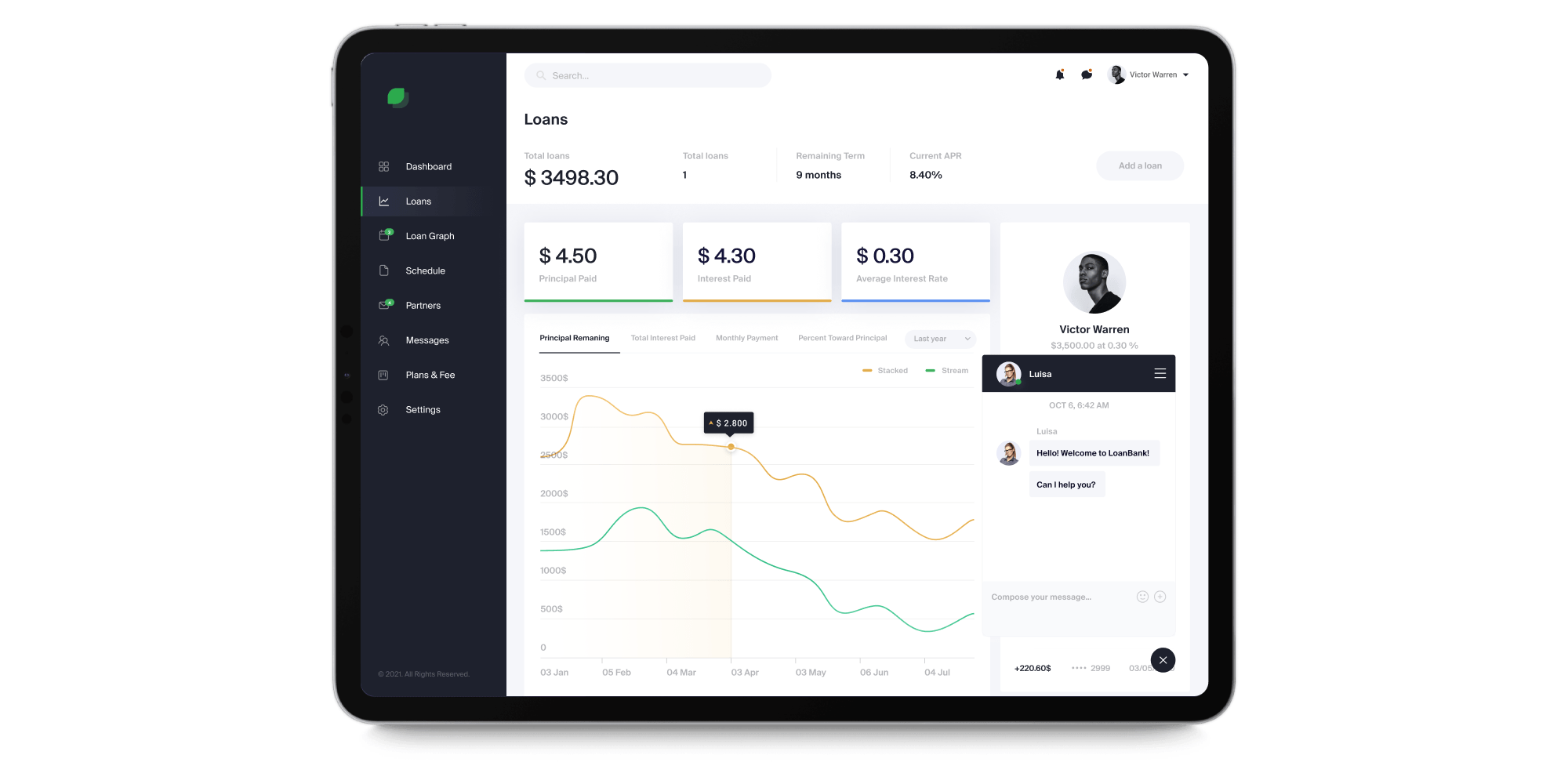

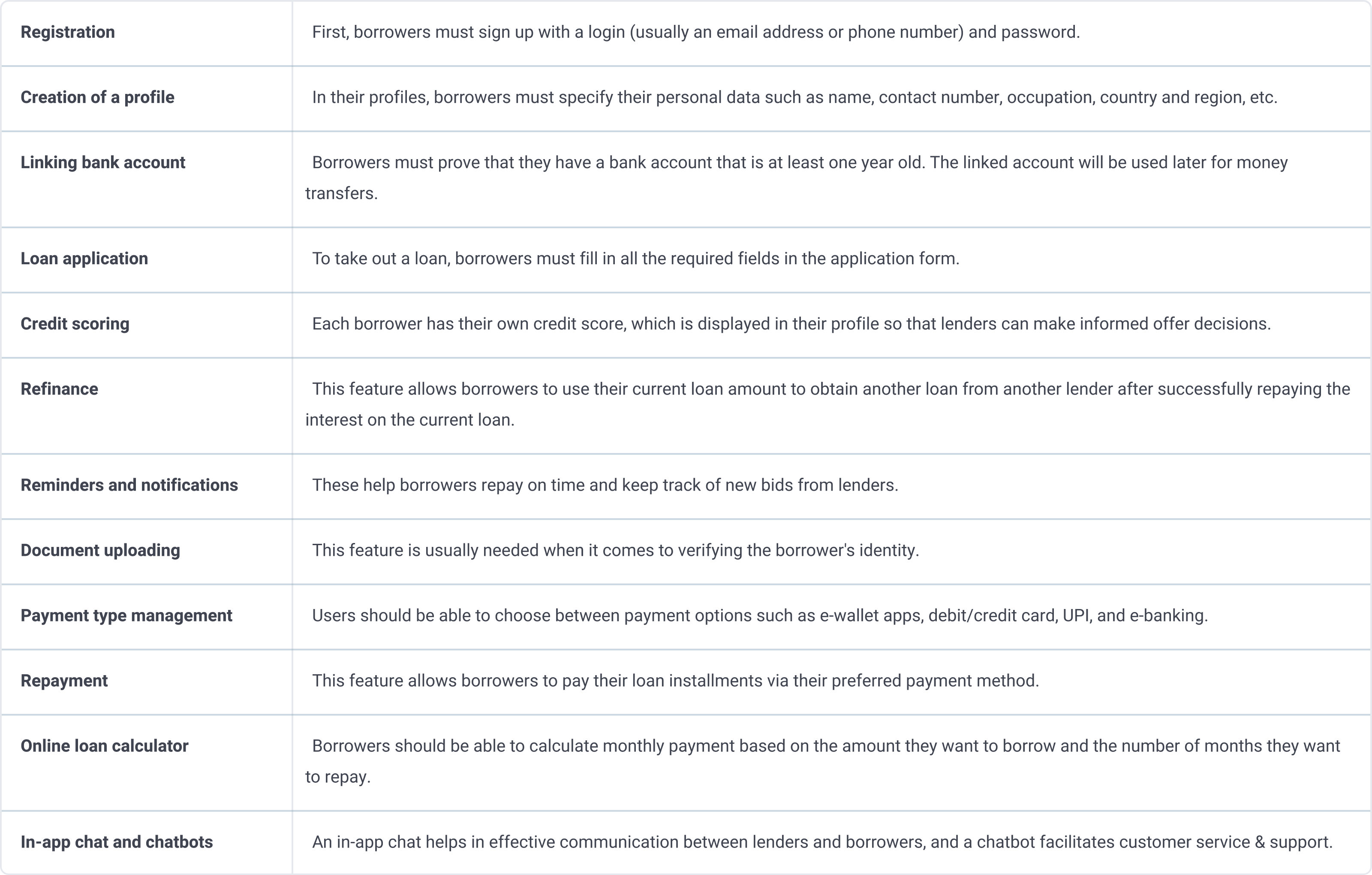

Key Features of Peer-to-Peer Loan Mobile App

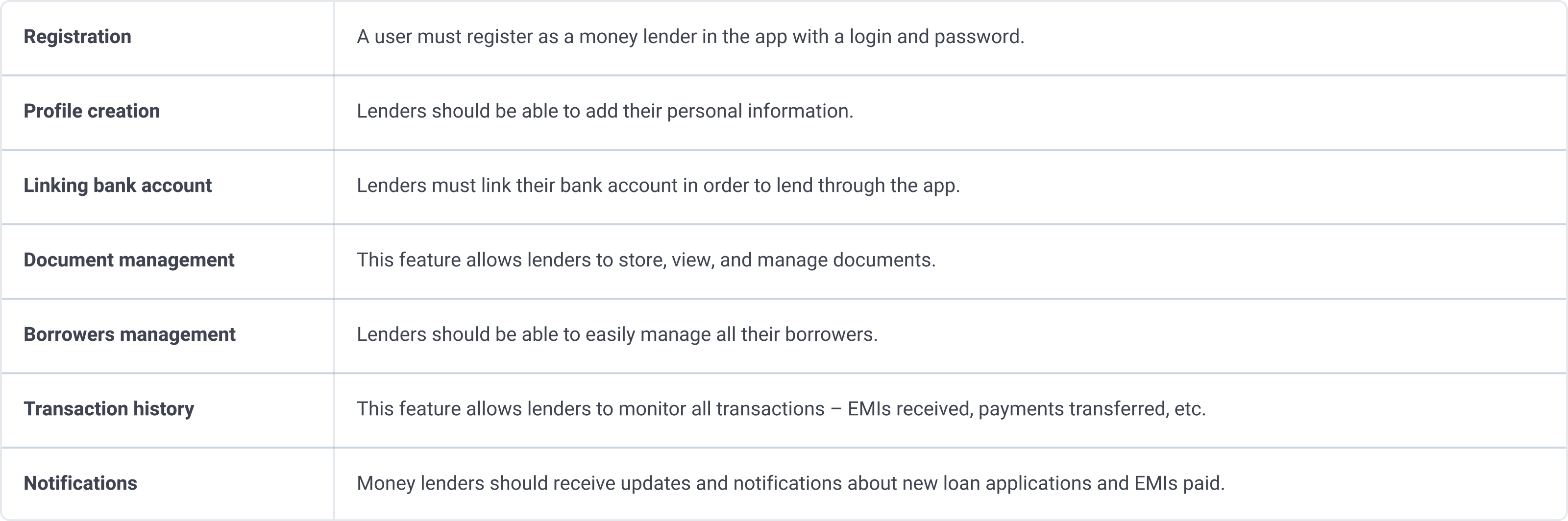

For Borrowers

For Lenders

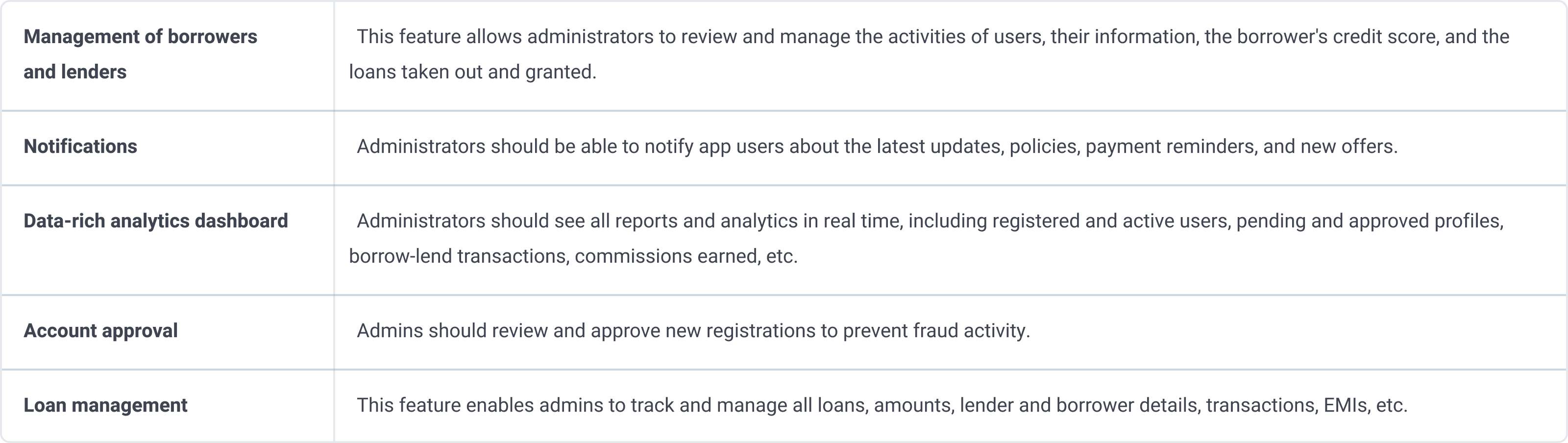

For Admins

How to Create a Money Lending App?

To create your P2P lending app, you need to find a fintech development company with a proven track record in the domain. In this case, the team can share its experience with you and advise you on certain things that may not be obvious at first glance. Discuss your requirements, features, technology stack, etc.

Usually, the development team consists of a project manager, a business analyst, UI/UX designers, front-end and back-end developers, and a QA team. Here’s what you and your trusted partner will do step by step.

1. Analyze the Market and Target Audience

It’s important to understand the pain points, challenges, and needs of users in your target market to ensure that the app will be successful. Study key competitors such as Upstart, Prosper, Funding Circle, and Payoff: download their apps, analyze how they work, and find their positives and negatives. This will help you better understand the trends in p2p lending software development and create some Unique Selling Points (USPs) for your solution.

2. Choose a Platform

Be clear about whether your peer-to-peer loan software will be a web app or a mobile app. If the latter, will it be available in the App Store or the Google Store? Or should you perhaps develop a cross-platform application? Again, the choice depends on your target audience, so make sure you’ve thoroughly researched their issues before making a decision.

3. Decide on Feature Set

It is vital to produce your version of an app that will be competitive among its peers. It can be done by adding valuable features like choice of payment options, 24/7 live chat support, geolocation, etc.

4. Create UX/UI Design

A clear interface and a memorable user experience can make your app a success from the start. That’s why UI/UX designers create low-fidelity wireframes, high-fidelity mockups, and prototypes, carefully testing each screen.

5. Proceed to the Development Phase

After UI/UX is ready and agreed upon, decide on the p2p lending software core features:

- Registration

- User profile

- Loan application form

- Notifications

- Payment protocol

After that, you can add more.

6. Test, Test, and… Test

After developing the peer-to-peer loan mobile app, it is important to fix any bugs to ensure that the app can be downloaded and run successfully so that app users do not find it confusing. The cost of a bug in your release can be devastating, as bugs and lags can cause a storm of negative feedback, leading to low ratings and bad reviews, so take testing seriously.

7. Release and Collect Feedback

Gather actionable insights from customer feedback after the app is released. Some of the user comments can help improve the app. Analyze mobile performance metrics as well. The more insights you get, the better your app will perform.

8. App Maintenance

To make sure your p2p lending platform software is up to date, it’s important to constantly improve it with new features keeping pace with the ever-evolving needs of the industry and staying on top of technical changes.

Peer-to-Peer Lending App Cost

The total cost of developing a P2P money lending app depends on a number of factors, such as the overall complexity of the solution, the features required, the tech stack, the hourly rate of the developers, the composition of the team, etc. On average, p2p lending platform development requires about 2200 development hours, which corresponds to a budget of about $110,000.

Summary

When you decide to start peer-to-peer lending software development, there are many things to consider, from features that will help you stand out in the market to rules and regulations, since you are dealing with other people’s finances. A trusted fintech development partner like Itexus will help you sort out all of these issues. Get in touch with us!