The online payments market is one of the fastest growing – according to Fortune Business Insights, it’s expected to hit $17,643.35 billion by 2027. The annual Global Payments Report by Worldpay from FIS indicates a significant decline in cash payments in several countries, including Canada, Australia, the U.K., France, Norway, and Sweden. The report also highlights that about 40% of in-store payments in the Asia-Pacific region are executed through digital payments.

This rapid adoption of digital wallets is driven by several factors, including the global increase in smartphone and internet users and technological advancements. Moreover, users show growing interest in convenient, fast, and secure payment methods. Digital wallets fulfill all these criteria by providing fast transactions, convenient payment options, and a high level of security for user data.

To help you get answers to all your questions about these apps, we’ve created a comprehensive guide to digital wallet development. Inside, you’ll learn how to develop a digital wallet, what subtleties to pay attention to when designing the user interface, what trends to expect in the niche, how to win user loyalty with advanced features, and much more.

Why does the market need more digital wallets?

The global FinTech market continues to evolve and is predicted to grow at a GAGR of 23.58% by 2025. The robust integration of technologies into financial services leads to constantly emerging market demands dictated by customers. Look how changing environment affects the FinTech domain:

- the emergence of cryptocurrencies launched the race for crypto wallets;

- the COVID pandemic drove the adoption of safe contactless payment technology;

- e-commerce growth set off wide usage of online payments;

- today’s generation, especially millennials, prefers to have faster, more flexible, and more convenient payment methods.

You see, every new financial trend or lifestyle change causes a technological response in the form of a new product, service, or process. And whatever the trends are, service providers have to adjust to create and deliver value to their clients. A lack of trust in the traditional banking industry, demand for access to alternate financial services, and lots of underserved areas of banking are among other reasons for FinTech rise. To sum up, it’s clear that new solutions are still needed and they will continue to emerge.

Advantages of digital wallets

The increasing use of digital wallets is due to a number of benefits they offer to both businesses and consumers. They save time and money, provide unique services, and even allow instant access to information that would otherwise be unavailable. Below, we listed the key advantages of digital wallets for businesses and consumers.

Benefits of digital wallets for businesses

✔️ Improved customer experience and increased conversion rates reached due to streamlining the payment process and offering customers more payment options.

✔️ Protected cardholders’ sensitive financial data and an additional layer of security with biometric features – e.g. fingerprint, retina scan, or facial recognition.

✔️ Access to real-time data and actionable insights into customer behavior, enabling data-driven decisions and more effective marketing efforts.

Benefits of digital wallets for consumers

✔️ Multiple payment methods available through a single app as if users were storing multiple cards in a physical wallet.

✔️ Storing of additional information such as loyalty cards, concert tickets, travel cards, coupons, boarding passes, etc.

✔️ Enhanced security – users don’t risk losing their cards or cash, and all sensitive financial data is encrypted and protected by multi-factor authentication.

✔️ P2P money transfers, making it easy to share bills with friends or send money to family.

✔️ Advanced features such as an expense tracker that helps develop healthy financial habits.

Digital wallet winning features

Bringing more similar solutions to the market is pointless. To enter a niche and outwit the competition, a new digital wallet solution must stand out from others. It might be a unique feature much needed by the target audience, enhanced security, the lowest fees, or whatever else that would become a competitive advantage of a new wallet.

For sure, there is no single formula for an e-wallet that would be loved by millions. Yet there are some winning e-wallet features that would enable your solution to deliver the best user experience possible and differ advantageously from your competitors. Let’s point these features out.

✅ Simple registration

You never get a second chance to make a first impression, and when it comes to digital wallets, that very first impression is the simple and quick registration process. Did you know that the majority of your mobile app sign-in drop-off rate is caused by the complex registration process itself?

Your solution may offer a unique and helpful feature, but eventually, it all comes down to the experience the users have interacting with your product. Provide users with a streamlined and well-designed registration process that would take just a few taps, otherwise, they will switch to a more customer-oriented product.

✅ Security

The ever-increasing popularity of digital wallets is driven not only by their convenience and ease of use but their enhanced security. Losing a wallet or having it stolen can be a blast as one’s has to cancel all their cards and then get them reissued. But this is not the case with e-wallets; they are inherently more secure than conventional payment methods.

Advanced security of users’ money and sensitive data must be your top priority if you want your wallet to be a blast. When one makes an in-store or online payment via a digital wallet, only a unique transaction identifier or token is exchanged, not their account information. Still, there are many threats like impersonation, SIM swapping attacks, phishing, malware attacks, etc. So consider cybersecurity carefully before getting down to the ewallet development.

And take into account that human error is still very much the driving force behind an overwhelming majority of cybersecurity problems. Consider an algorithm impacting users’ security awareness to help them protect their data and money. It can be popups with relevant tips on enhancing the account security, notifications offering to update the password, or whatever else you can come up with.

✅ Fast transactions

One of the principal advantages of digital wallets is high transaction speed. Unlike traditional bank transfers when the recipient has to wait for money from several hours to a few business days, digital wallets allow wiring funds to the recipient’s account in a matter of seconds. Instantaneous and simple transactions made in a few taps are what make e-wallets a better choice for users so high transaction speed is a must for such an app.

✅ Low fees

Lower exchange rates and flat fees for some transactions or functions compared to traditional bank services are another competitive edge of digital wallets. Fewer service and transaction charges mean broad availability and an audience of millions of people. Make sure to consider your pricing policy to combine two objectives – monetize your app properly and make it profitable for users.

✅ User-friendly design & navigation

When it comes to user experience, the role of UI/UX design and intuitive navigation can not be overemphasized. According to CBI, 17% of startups fail due to unfriendly product design. By user-friendly design, we mean an easy-to-use app that has a unique visual appeal, engages users and interacts with them. If an app is well-designed, it is easy for users to start with and understand how to use it.

As for navigation, it has to be clear, logical, and well-structured to enable users to make transactions quickly. Isn’t that what they expect from a digital wallet?

According to the 2020 Google Cloud’s FinTech Focus Report, only 6% of FinTech startups break even, but you can improve your chances. For this, you should build a digital app keeping your customers in mind. Apply a customer-centric approach, create customer personas, build customer journey maps – all these activities would help you to dig deeper into the target audience’s needs and wants and to better understand how to solve their problems with your product.

✅ Reward programs

Reward programs are all about clients’ loyalty which is vital when you expect users to entrust your app with their money and sensitive data. Reward programs can become a powerful tool for acquiring and retaining customers, increasing brand awareness, and enhancing customer experience.

The essence of a reward program boils down to providing greater value for each transaction. This can be reached via multiple options – offer cashback to users, reward new users after registration, affiliate program, enable users to pay via earned rewards points, etc.

✅ Connected with crypto trends

Although there are specific wallets intended for cryptocurrencies, it wouldn’t hurt to add to your e-wallet app some of crypto wallets’ functionality. It is a way to cover a larger audience and open up new horizons of possibilities for users. Cryptocurrency payments are profitable for both businesses and individuals due to protection against fraud, fast international transactions, and financial transparency. Thus, connecting your app with crypto trends will equip it with another robust competitive advantage.

Digital wallet core components & costs

Let’s explore the basic features of the digital wallet and its cost. Whether you intend to introduce an e-wallet under a particular brand or contemplate constructing a digital wallet white-label solution, all of the mentioned functionalities are important.

Please note that all estimates are rough and can go either way. For simplicity, features are estimated in labor hours – to express it in monetary terms, multiply the labor hours by the hourly rate of your software development partner. On average, the hourly rate of experienced fintech developers starts at $40.

Registration & onboarding

The financial services industry is heavily regulated, and fintechs are also subject to these regulations. To comply with AML requirements, it is necessary to allow users to undergo KYC verification (or KYB – this depends on the specifics of your particular app) during registration. For this purpose, your digital wallet will be integrated with a KYC provider (e.g. Jumio or Alloy). Such solutions not only allow you to perform KYC but also help fintechs prevent fraud and money laundering.

✔️ On average, it takes 14-26 hours to implement registration & onboarding for iOS devices and 20-28 hours for Android. Backend development takes between 18 and 26 hours.

Authentication

Although it’s a standard feature of any fintech app, it should be approached with proper attention as it implies handling user credentials. Therefore, security measures should be taken – a common practice is to enable multi-factor authentication.

✔️ Implementing a secure login with MFA takes 14-26 hours for iOS and 20-28 hours for Android. Backend development takes between 18 and 26 hours.

Card management

As mentioned earlier, one of the biggest advantages of mobile wallets is that they allow users to store a variety of information in a single app – not only credit or debit cards but also loyalty cards, coupons, tickets, etc. This multitude of items should be easily and conveniently managed so that users can switch between cards or their categories, select a card for payment, view transaction history, etc.

✔️ Card management implementation takes between 75-109 hours for iOS and 88-124 hours for Android. The backend requires about 75-105 hours.

Money management

This feature includes topping up accounts, checking account balances, withdrawing money, transferring money to other cards within the app, and making transfers to other users. Needless to say that all transactions should be fast and secure.

✔️Implementing money management requires between 35-48 hours for the iOS app and 44-58 hours for Android. The backend development takes 166-105 hours.

✔️If you want your users to be able to pay rent, utilities, telecom, insurance, and other bills with your digital wallet, this requires extra time – 36-50 hours for iOS, 44-56 for Android, and 165-221 for backend development.

Payment link sharing & contacts management

This feature allows digital wallet users to create and share a payment link in the app or generate a link to request and send money through a messenger of their choice. Payment links function takes between 32-43 hours for iOS and 44-56 hours for Android. The backend takes 101-134 hours.

✔️The contact management feature allows users to manage contacts manually or sync the app with the phonebook and requires 54-73 hours for iOS, 63-80 for Android, and 40-55 hours for backend development.

Analytics & reporting

It’s crucial to provide users with actionable insights into their spending patterns through comprehensive information about their transactions. To enable your digital wallet to analyze expenses and create descriptive and digestible charts and infographics, you can implement the analytics and reporting feature.

✔️ This feature requires between 120-160 hours for iOS, 140-180 hours for Android, and 83-109 hours for the backend.

User support

It’s not that difficult to gladden already satisfied users. However, when a user faces a problem, it is the availability and quality of support that determines their overall experience. Therefore, it’s important to implement efficient support service.

✔️ This takes between 20-28 hours for iOS, 26-34 hours for Android, and 22-32 hours for backend. Note that this is the estimate of a basic support system – advanced features like AI-powered chatbot require extra time.

Notifications & alerts

Notifications are not only necessary to keep users updated about their transactions and account, remind them about upcoming payments, etc. They are also a powerful marketing tool – used correctly, they can increase user engagement and retention and contribute to upselling and cross-selling.

Implementing the feature requires 28-39 hours for iOS and 37-45 hours for Android. Backend development takes between 22-32 hours.

Advanced functionality

Depending on the specifics of your app and your target audience, you may want to add some advanced features. These can be QR-enabled payments, bill splitter, crypto asset management or even trading, loyalty programs, budget planning, and so on. If you’re developing a white-label digital wallet, you can provide these features as additional functionality at an extra cost.

For more information about advanced features, the time required to implement them, and the overall digital wallet architecture see our article on e-wallet app components.

How to create a digital wallet: Itexus expertise and portfolio

Having a rough idea isn’t enough for getting down to the digital wallet development phase. To give your digital wallet a good start, undertake some preparatory work.

- Define your target audience. The same functionality can be delivered in different ways depending on the target audience of the app. Make sure to explore the economic, social, and cultural context of your targeted users to verify your hypothesis and adjust your idea according to your findings.

- Analyze the market. You might find similar solutions, and if that’s the case, think twice before entering the market without a unique feature. Competing with solutions that have already gained clients’ loyalty would be successful only if you can offer something much more valuable for users.

- Create customer personas and journey maps. A customer-centric approach is what helps to design genuinely good solutions. Even one comprehensive customer persona can provide you with a wide range of insights about your target audience, their needs, motivations, and pain points. And outlining a map of the journey users will take while interacting with your solution can help you better understand the experience they get at each stage of their journey, grasp their expectations, and identify areas for improvement. That is how great ideas come.

- Build an MVP. Whether you’re planning digital wallet web app development or going to build a mobile solution, it’s essential to validate the app concept first instead of rushing to develop it right away. Building an MVP allows you to test a product idea, assess the validity or invalidity of your business plan, save time and money, avoid building the wrong product, and reduce numerous risks.

Once you’ve done preparatory work, it’s time to move forward with your app. Building a digital wallet that would be loved by millions requires a skilled development team with strong expertise in the FinTech domain and a proven track record of providing digital wallet development services. Itexus has helped multiple clients to build and deliver to the market next-generation financial solutions. Feel free to check out our latest FinTech projects to get inspired for crafting your own.

Itexus digital wallet expertise and portfolio

Now that you know all about digital wallet app development, you may want to get some inspiration to refine your own product idea. To that end, you can check out a couple of digital wallet projects Itexus has delivered for our clients.

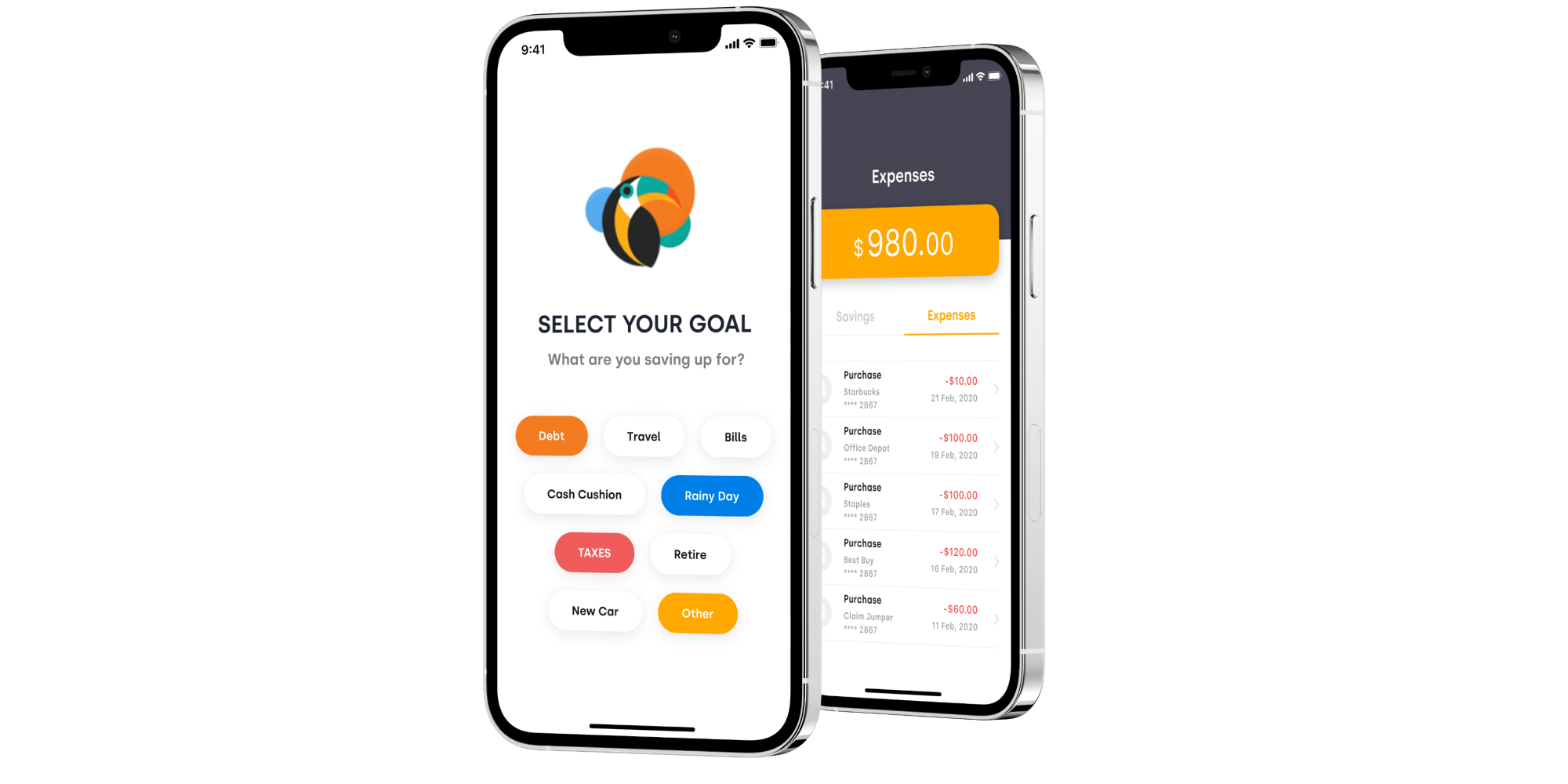

Money saving and personal finance assistant app

The app delivered for a Silicon Valley startup helps users develop healthy financial habits with advanced gamification features and supports viral marketing through social features. Within the app, users can manage their finances, set and achieve savings goals, participate in various challenges (such as “Cutting down on junk food”), and invite friends to track or compete with their progress. To ensure an appropriate level of security, the app uses in place role-based access controls, multi-factor authentication, encryption, and other measures. To learn more about the project, read the original case study.

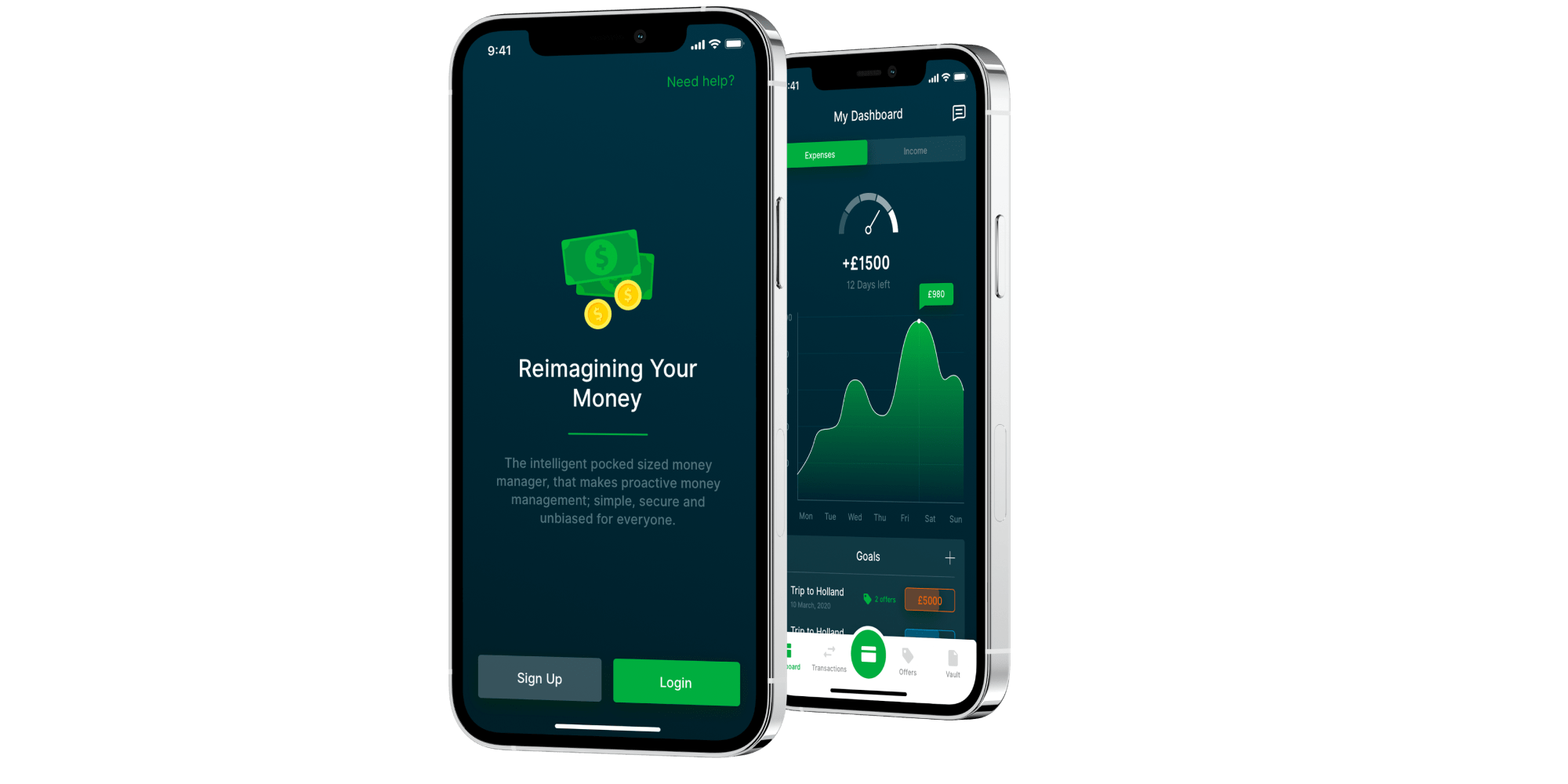

Personal finance assistant app

In a nutshell, it’s an intelligent money management system designed to help users make proactive and rational decisions about their finances. The app’s target audience is millennials, who often struggle to keep track of their regular spending. The solution takes advantage of ML and AI technologies to analyze, systematize, and categorize data about the user’s income and expenses over a period of time and displays the corresponding results in the form of graphs and charts. To learn more about the project, read the original case study.

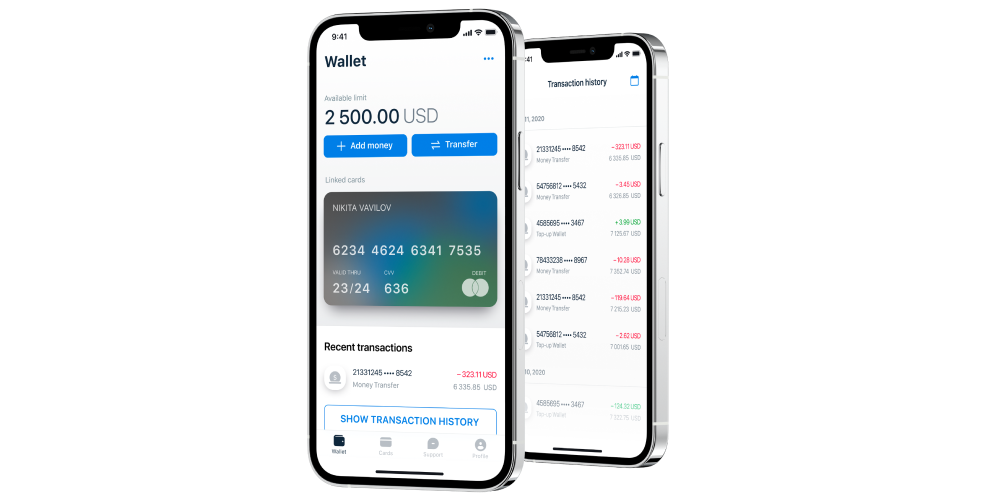

Team extension for building eWallet

At Itexus, we do not just provide digital wallet development service – we also offer flexible engagement models to fill the knowledge or skills gap in your in-house team. That’s exactly what we did for a fintech startup from Northern Europe. Our client had already started developing a digital wallet and then decided to hire more mobile developers with deep fintech expertise to increase the project’s capacity and accelerate the product’s time to market. To learn more about the project, read the original case study.

Mobile bank transfer app

As a trusted digital wallet development company, Itexus was assigned to develop a mobile app-to-bank transfer solution for a US-based startup. We created and delivered to the market iOS and Android apps that facilitate sending money from US-issued bank cards to Nigerian bank accounts. The apps also allow paying bills, managing several bank cards in one account, etc. To learn more about the project, please read the case study.

Mobile banking app for migrants

This neobank solution crafted for an American entrepreneur is designed specifically for migrants and other unbanked audience segments. The app facilitates monetary transactions like financial help to families, getting paychecks early, micro-loans, etc. To learn more about the project, please read the case study.

Summary

Digital wallet mobile app development requires resources, expertise, attention to detail, and a thorough understanding of the needs, habits, and problems of the target audience. However, if you get it right, your efforts will be rewarded. The market for mobile payment solutions is growing rapidly, along with the number of users who are adopting new approaches to their daily financial transactions.

If you are interested in developing a digital wallet from scratch or need specialists to fill the skills gap in your team, we’ve got you covered. Our team consists of experienced fintech engineers, designers, business analysts, project managers, and other specialists who can help you transform your idea into a secure and exceptional digital wallet that users will adore. Contact us to learn about the benefits our expertise can bring to your project.