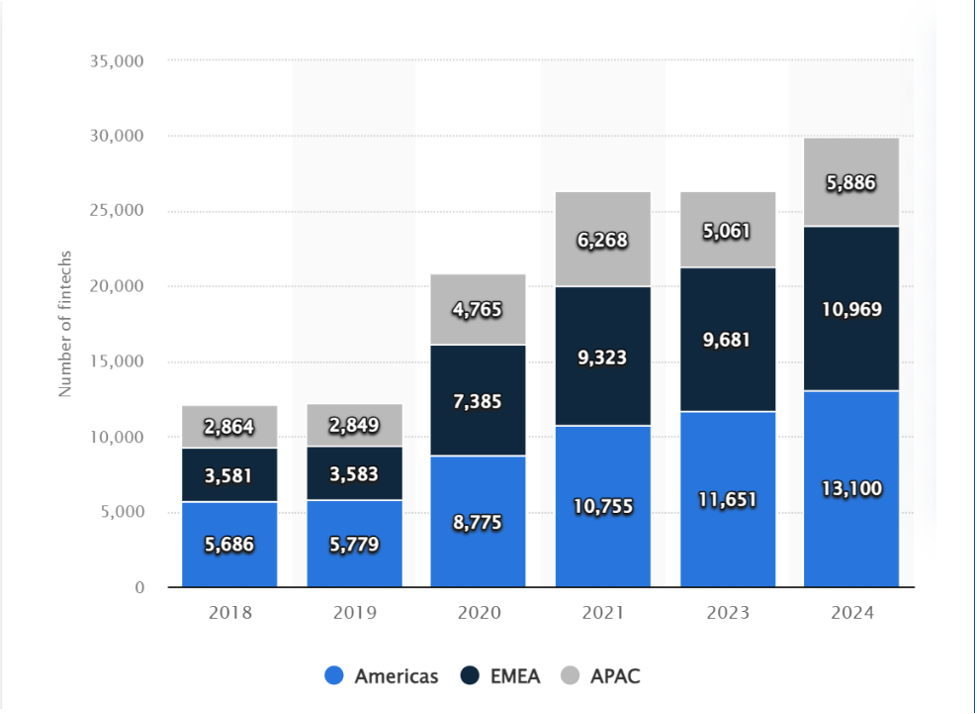

The global Fintech market is expected to grow to over $400 billion by 2029 while digital banking users are expected to increase to 217 million by 2025.

A recent study revealed that about 96% of millennials prefer online banking. However, a recent research by Facebook IQ revealed that only 36% of these millennials have experienced using Fintech apps, including financial management apps. This indicates a huge gap in the market that is yet to be satisfied. This is where FinTech app development companies come in.

Source: Statista

This article will guide you through developing an app like Credit Karma including its business model, features, and development costs. We will then discuss and recommend top FinTech app development companies.

Let’s dive in!

Understanding the Credit Karma Model

Notably, Credit Karma offers its services to users for free. Also, Credit Karma does not sell user data to third parties as most digital service providers do. So, what is Credit Karma’s business model?

The application employs the aggregator business model, getting money through various types of fees including:

- Referral fees

- Interest on cash

- Interchange fees

Referral fees

Referral fees are Credit Karma’s main revenue source. The app recommends different financial services to its users and then receives a referral fee every time a user purchases or signs up for the recommended services.

The app collects and analyzes each user’s data, which informs recommendations of relevant services. The data analyzed include spending habits, financial status, credit score, and financial history.

The services Credit Karma recommends fall under various categories including:

- Loans

- Cards

- Mortgage

- Insurances

Interest on Cash

Credit Karma allows users to deposit money in their accounts. Then, the company lends this money to banks and other financial institutions. The interest paid on the cash becomes one way that Credit Karma generates revenue.

Interchange fees

When users open an account with Credit Karma, they receive a Visa Debit card as well. Each time a user purchases a service or product and pays with the debit card an interchange fee is incurred. The fee is less than 1% of money spent on purchases and is charged by the seller. Credit Karma gets a share of this fee, generating revenue.

Credit Karma’s Unique Value Addition

Credit Karma enables its users free access to credit scores and financial information, eliminating any unexpected fees. In contrast, established credit bureaus only offer free access once a year and charge fees for additional financial information requests.

The company sources the credit score information from TransUnion and Equifax which are two of the largest credit bureaus.

Therefore, to successfully develop an app like Credit Karma, you need a value-additional strategy that will attract both financial services consumers and financial institutions for partnerships.

Essential Features of a Credit Karma-Like App

Credit Karma offers a wide range of features that help users track credit scores and generate reports for free, as well as facilitate personal finance management. This includes debt management, savings, and access to different financial products.

- Credit Score Monitoring: Users get free access to their credit scores and credit score reports from reputable credit bureaus. Also, the app provides a user-friendly dashboard with timely updates.

- Financial Product Recommendations: The feature allows for recommendations of loans, credit cards, and insurance products that could save the user some money. The feature uses AI-driven algorithms for personalized suggestions.

- User Profile and Data Security: The security features protect users’ data and identity to prevent fraud and theft. Users get alerts each time changes are made. Security is also provided through data encryption, regulatory compliance, and secure authentication.

- Personalized Financial Advice: The feature uses AI to offer personal finance management advice including; financial planning, budgeting tools, and insights.

- User Engagement Tools: Push notifications, gamification, and community features.

Development Stages and Cost Breakdown

Businesses need to know the fintech app development stages and costs before partnering with an app development company. The cost of app development can be affected by the level of innovation required and the type of app being developed. The different types of financial apps include; banking apps, personal finance apps, investment apps, insurance apps, and lending apps.

Additionally, other factors are considered in the app development cost breakdown. They include; app complexity, interactive UI & UX design, delivery period, advanced technology, programming languages, app features, and app maintenance.

Below is an approximate breakdown of how much it would cost to develop an App like Credit Karma:

| App development stage | Activities | Estimated Cost Range |

| Planning and Research | Market analysis, competitor research, feature prioritization | $5,000 – $10,000. |

| UI/UX Design | user-friendly interface design intuitive user experience | $10,000 – $25,000 |

| Front-End and Back-End Development | Core features, credit score integration, recommendation engine | $50,000 – $100,000 |

| Third-Party Integrations | Integration with credit bureaus, banks, and financial institutions. | $20,000 – $50,000 |

| Security and Compliance | Ensuring data security, GDPR compliance, and other regulatory requirements | $15,000 – $30,000 |

| Testing and QA | Testing across devices, bug fixes, quality assurance | $10,000 – $20,000 |

| Launch and Marketing | App store optimization, initial marketing campaigns, user acquisition strategies | $10,000 – $30,000 |

| Ongoing Maintenance and Updates | Continuous updates, bug fixes, and new features. | $5,000 – $15,000 per month |

Top 10 Development Companies for Building a Credit Karma-Like App

- Itexus

Experts have continuously referred to Itexus as the global leader in Fintech app development. The company, established in 2001, provides fintech software development solutions to financial institutions including banks and insurance companies.

Comprehensively, Itexus’ services include consultation, software development, software maintenance, and system integration. They have been trusted by large institutions like mBank and ING Bank Slaski to develop their software development services.

Why choose Itexus:

If you’re looking for a Fintech app development company to develop an app like Credit Karma, Itexus would be the perfect choice.

The company’s key strength areas in Fintech app development include:

- Digital banking

- Alternative finance apps and digital lending

- Stock market analytics and trading

- Online payments

- Cryptocurrency and decentralized apps (Dapp)

- InsurTech

- Personal finance management

- Wealth management

Itexus’s experience with developing fintech apps for wealth management and personal finance management gives it immense experience and expertise in developing apps like Credit Karma, that would bring value to your customers while generating revenue.

The wealth management apps Itexus builds offer wealth management startups and established firms a way to expand their market size from advanced investors to underserved populations including millennials.

The app Itexus features builds include:

- Quantitative market analytics

- Portfolio construction

- Portfolio analysis & optimization tools

- Financial data analysis

- AI-based robo-advisors

- Credit score monitoring

- Expense tracking

- Debt refinancing

- Social and gamification features

The company offers differentiation and competitive advantage through innovative features such as gamification and integration with social networks. This attracts more consumer traffic to your services.

- WillowTree

WillowTree is a software development company based in the US and was founded in 2007. The company has since then specialized in digital product development and mobile app development.

Due to its experience, WillowTree has grown to be among the top fintech app development companies globally. The company is popularly known for its UX design for mobile apps.

The key services offered by WillowTree include:

- UX design

- Mobile strategy

- Quality assurance

- Software development

- Fueled

Fueled is one of the top mobile app development companies globally. Its headquarters is situated in New York and it was founded in 2008.

The company has been building custom mobile applications for businesses in various industries. It also offers web development, digital product creation, and UI/UX design.

It is especially famous for creating great user experiences in the digital space, driving engagement and business growth.

Its key services include:

- Web development

- Mobile app development

- Digital product creation

- UI/UX design

- Yalantis

Yalantis provides software development services to businesses that outsource for their web and software development needs.

Apart from offering technology solutions to businesses, Yalantis has an online learning platform for back-end development; the Yalantis Golang School.

Some of the areas Yalantis provides technology solutions for include insurance, consumer finance, and e-wallet solutions among others.

The company’s key services include:

- Fintech app development

- Cybersecurity

- Machine learning and artificial intelligence

- Low code solutions

- DevOps and Cloud

- Consagous Technologies

Consagous Technologies is a globally recognized web and mobile app development company; providing IT and software solutions to different types of businesses across various industries.

The company was founded in 2008 and has expanded to providing technology solutions in several areas including digital marketing and branding. Notably, the company leverages emerging technologies like artificial intelligence, machine learning, AR/VR, and salesforce.

Its key services include:

- Mobile app development including fintech apps

- Blockchain development

- Market and design

- Web development

- Enterprise resource planning

- Appinventiv

Another top Fintech app development company is Appinventiv. The company boasts of offering the most resilient, high-performing, and scalable mobile app solutions.

According to online reviews, the company has a 95% customer satisfaction rate, having delivered over 500 custom app development solutions.

The company’s dedicated team of experts collaborate to develop solutions that offer businesses a competitive advantage.

Its key services include:

- Software development

- Mobile app development

- UX/UI design

- App testing

- Konstant Infosolutions

Konstant Infosolutions is known globally for its app development services. The company works with startups, businesses, large enterprises, and SMEs across all industries.

The company founded in India in 2009, boasts of developing mobile applications that attract high volumes of traffic to the client’s services or products.

Its key services include:

- Mobile app development

- IT Consulting

- Blockchain development

- Web development

- UI/UX design

- Intellectsoft

Intellectsoft is a software development company headquartered in the USA. It was founded in 2007 and currently operates in several countries including the UK, Ukraine, and Norway.

The company stands out as a leading app development company providing innovative digital solutions.

Its key services include:

- Mobile applications development

- Software development

- Blockchain development

- Enterprise solutions

- OpenXcell

OpenXcell has grown to be one of the top Fintech app development companies. It is an Indian-based company that holds a significant share of the USA market.

The company provides various services, from web development and mobile app development to digital marketing solutions. It works with large enterprises, SMEs, and startups across different industries.

The key services include:

- IT Consulting

- Web development

- App development

- Digital Marketing

- TechAhead

The next name in the list of top fintech app development companies is TechAhead. The company is a well-known financial software developer in the USA.

The company boasts of providing unmatched services catering to client needs and bringing business visions to life.

TechAhead is also known for its innovative approach and experimentation with emerging technologies in developing solutions.

Its key services include:

- Mobile app development

- Digital wallet development

- UX/UI design

- App development with React

Conclusion

As the need for mobile banking and online financial services continues to grow, you’ll need an app development company to partner with. Choosing the right fintech app development company will significantly propel the success of your business and new fintech ventures.

Whether you’re looking to innovate with emerging technologies, streamline your Fintech services, or enhance the user experience for your consumers, choosing a reputable app developer is a key consideration.

For further consultation into Fintech app development solutions and exploration of emerging tech solutions, consider collaborating with Itexus. So far, the company has been consistent in providing innovative, cutting-edge Fintech app solutions.

FAQ

- What are the key features needed to develop an app like Credit Karma?

Some of the Credit Karma’s app features you can include in your financial app include sign-up & login features, personal profile, onboarding tutorial, credit monitoring, push notifications for recommendations and financial information, app settings, credit score ratings, loans, search and filters, financial advisor, bank accounts, and payment gateway.

- How much does it cost to develop a financial app?

Fintech app development cost varies according to different factors including design intricacies, complexity of the required features, development team’s hourly rate, and regulatory considerations. However, the top fintech app development companies’ estimates range between $125,000 and $280,000.

- Which companies are the best for FinTech app development?

With the growing demand for digital banking services and mobile finance apps, several companies are emerging as Fintech app developers. However, research has proved the best Fintech app development companies are Itexus, TechAhead, OpenXcell, Intellectsoft, Appinventiv, Yalantis, and WillowTree.

- Why is Itexus a top choice for developing a Credit Karma-like app?

Itexus remains the top choice for developing a Credit Karma-like app due to its focus and specialization in Fintech app development. Specifically, Itexus has worked with prominent financial institutions developing wealth management and personal finance management apps; offering features quite similar to if not improved versions of Credit Karma app features.

- What factors should be considered when choosing an app development partner?

Whether you are an established business or a startup, the app development company you choose to collaborate with can accelerate the growth of your app and as a result your business. The factors to consider when hiring an app development partner include; app development cost and pricing models, company reputation, professional expertise, project management, communication, regulatory compliance measures, and post-app development support.