Imagine a world where people carry their finances in their pocket—not just cash or cards, but everything from cryptocurrency to loyalty points. That’s the power of a digital wallet! In today’s fast-paced, digital-first economy, creating your own digital wallet isn’t just a cool idea—it’s practically essential for businesses in fintech.

In this guide, I’ll walk you through everything you need to know to create a successful digital wallet. Whether you’re a startup looking to build your first app or an established business expanding into mobile payments, this guide is packed with insights, strategies, and tips to help you stand out from the competition.

Why Digital Wallets Are the Future

Digital wallets have evolved beyond simply storing money. They’ve become essential tools for managing finances, accessing digital identities, and simplifying everyday transactions. With over 2.5 billion digital wallet users expected by 2025, the demand is exploding. If you’re considering building one, you’re on the right track.

But creating a successful digital wallet isn’t just about coding an app. It’s about understanding user needs, mastering security protocols, and offering a seamless experience.

Steps to Create a Digital Wallet

Let’s get into the core steps you need to follow to build a digital wallet that’s functional, secure, and scalable.

| Step | What to Do | Pro Tips |

|---|---|---|

| 1. Define Your Purpose | Is it for payments, loyalty points, or cryptocurrency? Understanding the wallet’s core function is key. | Start with an MVP (Minimum Viable Product) to test user engagement. |

| 2. Choose the Right Technology Stack | Pick technologies based on your needs—whether it’s Java, Kotlin for Android, or Swift for iOS. For cross-platform, React Native is a great option. | Ensure your stack supports scalability from day one. Using APIs for quick integrations is also a smart move. |

| 3. Prioritize Security | Implement robust security measures such as encryption, two-factor authentication, and biometric verifications. | Never compromise on security. User trust is paramount in fintech. Ensure compliance with PCI DSS and local regulations. |

| 4. Design an Intuitive UI/UX | Make the interface simple but powerful. Users want a smooth, easy experience. | Focus on making transactions 2-3 taps max. Clean design and intuitive flows make all the difference in retention. |

| 5. Integrate Payment Systems | Choose the right payment gateway. PayPal, Stripe, or even direct bank integrations might be necessary. | Build for multi-currency support if you plan to go global. Consider integrating QR code payments for speed and convenience. |

| 6. Test and Launch | Rigorous testing is critical. Make sure to stress test for heavy loads, as payment apps often handle large transaction volumes. | Beta testing with a small group can give you invaluable feedback before a wider launch. Always be ready for rapid post-launch iterations. |

| 7. Ongoing Maintenance | Regular updates and quick fixes are part of the game. Your digital wallet needs to evolve to stay relevant. | Set up a dedicated team for post-launch support. New features and security updates will keep your app competitive. |

Secret Ingredients for a Successful Digital Wallet

Now, here’s where I share the insider knowledge. These are the real differentiators that make an “OK” wallet into a “Wow” wallet.

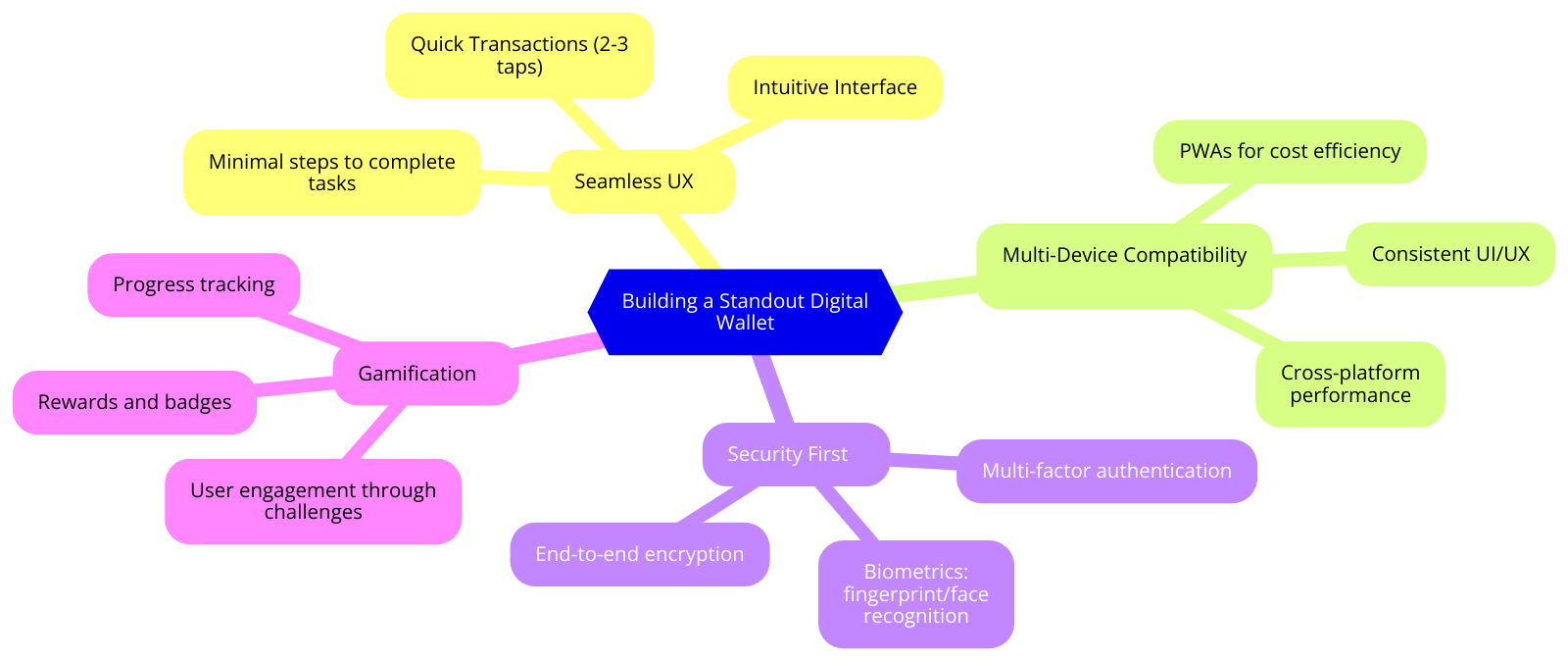

1. Seamless User Experience

A good wallet feels like magic—it just works. You don’t want users hunting for features or struggling to make a payment. Pay attention to the number of steps it takes to complete common actions like sending money or checking balances.

Tip: Make every transaction possible within 3 taps. Simple and quick interactions will keep your users loyal. Take a cue from Venmo—they nailed simplicity with its social-feed-like interface.

2. Focus on Multi-Device Compatibility

People move across devices—tablets, phones, wearables—and they expect their wallet to move with them. Ensuring a smooth experience across platforms will increase engagement and retention.

Tip: Consider Progressive Web App (PWA) technology to reach users on multiple platforms without heavy development costs.

3. Security Is Non-Negotiable

Nothing erodes trust faster than a data breach or stolen funds. Users need to feel safe with your app, especially if they’re handling sensitive information. Build in multi-factor authentication (MFA), biometrics (like fingerprint/face recognition), and end-to-end encryption from day one.

Tip: Learn from the downfall of Libra (Facebook’s cryptocurrency wallet)—regulations matter! Ensure your wallet complies with PCI DSS, GDPR, and other local data protection laws.

4. Engaging Gamification

Want to take user retention to the next level? Gamification techniques such as rewards, badges, and progress trackers can help. It not only keeps users engaged but encourages them to use the app more frequently.

Tip: Paytm, an Indian digital wallet, added gamification elements that allowed users to collect virtual points for every transaction. The result? Massive user engagement.

Integrating a FinTech Payment Flow in Mobile Wallet Apps

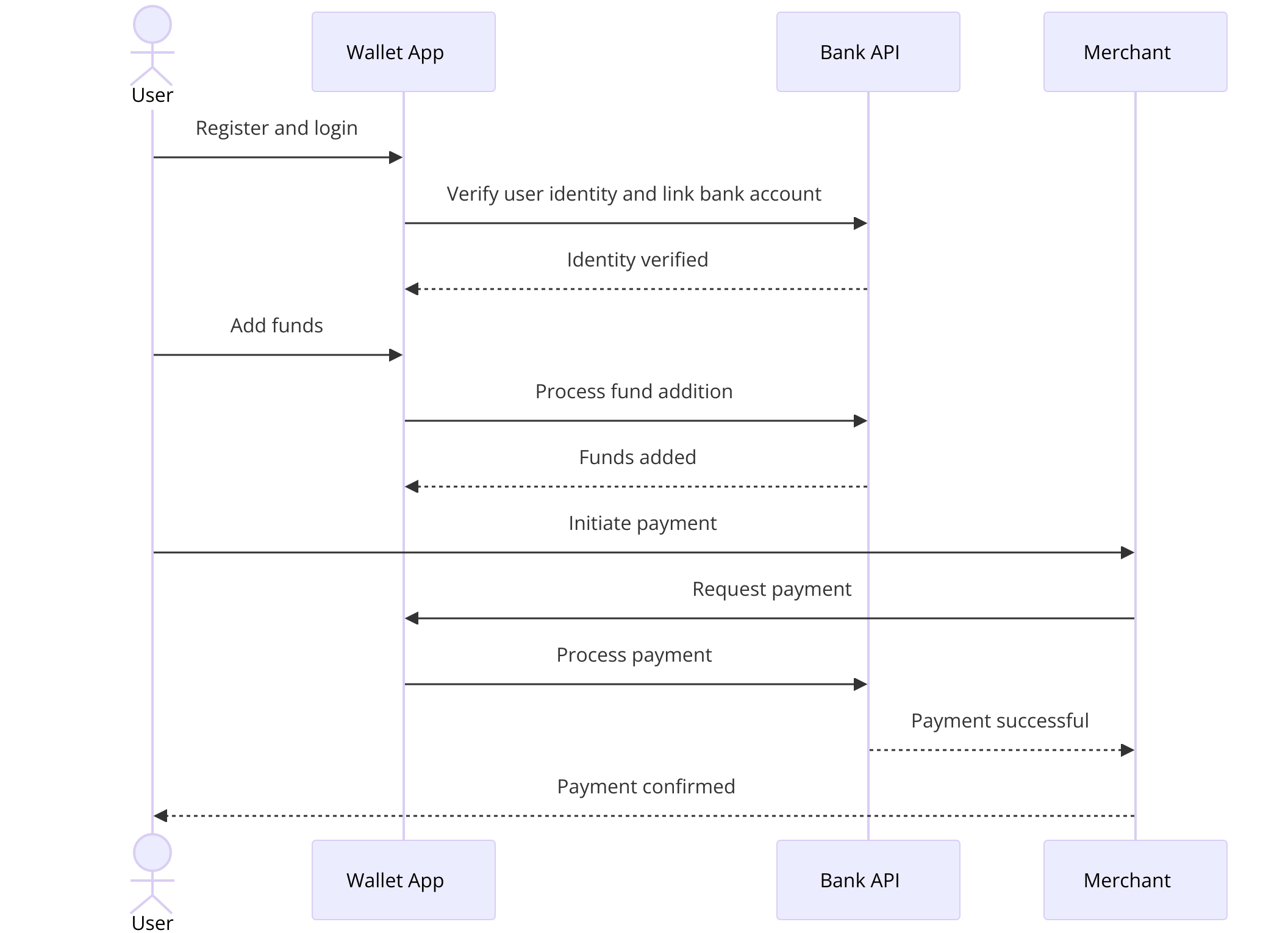

In the world of FinTech, efficient and secure payment processes are crucial for providing a seamless user experience. The diagram above illustrates the interaction between a Wallet App, a Bank API, and a Merchant during a typical payment flow. It begins with the user registering and logging into the wallet app, linking their bank account via identity verification. Once verified, users can add funds to their wallet and initiate payments to merchants. The app communicates with the bank to process the transaction, and upon successful completion, the payment is confirmed to the user.

This visual represents the flow of essential steps that ensure secure and swift financial transactions, which are the backbone of any digital wallet solution. Understanding these stages helps in designing user-centric and secure mobile payment applications.

Feel free to use the diagram to better visualize how these elements interact.

Competitor Analysis: What Makes the Best Digital Wallets Shine?

To build a winning digital wallet, you must understand what your competitors are doing right (and wrong). Let’s look at a few leading digital wallets and break down what you can learn from them.

| Digital Wallet | Key Features | What You Can Learn |

|---|---|---|

| PayPal | Widely accepted, easy integration, supports various payment methods including cryptocurrency. | PayPal’s success comes from its global reach and seamless integrations. Building a multi-functional wallet can help you capture more users. |

| Venmo | Social media integration, instant peer-to-peer transfers, highly visual interface. | Venmo’s social element makes payments fun. Adding a social layer, even in a subtle way, could differentiate your wallet from others. |

| Cash App | Focus on simplicity, instant payments, cryptocurrency trading, and investment options. | Keep it simple. Users love a clean, no-frills design. The added crypto and stock trading options have helped Cash App carve a niche. |

| Google Pay | NFC payments, loyalty program integrations, wide vendor acceptance. | Google Pay excels in its ease of use. Seamless integration with existing vendor systems can be a powerful selling point for your digital wallet. |

| Apple Pay | High-level security, NFC, face/fingerprint ID verification, widespread acceptance. | Apple Pay’s emphasis on security is unmatched. Prioritize biometric security and NFC capabilities in your development strategy. |

Mistakes to Avoid

Creating a digital wallet isn’t without its pitfalls. Here are some common mistakes that can kill user engagement:

- Overcomplicating the Interface: If users feel overwhelmed by too many features or a clunky design, they’ll leave.

- Ignoring Compliance: Regulations vary by country, and non-compliance can shut down your app faster than you can fix a bug.

- Underestimating Security: Wallets are prime targets for cyberattacks. Skipping on security testing is a shortcut you cannot afford to take.

Final Thoughts

Building a digital wallet is both a challenging and rewarding endeavor. It requires a fine balance between functionality, security, and user experience. But by focusing on these key areas, integrating smart technologies, and avoiding common pitfalls, you can create a digital wallet that stands out in a crowded market.

Whether you’re a startup or an established company, following these guidelines will set you on the right path. And remember—listen to your users, iterate quickly, and never compromise on security.

Now, contact us and let’s build a wallet that people can’t live without!